This first week of May is very busy on the fundamentals front, with new rate hikes by the FED and ECB and the publication of the NFP report in the US on Friday. The increased likelihood of a US recession is leading the market to predict a Fed pivot as early as summer 2023. What impact could this have on the Bitcoin (BTC) price trend?

The Federal Reserve could “pivot” during the summer

The US Federal Reserve (The FED) issued a new monetary policy decision on Wednesday evening and its Chairman Jerome Powell held a press conference. As expected by the consensus of financial analysts, the FED raised its key rate by 25 bps to 5.25%, surpassing the record set in 2007!

Jerome Powell insisted that inflation (particularly core inflation) was far from over and that monetary policy could remain restrictive for many months to come.

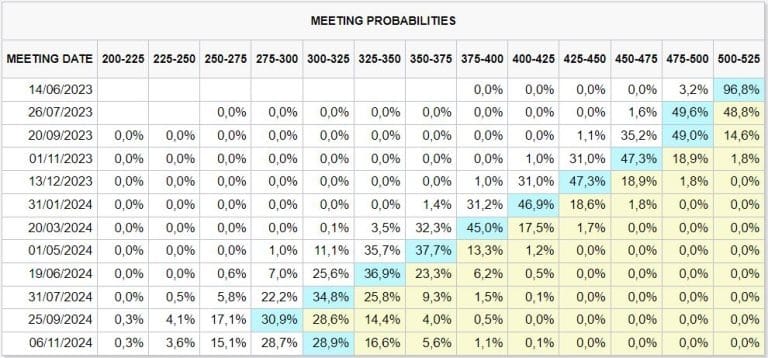

Surprisingly, the market no longer seems to believe the FED and is now projecting a downward reversal in the FED’s interest rate cycle. In plain English, this is known as a downward pivot in Fed rates. According to the CME FED WATCH TOOL (see table below), the market is anticipating that the FED’s terminal rate has now been reached and that the FED should make its pivot in the course of the summer; this is in fact what is being taught by the price of futures contracts traded on the Chicago exchange on the Fed funds interest rate.

Clearly, such a scenario of an end to restrictive monetary policy is a fundamental factor in supporting so-called risky assets on the stock market, particularly the equity and crypto markets.

How can we explain such optimism in market expectations, which runs counter to the FED’s official rhetoric?

First of all, there is the increased likelihood of a US recession with the growing difficulties of US regional banks, and above all the market’s belief that disinflation will continue (recent fall in oil prices on the stock market in particular).

Nevertheless, we must remain cautious, as the Fed will not pivot as long as underlying inflation remains high.

Table from the Chicago Stock Exchange’s CME FED WATCH TOOL, which describes the probability of the US Federal Reserve (FED) interest rate cycle evolving

Bitcoin’s (BTC) trend continues to be heavily influenced by the interest rate/US dollar trend

Now let’s look ahead and imagine that the market’s expectations are correct. In this forward-looking scenario, the FED would initiate a downward trend in interest rates from the end of the summer, which would have a downward effect on market interest rates and the US dollar against a basket of major currencies.

The chart below reminds you of the strong inverse correlation between Bitcoin and the US dollar/interest rate pair, so if the market’s expectations are borne out, it would be a great help to the crypto market to continue the upward rally it began at the start of the year.

Finally, from a chartist point of view, the uptrend of the year remains active as long as the Bitcoin price preserves the $25,000 support.

Chart showing the Bitcoin price in weekly Japanese candlesticks (arithmetic scale) with US interest rates and the trend of the US dollar on Forex