After 2023 marked the end of the cryptocurrency market’s bear market, what does 2024 have in store? The stars seem to be aligned for a bull run comeback, but caution remains the order of the day. In this feature, let’s explore together the key trends that could drive the cryptocurrency industry in the new year.

Preamble: 2023, the year of the end of the bear market

On January 1, 2023, the cryptocurrency industry was just recovering from a monumental hangover. In the aftermath of the FTX bankruptcy, one of the darkest affairs in its young history, and following the Terra / LUNA collapse, the Celsius bankruptcy and the Three Arrows Capital affair, it was high time for 2022 to come to an end.

While a Bitcoin at $16,000 might be an unmissable bargain for some, it has to be said that crowds weren’t flocking to buy them at that price. Looking back over the past year, few, even the most optimistic, had anticipated the scenario that 2023 held in store for the cryptocurrency market.

One year later, on January 1, 2024, Bitcoin was trading for over $45,000, validating a performance of 150%, the best of all asset classes combined. In our ecosystem, a few short 365 days have probably been enough to make us forget the past catastrophe and give us hope that the long-awaited “bullrun” will return.

Bitcoin (BTC) price evolution in 2023

While 2023 ended on this exciting note, 2024 got off to a flying start with the approval of the very first Bitcoin spot ETF in the United States. Expected by investors for over 10 years, this event marks a major turning point for Bitcoin. It symbolizes institutionalization, recognition by US regulators and simplified accessibility to this new asset class.

From the acceptance of spot Bitcoin ETFs to the approach of halving, via a Fed pivot expected in the coming months, the stars seem to be aligned for a bullish recovery in the cryptocurrency market in 2024. In this feature, we take a look ahead to the year ahead and take an in-depth look at the trends that could drive the industry.

Bitcoin: layer 2, DeFi & BRC-20

While conditions seem optimal for a bullish continuation of the cryptocurrency market in 2024, many macroeconomic and geopolitical uncertainties still weigh and it would be dishonest not to mention them. The risks of a real estate crisis in the United States, armed conflicts around the world, the possibility of an economic recession or even rising oil prices could thwart optimistic scenarios. In such an eventuality, will the price of Bitcoin react in the same way as risk markets, or on the contrary, will it don its safe-haven hat? It’s hard to say for sure.

One thing is certain: Bitcoin’s thesis is becoming more and more obvious as the years go by. The approval of Bitcoin spot ETFs in the U.S. is proof of recognition for this asset class, and will enable millions of American savers to invest in a regulated and secure manner. Added to this is Bitcoin’s 4th halving scheduled for the end of April, an event historically followed by a bullish period, and although its impact tends to diminish with each passing event, the self-fulfilling thesis theory should not be overlooked.

Given the context, Bitcoin seems to be in a strong position compared to other cryptos and should continue to extend its market dominance, at least until a real euphoria occurs and triggers a new altcoin season.

But that’s not the only reason for Bitcoin’s presence here. The arrival with great fanfare of the Ordinals protocol has reminded us that Bitcoin is king, and that any trends concerning it can quickly take on a disproportionate scale. Digital artefacts (enhanced NFTs) and BRC-20s (the first tokens on Bitcoin) have established themselves at the top of the capitalization rankings in their respective categories, and this trend could continue into 2024.

Among the main initiatives emerging around Bitcoin are:

- BRC-20 tokens: these are gradually being listed on the main centralized exchange platforms, although their intrinsic usefulness remains to be defined;

- Bridges: these enable BRC-20s to be transferred between Bitcoin and other ecosystems (Ethereum, Solana, Avalanche, etc.);

- Layer 2: these are designed to integrate decentralized applications based on the Bitcoin network;

- Decentralized finance protocols (DeFi), also known as OrdFi: via the Ordinals protocol or other similar initiatives.

Ethereum and the ZK Rollups season

While the cryptocurrency market returned to growth in 2023, Ether (ETH) left investors with a bitter taste. In the space of 365 days, the ETH price underperformed Bitcoin by almost 30%, despite a notable 94% performance against the US dollar.

Evolution of the ETH/BTC pair over the last 12 months.

However, the industry seems to have a short memory and is quick to forget that Ethereum has recently undergone two updates on a scale never seen before: The Merge (September 2022) and Shapella (April 2023), which marked the network’s final transition to Proof of Stake.

