The price of Bitcoin (BTC) has managed to hold at the top of the trading range it has been building since November, without yet breaking through the extreme technical resistance of the $38,000 mark. The fall in the US dollar and market interest rates helped to record another favorable monthly technical close.

The near-certainty of a Central Bank pivot in 2024

Market interest rates have been falling in the United States and Europe since the end of October. This is due to the conviction that the peak of the monetary tightening campaign by the major Central Banks is behind us.

Disinflation, economic slowdown or even economic recession – these are the two factors that could motivate a pivot by the FED and then the ECB in 2024. In anticipation of this event, market rates are showing bearish technical signals.

The starting point for the decline was given when the US 10-year bond yield reached the 5% threshold on Thursday October 19. The latter (which is the ultimate benchmark for assessing long-term financing conditions for governments, companies and individuals) is close to the record reached in 2007 before the subprime crisis, and is considered a warning threshold putting more than 50% of US small and mid caps in serious difficulty.

The fall in market interest rates since the end of October initially validated bearish technical signals in daily data, before the medium-term charts (in weekly data) took over following the “dovish” comments made by the FED’s Mr. Waller at the beginning of the week.

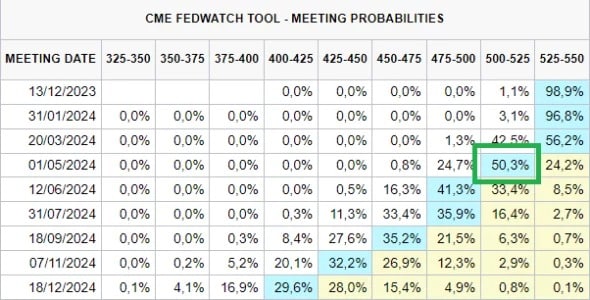

Chart representing the probability of the FED’s monetary decisions at its next meetings, based on FED swaps on the Chicago stock exchange

The market is 100% certain that the FED’s Terminal rate has been reached at 5.50% and therefore anticipates a 100 basis point drop (i.e. a % point drop in the FED rate, from 5.50% to 4.50%) by December 2024.

Don’t put the cart before the horse when it comes to disinflation

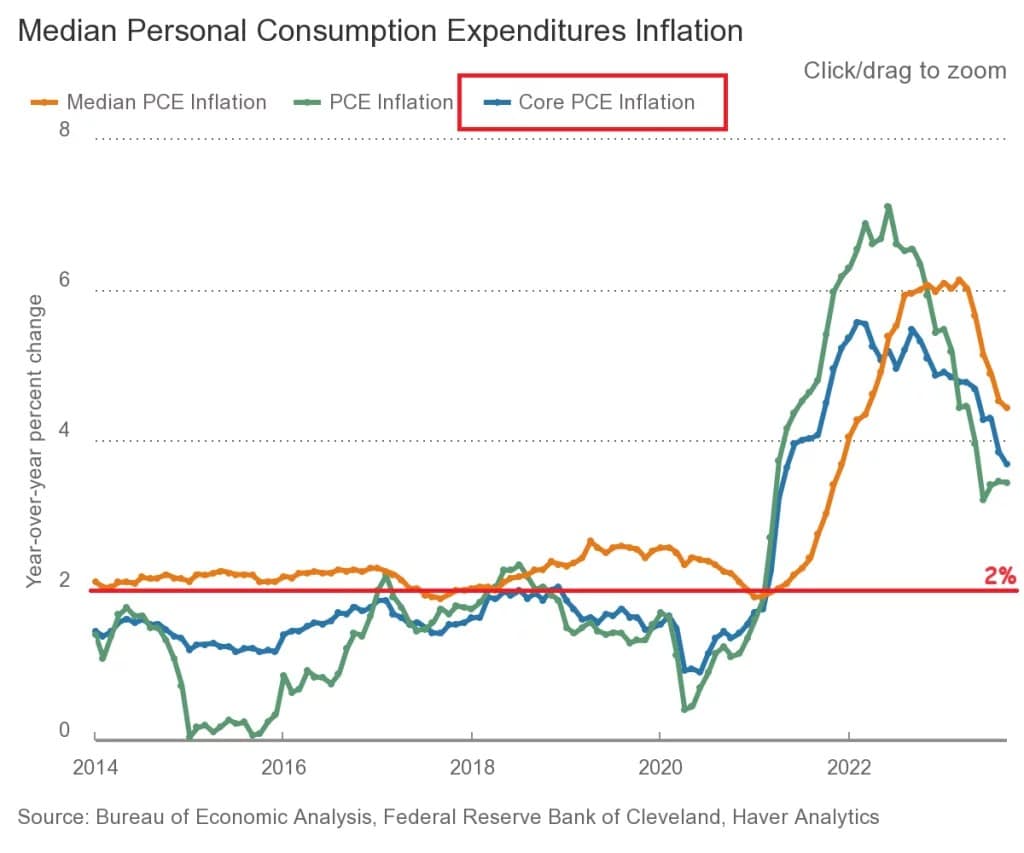

This bearish market expectation for Central Bank rates is based on a dual conviction that may still seem presumptuous at this stage. The first is that the process of nominal and underlying disinflation (core inflation) will continue up to the 2% target at the rate in place since the last quarter of 2023.

The second is that the Fed would like to pivot quickly enough to avoid a “hard landing” for the US economy, i.e. an economic recession in the service sector (80% of GDP) and a surge in the unemployment rate, while the US labor market has been giving orange (not red) warning signals since autumn 2023.

However, let’s not put the cart before the horse: there is a real risk to this bearish market anticipation for Central Bank rates. Here they are:

- The maintenance of high core inflation (PCE core) despite a return of nominal inflation below 2%, due to the resilience of the service sector and its determination not to cut margins;

- A too-rapid rate cut would boost nominal inflation.

Graph showing the PCE inflation index, the one preferred by the FED and calculated by the US government agency, the BEA