The price of Bitcoin (BTC) has shown surprising outperformance in recent weeks, compared with several asset classes that have come under pressure from the renewed upward surge in bond yields. Can this relative improvement continue?

Bitcoin outperforms several asset classes

September hasn’t been a bad month for the crypto market, with Bitcoin’s price bouncing back strongly off major technical support at the $25,000 mark. On the other hand, the market has yet to break through resistance that could make it safe from a return of a bearish impulse.

Be that as it may, bitcoin has been solid in absolute terms, but above all it has been convincing in relative terms. Indeed, over the same period in September, the European and US equity markets corrected sharply, as did the bond and precious metals markets.

The combined fall of these three asset classes (now stabilized) is a very rare stock market phenomenon, bearing witness to a period of financial stress that under normal circumstances would have carried bitcoin with it.

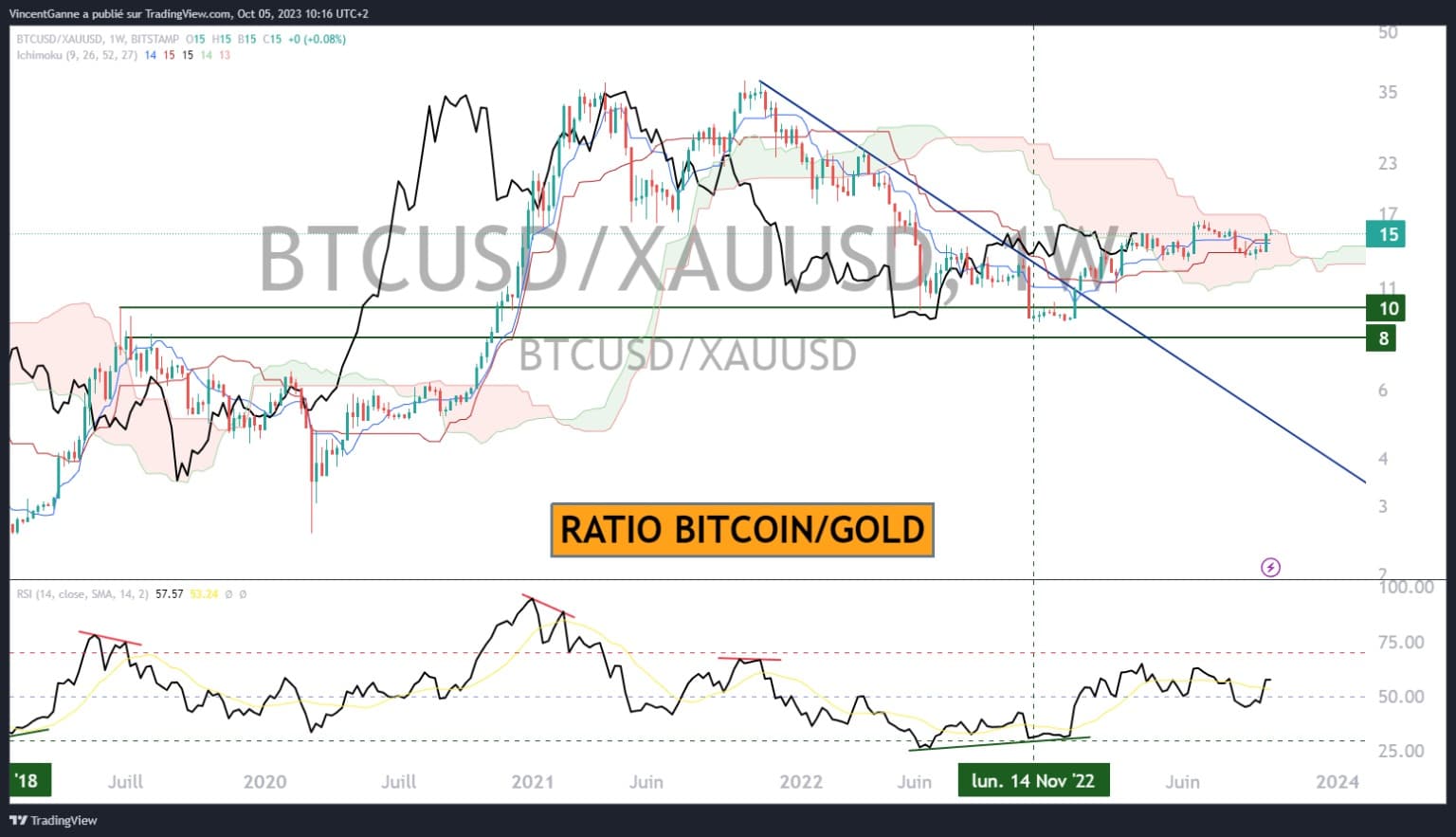

Nevertheless, surprising as it may seem, BTC has not met the same fate as gold or silver. And yes, Gold has fallen by 12% since its all-time high, yet precious metals on the stock market and cryptos obey the same inverted correlations vis-à-vis the US dollar and bond interest rates.

How do we explain this outperformance against gold?

First option, BTC will weather the storm with a delay. In this case, the rebound to $25,000 will have been the swan song. That’s why we need to remain very cautious until resistance at $29,000 is significantly breached on a weekly closing basis.