In recent years, the Ethereum narrative has evolved. The ambition is no longer to achieve a high level of scalability directly on the main layer, but rather through second-layer solutions. While Optimistic Rollups such as Arbitrum and Optimism are already up and running, expectations are high for ZK Rollups, which some believe to be more powerful and promising.

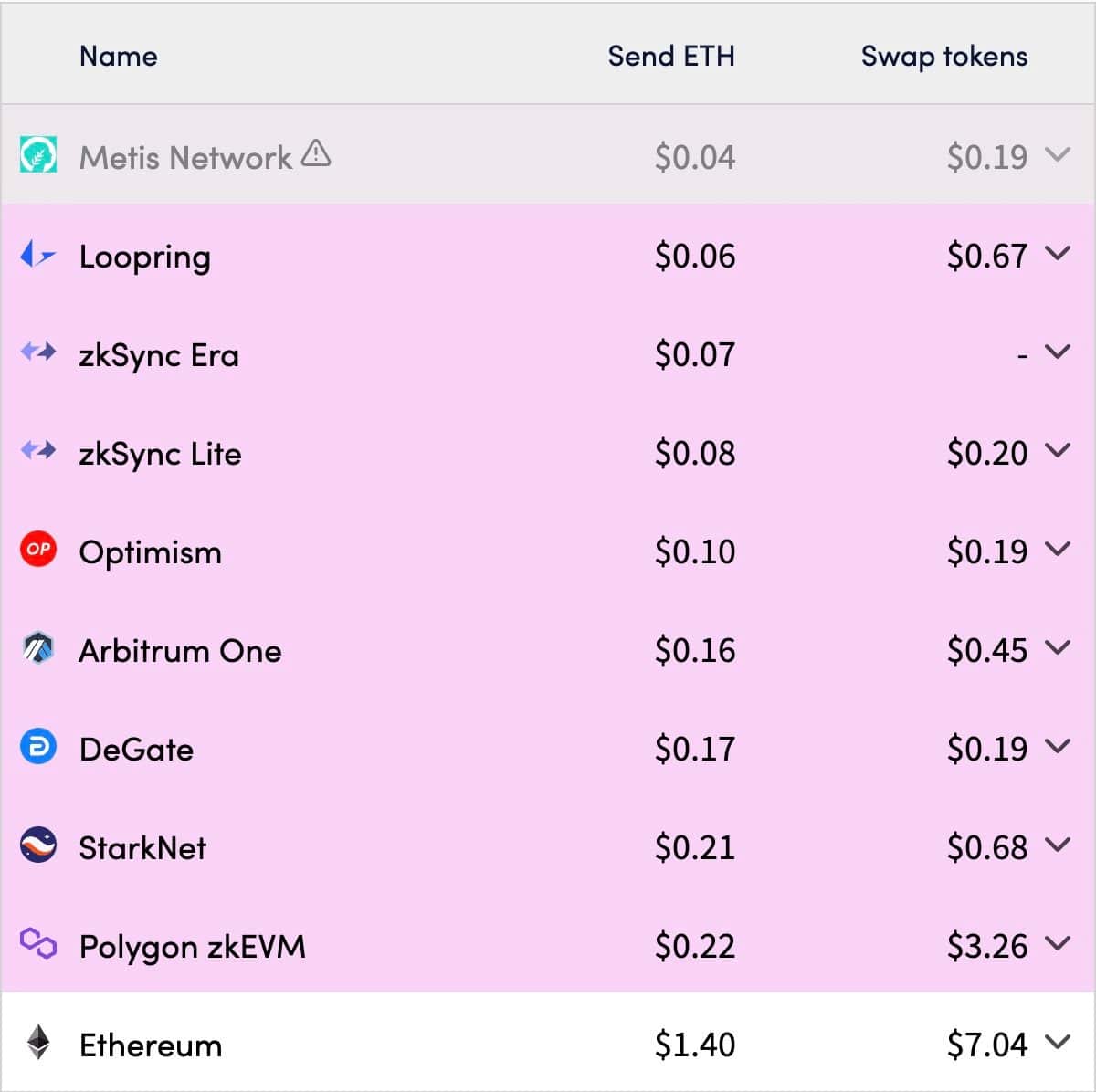

Ethereum co-founder Vitalik Buterin also maintains that the future of the network lies in Layer 2. Nevertheless, he believes that the transaction costs of these second-layer solutions must not exceed 5 cents to be “truly acceptable”. At present, we’re a long way from achieving this, as the graph below shows.

