The recent announcement of PayPal’s PYUSD stablecoin has sparked mixed reactions in the crypto community. While some see it as a bridge between traditional finance and the Web3, others see it as another centralised stablecoin. Either way, it comes at a time when the stablecoin market is in deep trouble. Will PYUSD be the cure

Does PayPal’s PYUSD come at a bad time?

In recent days, the eyes of members of the crypto community have turned to PYUSD, the stablecoin recently announced by PayPal, the payment giant with more than 435 million users around the world.

Due to be rolled out in the next few weeks, PayPal’s PYUSD will be issued on the Ethereum blockchain (ETH) and is expected to act as a bridge between traditional finance and Web3, since it can be used to make purchases and exchanges, as PayPal already allows in normal circumstances with fiat currency. PYUSD will also be compatible with Venmo, the most popular mobile payment application in the United States.

The announcement of the PYUSD has received a mixed reception: some see it as a way of democratising the cryptocurrency ecosystem, while others see it simply as yet another centralised stablecoin (the Solidity code used in the smart contract has a built-in freeze function, just like Tether’s USDT and Circle’s USDC).

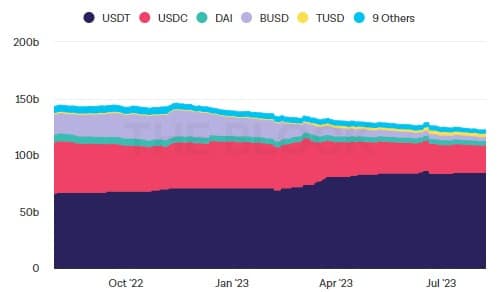

In any case, PYUSD has arrived at a time when the stablecoin market is clearly in a bad way. Indeed, since the number of stablecoins in circulation peaked in April 2022 with over $182 billion in capitalisation, it has only declined since then, and this movement has been amplified since the collapse of FTX in November 2022.

Stablecoins in circulation over the last 12 months (dollars)

Thus, since the beginning of the year, the supply of stablecoins in circulation has fallen by 12%. Will PayPal’s PYUSD be able to change that?

Clear regulation key to adoption

The PYUSD announcement has reverberated even in the US House of Representatives, to the extent that committee Democrat Maxine Waters has expressed “deep concern” about the lack of clear regulation of stablecoins, noting that “stablecoins represent the issuance of a new form of money, which makes federal safeguards essential”.

This is precisely what the Financial Services Commission is seeking to address with its proposed Clarity for Payment Stablecoins Act, pushed by Patrick McHenry, its current chairman, who also reacted explicitly to the arrival of PYUSD:

“This announcement is a clear signal that stablecoins, if issued within a clear regulatory framework, hold great promise as a cornerstone of our 21st century payment system. “

This project aims to establish federal and state oversight of stablecoin issuers (Tether, Circle, among others) by imposing various regulatory criteria on them. Although Maxine Waters collaborated on the project, she has suddenly expressed reservations about it, although it is not clear why.

Still at the preliminary stage, the project will have to be fine-tuned before it can be expected to be adopted definitively. For its part, the FED also recently made it known that it wanted to supervise more closely the activity of state banks offering stablecoins.

Stablecoins could also benefit the hegemony of the dollar

So it seems clear that the regulatory prism is the key to further development of stablecoins, at least for those backed by the US dollar.

But according to Mark Lurie, CEO of Shipyard Software, recently interviewed by The Block, the arrival of the PYUSD could also have a snowball effect, encouraging PayPal’s competitors to follow suit:

“If PayPal can prove the usefulness of stablecoins, not only will their utility become undeniably clear, but other traditional financial institutions will face a competitive imperative to adopt stablecoins as well. If Paypal is seriously considering stablecoins, it could be a major catalyst for stablecoin adoption. “

A view shared by Jeremy Allaire, the CEO of Circle (the issuer of the USDC), who had previously said:

“This is a strong signal that near-instant, borderless, programmable payments in the form of stablecoins are here to stay. “

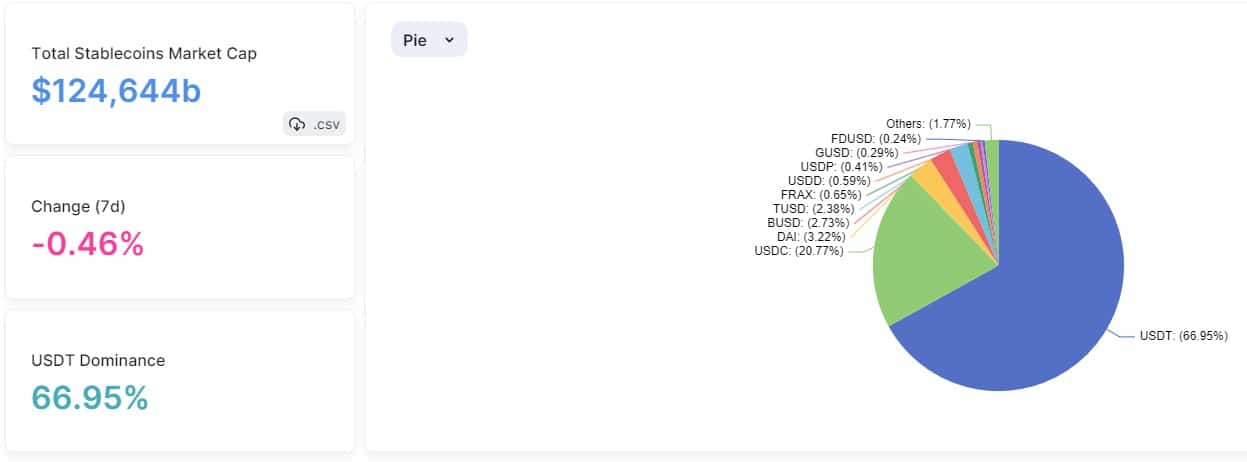

In any case, Tether continues to dominate the stablecoin market by a wide margin, with USDT currently accounting for 66.95% of stablecoins in circulation. In fact, Paolo Ardoino, Tether’s CTO, said at the time of the PYUSD announcement that he expected PayPal’s stablecoin to have no impact on the USDT. He even said that the PYUSD could help push “for sensible regulations”.

Breakdown of stablecoins on the crypto market

So the United States would be well advised to develop a favourable environment for dollar-backed stablecoins if it wants to retain its financial hegemony, which is more in question than ever. In 2000, dollars accounted for around 73% of the world’s central bank reserves, whereas today they represent just 59%. This decline could well be supported in the near future by the high-speed development of the BRICS.

That’s what Patrick McHenry had to say about the arrival of the PYUSD:

“We’re going to have to wait and see.

“We are at a crossroads right now to keep America at the forefront of digital asset innovation […] We need to finish the job.”