Less than two years after the euphoria, metaverses such as The Sandbox (SAND), Decentraland (MANA) and Otherside are in the midst of a bear market. With tokens down 95% and land prices slashed by a factor of 20, let’s take a look at some financial data to gauge the state of the market.

The metaverse is suffering the full force of its bear market

If the cryptocurrency market in general seems to be in the middle of the road, the metaverse is clearly in the middle of a bear market. And with good reason: less than two years after the euphoria triggered by Facebook, which will be renamed Meta at the end of 2021, the tokens and terrains associated with the digital worlds are pale in comparison.

To illustrate our point, we will focus on three projects:

- Otherside from Yuga Labs,

- The Sandbox (SAND);

- Decentraland (MANA).

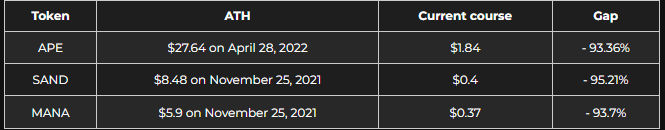

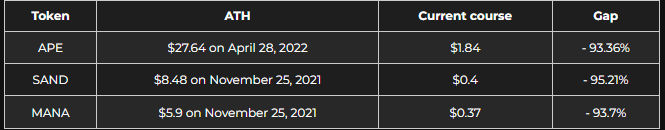

First of all, we can look at the tokens associated with these metaverses. June may have been a difficult month for them, with the Securities and Exchange Commission (SEC) describing them as securities, but that was just one stage in a long slide that began at the high point of the previous bull run.

The Sandbox’s SAND, for example, is currently down 95.21% from its all-time high (ATH). The situation is similar for its rivals, and the APE is also trading at historic lows:

Figure 1 – Price of metaverse tokens compared to their ATH

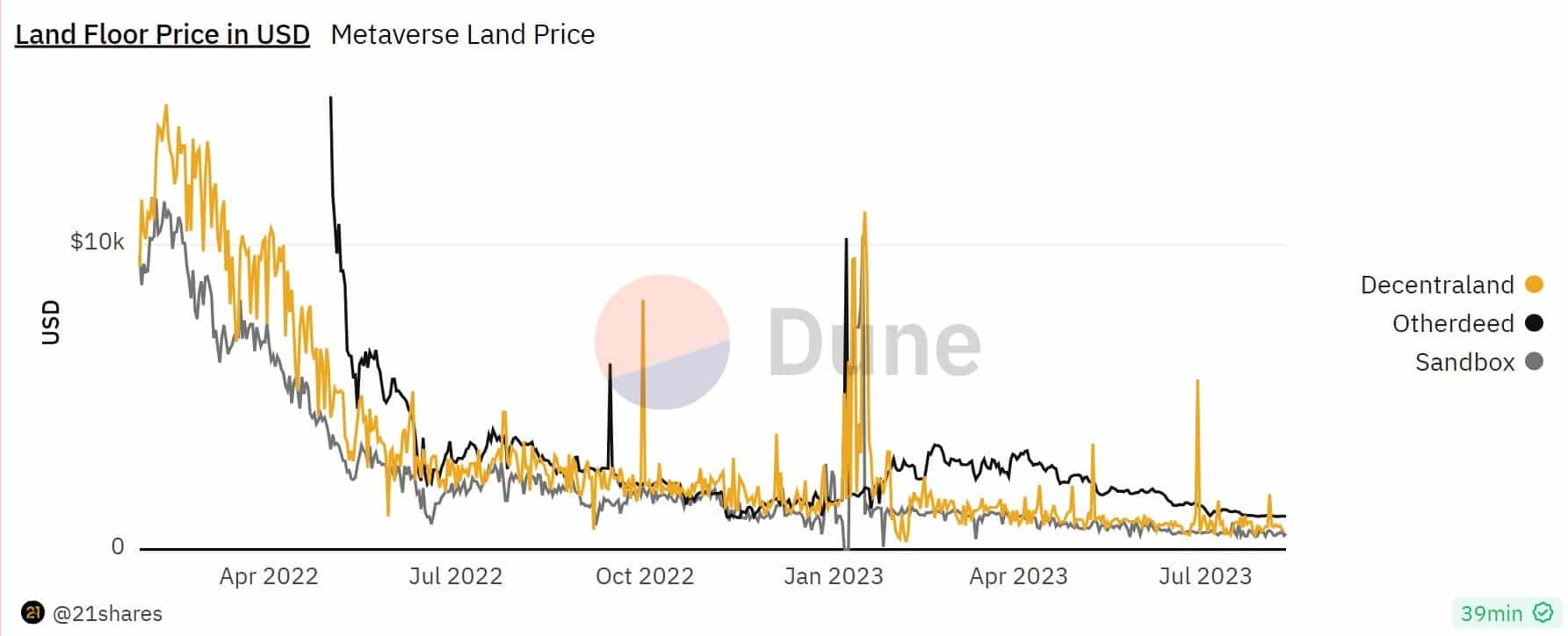

Land prices are particularly low

Another way to gauge interest in these metaverse is to look at their land prices. For The Sandbox and Decentraland, the floor prices of their virtual lands rose to over 11,000 and 14,000 dollars respectively in February 2022. For Otherside’s Otherdeed, the highest floor price was reached when the lands were first put up for sale, at nearly $15,000 in May 2022:

Figure 2 – Floors price of The Sandbox, Decentraland and Otherdeed lands

At the time of writing, the floor prices for The Sandbox, Decentraland and Otherdeed were $584, $736 and $1116.

However, this metric only allows us to judge the price of the cheapest non-fungible token (NFT) in a collection at a given time, but this does not necessarily reflect the state of the market.

For example, for The Sandbox, peak volume was reached on 22 November 2021 with 4,255 sales for 13,253 ETH, or more than $56 million at the price at the time. The day with the highest average unit price was 31 January 2022, with an average of nearly ETH 4.47, or more than $11,600 and 712 sales.

By comparison, Monday 7 August saw 46 sales at an average price of $1,302:

Figure 3 – Volumes generated by The Sandbox lands

Of course, these figures in no way detract from the fundamentals of the metaverses in question, but merely reflect a phase of excess that took place during the euphoria of over a year ago. As with the rest of the cryptocurrency ecosystem, this bear market is an opportunity to clean up the market, before starting again on a more solid footing.