Bitcoin (BTC) briefly surpassed its all-time high yesterday, before suffering a brief but sharp fall. A total of $1 billion in long positions were liquidated on the spot. A look back at the turmoil surrounding the world’s largest cryptocurrency

Bitcoin: a lightning correction just after the all-time record

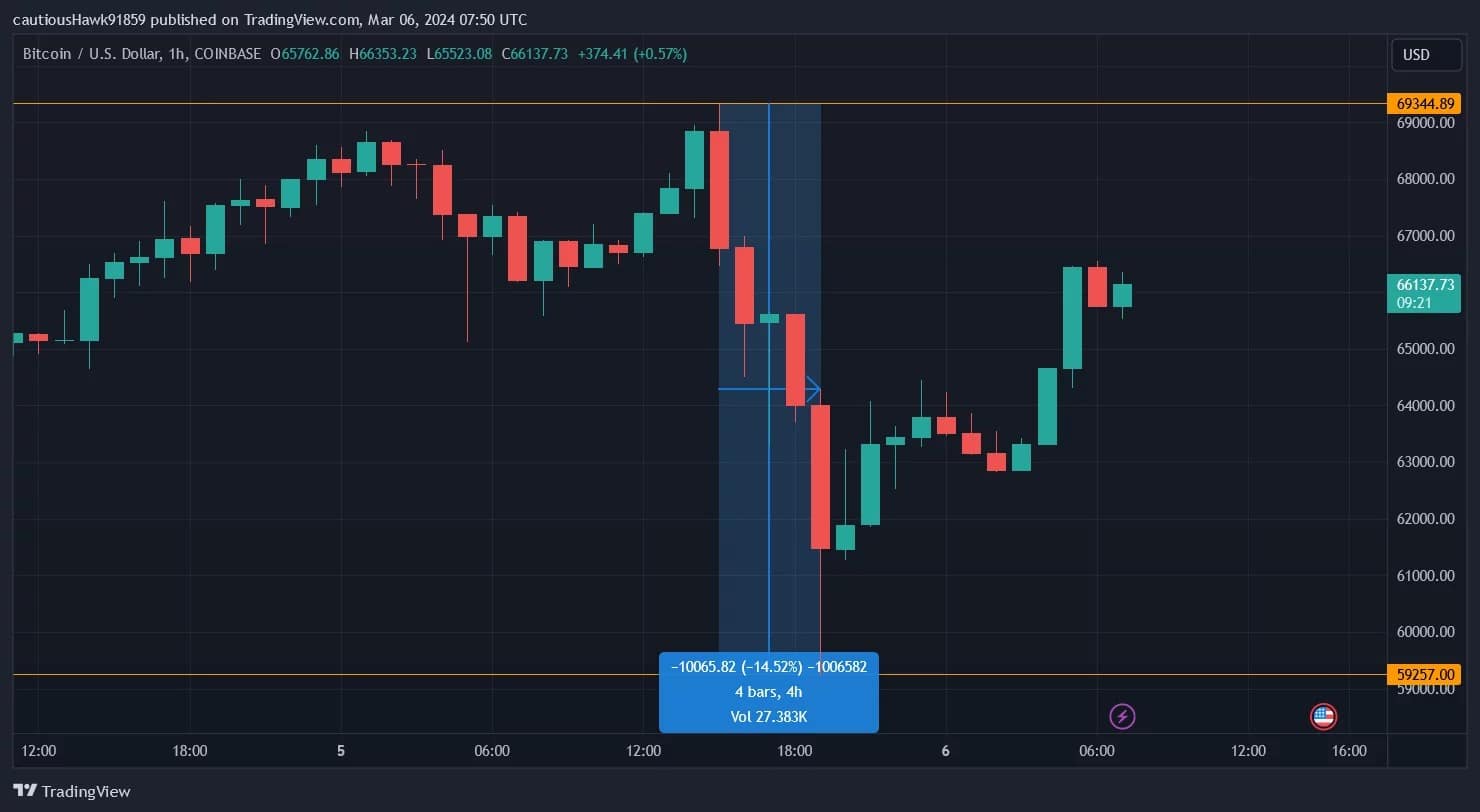

Yesterday, the price of Bitcoin (BTC) surpassed its all-time high, touching $69,200 and even $69,300 on some platforms. And the correction, expected after such a sudden rise, was swift and consequent. The largest cryptocurrency fell back below $60,000, before bouncing back :

Bitcoin price corrects quickly after breaking all-time high

In the space of 4 hours, the BTC price lost 14%. It has since recovered, and this morning stands at around $66,300. But this “flash crash” had consequences for investors who were betting on Bitcoin’s rise or fall.

$1 billion of positions liquidated

Investors who had bet on a continued rise after the all-time high were disappointed. A total of $1 billion was liquidated, most of it from long positions. According to analyst firm Santiment, the traders concerned had expected BTC to rise above $70,000, and hold at that level.

Most commentators agree that this is a cooling-off from the excesses of a market that had been in turmoil until then. Bitcoin has indeed risen very rapidly since the weekend, generating a great deal of speculation, according to Santiment:

“In a way, this fall can be seen as a sign that the “speculative excess” has been temporarily removed from the markets. “

Will the Bitcoin price break through its ATH again? Traders have the halving in their sights, which is scheduled for around mid-April. Historically, the BTC price tends to climb after a halving. This time, it climbed just before. All the more reason for investors to be hopeful, with the idea that this bull run will perhaps seek new highs in the months ahead…