Transaction fees for Ethereum’s main layer 2

This is the main criticism facing Ethereum: excessive network fees that exclude small wallets and annoy users. However, this is likely to change in 2024 with The Surge. Specifically, this update will involve the implementation of EIP-4844 (known as proto-danksharding). In simple terms, this will drastically reduce transaction costs, making Ethereum and its layer 2s much more accessible.

Let’s also note that the first half of 2024 could be marked by the long-awaited “ZK Season”, i.e. the successive launch of tokens from the main ZK Rollups layer 2 solutions (Linea, Scroll, zkSync, StarkNet), potentially in the form of an airdrop to the community. A succession of events that could put the spotlight back on the Ethereum ecosystem and close a few debates.

RWAs, the tokenization of real assets

“I’m convinced that this new technology will become very important. The future of the market lies in tokenization,” Larry Fink, CEO of BlackRock. After promoting Bitcoin, the chairman of the world’s largest asset manager recently promoted asset tokenization on the blockchain.

Real-world asset tokenization (RWA) is a mechanism that aims to digitally represent an asset on the blockchain in the form of one or more tokens. This concerns fields as varied as real estate, luxury items, works of art or even financial securities such as shares.

The tokenization of real assets has the advantage of offering greater accessibility to investments traditionally reserved for a financial elite. By splitting an asset into several tokens, the entry price is logically divided and a larger number of investors can therefore acquire them. These tokens can also be traded on a secondary market, making the asset more liquid. As for speed and cost of execution, it goes without saying that blockchain is more attractive than any traditional system.

In addition to Larry Fink, many other players in traditional finance have praised tokenization. According to Bank of America (BoA), tokenized assets are set to revolutionize today’s financial system, making it more efficient, faster and, above all, cheaper. According to the Boston Consulting Group, the tokenization market is expected to reach $16,000 billion by 2030.

What sectors of our ecosystem could be impacted by the success of this trend? Firstly, infrastructure blockchains, which will support applications that will themselves attract potential billions of dollars. Secondly, infrastructures connecting the real world and the blockchain world, namely oracles. These would potentially be two areas of consideration for an investor wishing to gain exposure to the RWA trend.

DePIN, the most eagerly awaited narrative

During the previous bull run, the cryptocurrency market was marked by a few more or less pronounced trends, the most significant of which was almost certainly decentralized finance (DeFi). While it’s possible that decentralized finance applications will see renewed interest in the potential next bull cycle, other sectors look more promising in 2024.

As a non-financial, decentralized sector, DePIN is one of the most eagerly awaited trends of 2024. If this term doesn’t ring a bell, that’s perfectly normal, since it was first introduced by Messari in their 2023 annual report.

In a nutshell, DePIN stands for Decentralized Physical Infrastructure Network. As the name suggests, the ambition is to provide a decentralized alternative to physical infrastructure networks through blockchain technology. This approach relies on the use of cryptocurrencies to encourage participants to share their available resources, be they storage capacity, energy, computing power and so on.

In order to overcome dependence on the large centralized entities that currently monopolize this sector, DePIN players rely on the sharing economy model and offer much lower execution costs than the competition.

The DePIN ecosystem as seen by Messari

While the DePIN narrative may look appealing on paper, does it really address a real, tangible need among historical users of these services? Is the industry ready to migrate to decentralized solutions? For the moment, there’s nothing to suggest that the answer is yes. If we look at the main DePIN projects – Filecoin (FIL), Render (RNDR), Helium (HNT), Akash (AKT) and Arweave (AR) – they were already present in the previous bull cycle and are struggling to find customers outside Web3.

players.

Evidently, the cryptocurrency market doesn’t always resonate logically. As an example, the explosion in artificial intelligence (AI)-related cryptos was based on nothing more than the recent success of ChatGPT, Midjourney and consort.

According to Messari, the DePIN sector could be worth more than $2,000 billion by 2028, corresponding to potential growth of a factor of 150. In this sense, it’s a sector that’s right at home in this dossier and could undeniably be among the most interesting to follow in 2024.

Airdrop and staking, the new (3,3) ?