As a second option, BTC is already being held by strong hands in view of the bullish news expected (or at least hoped for) for the year 2024, which is fast approaching. By this, we obviously mean halving and spot ETF endorsement, which seem to be the winning pairing of the coming months. Once again, without a technical signal to take shelter, the market can still quite easily break support at $25,000.

Whatever happens in price action over the next few weeks, bitcoin’s September outperformance will surely have been a signal of long-term bullish potential.

Chart representing the Bitcoin/GOLD ratio over the weekly time horizon

A sword of Damocles hanging over Bitcoin

Bitcoin’s long-term bullish potential, I don’t think anyone here doubts. However, the prospective short-term trend is much more uncertain, with the price describing a trading range between support at $25,000 and resistance at $29,000.

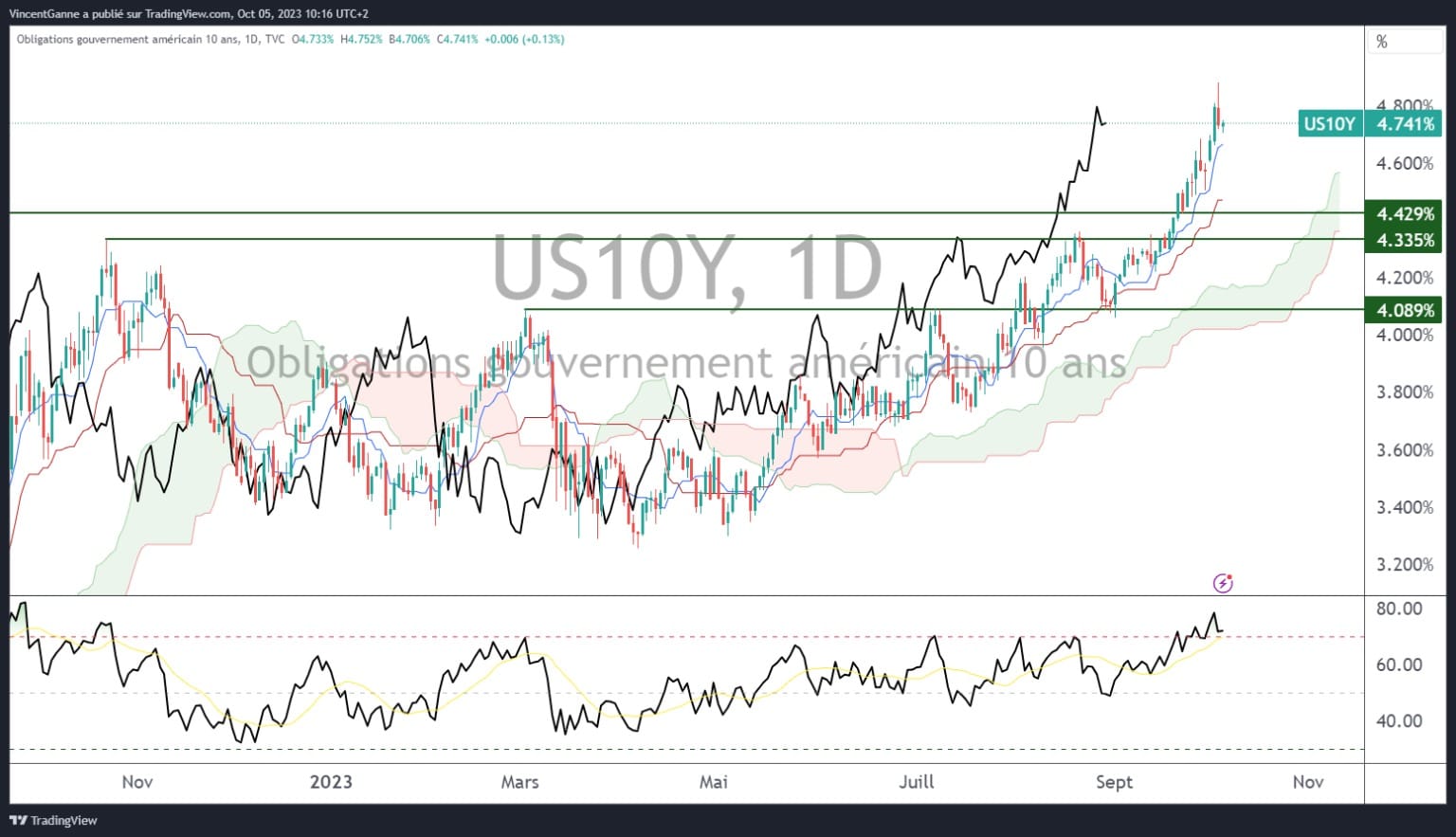

The immediate trend for risky assets on the stock market will be driven by the evolution of the US 10-year bond yield, the benchmark for the long-term cost of money and, above all, the main culprit behind the equity market’s fall in September.

In order for BTC to continue rebounding, it is imperative that this benchmark interest rate enters a period of reflux and, above all, does not exceed its 2007 record of 5.25%.

In the very short term, the first support for BTC/USD is at $26,800, a break of which would send the market back towards $25,000.

Chart showing Japanese candlesticks in daily data for the US 10-year bond yield