As we learn of Changpeng Zhao’s departure from Binance, the indictment against him and his crypto exchange has just been published. What does it tell us, and what exactly is CZ and its platform accused of?

What does the indictment against Binance and Changpeng Zhao tell us?

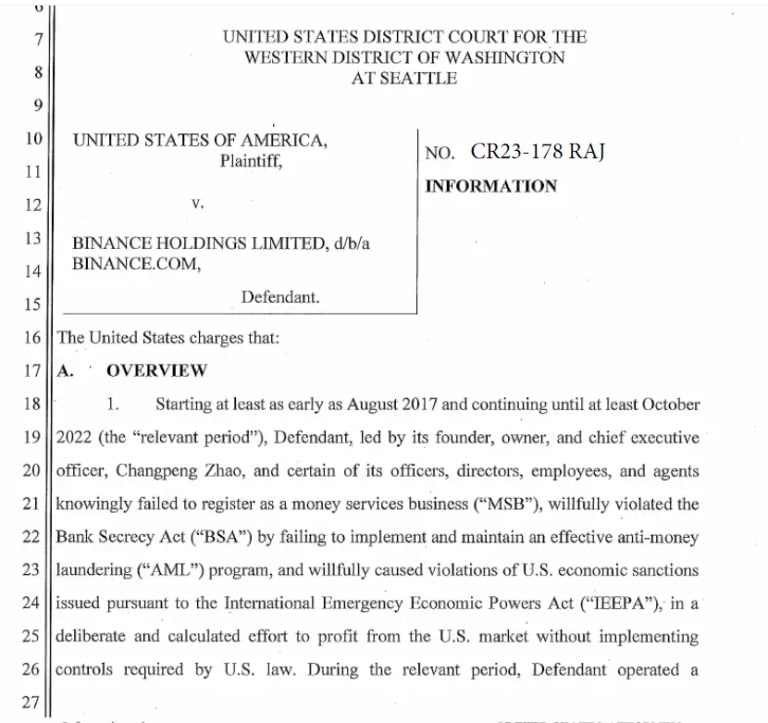

As the Wall Street Journal reports that Changpeng Zhao is stepping down as CEO of Binance, the world’s largest cryptocurrency exchange in terms of volume traded, the indictment filed by the U.S. Department of Justice has just been unveiled. The indictment was originally filed on November 14.

First of all, and in order to clarify the issues surrounding the various entities of the CZ empire, it is indeed Binance that is the target of the complaint, and not its subsidiary Binance.US, although it is cited in the document on several occasions.

The DOJ accuses Binance and Changpeng Zhao of violating the Bank Secrecy Act from 2017 until at least October 2022. According to the document, Binance failed to implement a mandatory anti-money laundering program, in addition to having “violated U.S. economic sanctions” relating to the International Emergency Economic Powers Act (IEEPA).

Overall, Binance and CZ are accused of concealing the activity of their international platform (Binance.com) in the United States, a territory normally served by Binance.US, the exchange’s dedicated subsidiary.

” The objective of the conspiracy was to enable Binance to operate as a virtual currency exchange and gain market share and profits as quickly as possible. Defendants chose not to comply with U.S. legal and regulatory requirements because they determined that doing so would limit their ability to attract and retain U.S. users.”

Excerpt from the indictment

More specifically, the document asserts that CZ and Binance were largely aware of their U.S. activity, as they actively monitored their numbers there. For example, a chart filed by the DOJ shows that in 2017, over 23% of Binance’s users were US residents.

Excerpt from the indictment brought against Binance and Changpeng Zhao

In 2019, Changpeng Zhao had also written that if Binance had blocked its US customers, the platform “wouldn’t be as big as it is today”, before adding that it was “better to ask for forgiveness than permission”.

Binance will plead guilty to 3 separate counts, including knowingly conducting, controlling, managing, supervising, directing and owning all or part of an unlicensed money transmission business and 2 other such counts, in part relating to its illegal operations conducted in Iran.

The agreement between the parties specifies that CZ will not be able to appeal if his sentence does not exceed 18 months. At most, the former Binance CEO faces up to 10 years’ imprisonment, given that he has pleaded guilty. At the same time, he has agreed to pay a personal fine of $50 million.

A compliance program adapted to US law will be put in place, as the DOJ has accused Binance of operating without a proper compliance program.

The price of BNB, Binance’s native token, is down just under 6% following the news.