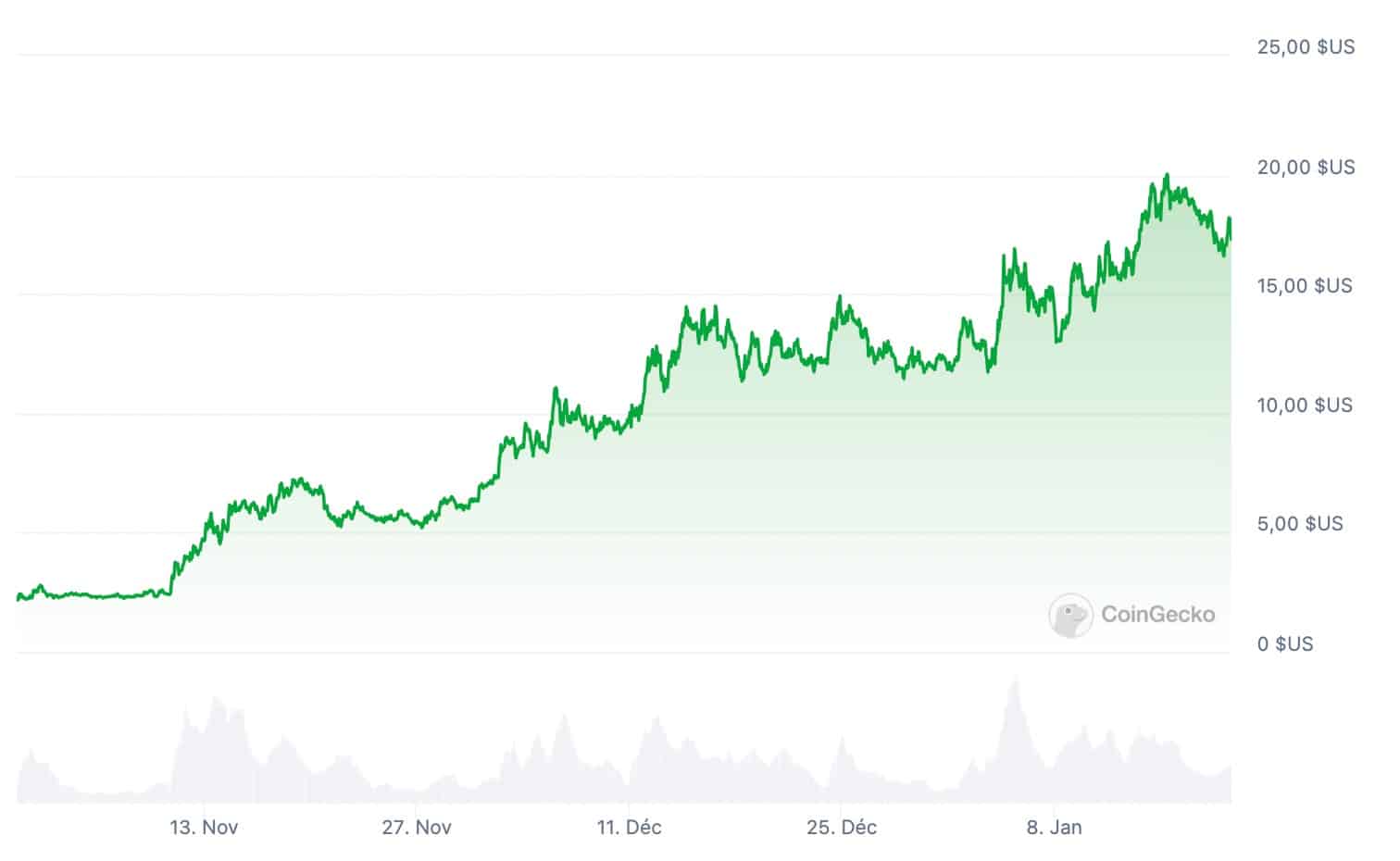

Anyone who was at least a little active during 2023 certainly didn’t miss the recent airdrop events, particularly the one at Celestia (TIA). Users who have staked ATOM tokens have been pleasantly surprised to receive an allocation of TIA tokens as a reward, worth around $2 at launch on November 1, 2023 and trading at around $17 at the time of writing.

