The FTX black swan and its ramifications, as well as the cost of energy for mining activities, continue to exert bearish pressure on Bitcoin and cryptocurrency prices, all the more damaging as the appeal of the equity market has made a comeback since the short squeeze on Thursday 13 October. Let’s ignore this difficult backdrop and make an unfiltered technical diagnosis of the crypto market.

A confidence issue that will be resolved in the coming weeks

The collapse of the FTX platform, the crook that is the person of Sam Bankman-Fried, the powerful movement of distrust towards crypto currencies that followed via a very large amount of withdrawals from centralized platforms (CEX) is a black swan.

For financial markets, a black swan is the worst fundamental event that can occur, as its exceptional nature poses a systemic risk, i.e. a risk of collapse of the market concerned due to unpreparedness to cope.

By definition, this is a market risk that was not listed as a potential risk at the beginning of the year. In the current case, FTX was still considered a “top ranking and safe” player a month ago and its CEO a benefactor for the ecosystem.

Now, this gentleman turns out to be a black sheep (no relation to the swan), a low-life crook who ultimately finds himself excluded for the sake of the future of the crypto ecosystem.

But don’t dream, it will take a long time to erase the crisis of confidence that this event has triggered. In turn, the downward trend in cryptocurrency prices in place since autumn 2021 is developing further, making fewer and fewer mining farms profitable.

It is therefore becoming urgent to stabilise the total market capitalisation of cryptos, so that a healthy structural basis can be put back into an upward trend in 2023.

In the meantime, the balance of holders continues its upward slope, confidence in the CEX is not yet making a comeback.

Figure 1: Graph juxtaposing the Bitcoin price with the holders’ and traders’ balances

On a technical level, volume and participation data are the key to assess a possible buying remobilization

In order to measure the evolution of general confidence in cryptos, volume, commitment and participation data is the most relevant within the tools of technical analysis of financial markets.

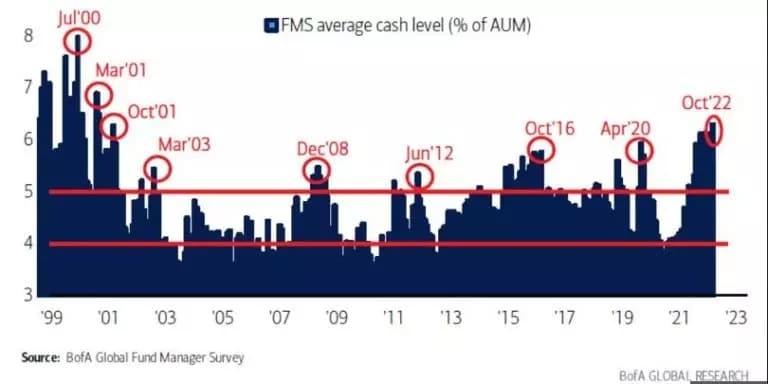

The evolution of deposits and withdrawals at centralised platforms (CEX), the measurement of Open Interest (OI) on crypto futures, Asset under Management (AUM) on crypto ETFs as well as the evolution of the share of cash at institutional managers.

The latest data from these metrics does not yet show a return of available liquidity to cryptos, but there is a stabilisation that shows that the post-FTX bankruptcy haemorrhage has stopped.

I remain convinced that the available liquidity (the amount among institutional traders is close to its record high following the bursting of the speculative bubble 2.0 at the beginning of the century) will be reinvested in part in the crypto market as soon as confidence returns, a confidence that depends first and foremost on the accounting transparency and financial solvency of the key players in the ecosystem.

To conclude on a chartist level, the Bitcoin (BTC) price needs to break above the former lows of last June to get back into an uptrend, i.e. resistance at $19,000 / $20,000.

Figure 2: Chart showing the evolution of the share of liquidity among institutional managers