CoinShares, a leading asset manager in Europe, has announced the acquisition of Valkyrie Funds LLC, expanding its presence in the US market. Now with over $7.3 billion under management, the deal expands CoinShares’ global footprint and gives CoinShares the rights to Valkyrie’s ETFs, including the Bitcoin cash ETF, BRRR.

CoinShares takes on the US market

On Tuesday, March 12, 2024, CoinShares, one of Europe’s leading asset managers, announced that it had acquired Valkyrie Funds LLC, the ETF platform of Valkyrie, another asset manager, but operating on US soil.

The acquisition gives CoinShares further access to the U.S. market and sponsorship rights to all Valkyrie ETFs, including BRRR, the manager’s Bitcoin cash ETF.

The acquisition amount will be determined and paid at the end of a 3-year period, based on Valkyrie’s financial performance.

On this occasion, Jean-Marie Mognetti, CEO of CoinShares, declared:

“The integration of Valkyrie into our fold marks another step forward in our growth momentum, this time with a particular eye on the United States. This contribution of $530 million in assets under management propels CoinShares to the forefront from day 1. But even more important is the expansion of our product range, the strengthening of our innovation potential and the 15-fold increase in our target market. “

Jean-Marie Mognetti emphasized that Valkyrie’s ETF platform will enable them to create value for the company’s shareholders and partners, considering the US market essential for asset managers.

Following this announcement, Valkyrie clarified in a series of publications on network X that the brand would continue to exist and maintain its other activities, notably via its hedge fund and trusts.

Where does Valkyrie’s Bitcoin ETF stand in the market?

With nearly $355 million in Bitcoins, Valkyrie’s BRRR ranks 7th among the spot Bitcoin ETFs with the most assets under management, behind Invesco Galaxy’s BTCO with $380 million, and Bitwise’s BITB with $1.88 billion.

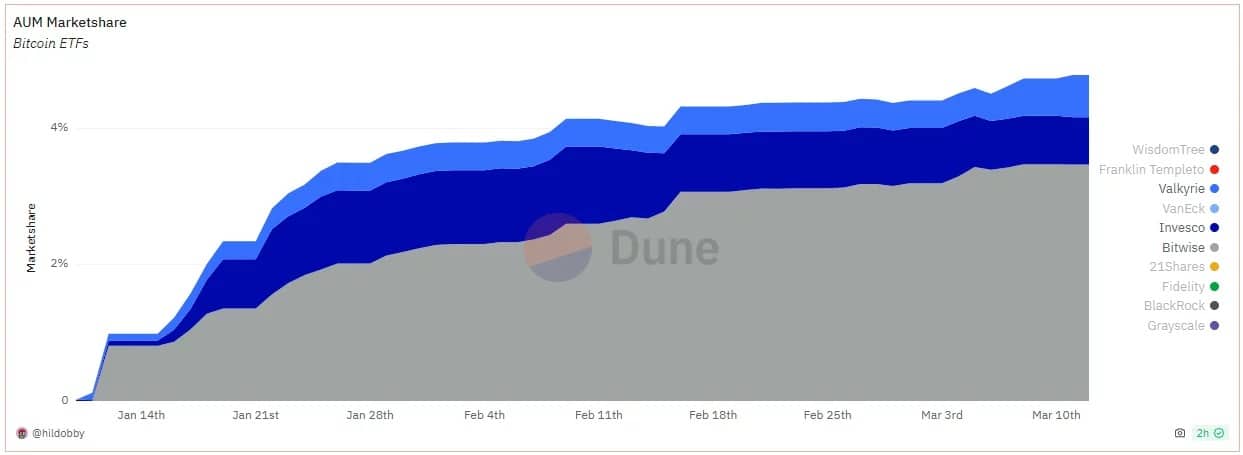

Bitcoin spot ETF market shares in terms of assets under management

However, BRRR stands out as one of the most competitive spot Bitcoin ETFs, with annual fees of just 0.25%. Since its launch, its market share has only increased, now representing 0.6% of the market, up from 0.4% the previous week.

The acquisition of Valkyrie and its Bitcoin Spot ETF positions CoinShares optimally to take advantage of the current bullish momentum in Bitcoin and the cryptocurrency market in general.