At the same time, users who had deposited TIA tokens in staking were pleasantly surprised to be eligible for a series of numerous airdrops: Dymension, Namada, Saga and others. In other words, the end of 2023 was also punctuated by this series of airdrops rewarding users practicing staking.

Price evolution of Celestia (TIA) since its launch

The rise in the TIA share price over the last 2 months can be explained as follows. The anticipation of a wave of airdrops aimed at stakers prompted many users to buy TIA and place it in staking, regardless of its price, considering that the rewards they could receive would exceed the stake they placed in staking.

That’s why this section has been dubbed “the new (3,3)”. For those of you in the know, the (3.3) is a term coined by Olympus DAO to describe a trend in decentralized finance in 2021. In a nutshell, it’s a kind of game theory that says there’s no point in selling because buying and storing tokens is good for everyone. In other words, a Ponzi scheme that has been recycled over and over again and has produced nothing but failure.

Obviously, this comparison is only an amusing reference, and the idea is absolutely not to associate Celestia with a Ponzi scheme. On the other hand, the facts are there: the anticipation of potential airdrops to stakers of TIA tokens had the effect of inciting many individuals to buy them for the sole purpose of staking, driving up the crypto’s price without imposing any selling pressure.

In short, it seems to me that 2024 could be marked by a season of airdrops rewarding stakers in several cryptocurrencies. Among the ecosystems concerned are Celestia (TIA), Cosmos (ATOM), Injective (INJ) and Pyth Network (PYTH).

Let’s take Pyth Network as an example. An airdrop of PYTH tokens was distributed in November 2023 to individuals who had staked ATOMs on Cosmos. In the same vein as Celestia, many individuals expect PYTH staking to unlock airdrops from other projects. Obviously, this is all based on pure speculation; but it’s a trend that’s been building over the past few weeks and could continue to drive 2024.

ETH restaking on Ethereum

Let’s end this issue with a trend that’s making a lot of noise at the start of 2024, and which reinforces the convictions expressed above regarding the Ethereum ecosystem. Dubbed restaking, this new trend was first introduced by EigenLayer, a protocol whose name is likely to be circulating more and more in the coming weeks.

Ever heard of staking? This concept aims to lock cryptocurrencies into a protocol or blockchain in order to contribute to its operation and security, while being rewarded for this activity. Restaking, on the other hand, enables ETHs staked on the Ethereum network to be reused for staking in other protocols in the ecosystem.

At first sight, this may seem hard to understand, so let’s take a concrete example. You place 1 ETH in the Lido Finance protocol to participate in Ethereum staking. In return, you receive a stETH, a token signifying that you have deposited your funds, which can be used in any decentralized finance protocol. This is what we call Liquid Staking, a way of making assets that are locked on the Ethereum network liquid. From here, you can deposit your stETH in EigenLayer so that it can be used to secure and operate other protocols in the Ethereum ecosystem.

Why is this so important? It’s important to understand that Ethereum is a network whose security and decentralization stem from the large number of validators in operation. At present, around 19 million ETH are staked, representing over $50 billion. Similarly, all infrastructure protocols also require validators to ensure their operation and security: bridges, oracles and layer 2s.

However, Ethereum captures the majority of staking activity, and these protocols are struggling to find a large enough number of individuals willing to deposit staking assets with them. This is why EigenLayer is proposing to reuse ETH already staked and place them in these protocols.

The interest is already palpable, with many emerging Liquid Restaking protocols offering to redirect their liquid staking tokens (stETH for Lido, for example) to EigenLayer. What’s more, this trend is reinforced by rumors of airdrops for EigenLayer users

Conclusion on the year 2024 of cryptocurrencies

The year 2023 marked the end of the bear market for the cryptocurrency market, turning the page on one of the most catastrophic periods in its young history. As you will have seen from reading these lines, there are several arguments to suggest that 2024 could follow in this footsteps, although macro-economic and geopolitical uncertainties still loom large.

Nonetheless, the fundamentals are consolidating over time, and trends are emerging. Among these, we have identified the most promising: the Bitcoin ecosystem, the rise of Ethereum, asset tokenization, DePINs, the airdrops of the Cosmos and Celestia ecosystems and, finally, restaking.

The opinions set out are, of course, indicative and informative and do not constitute advice to guide your cryptocurrency investment strategies. See you in 1 year’s time for a review of 2024 and a look ahead to the following year.