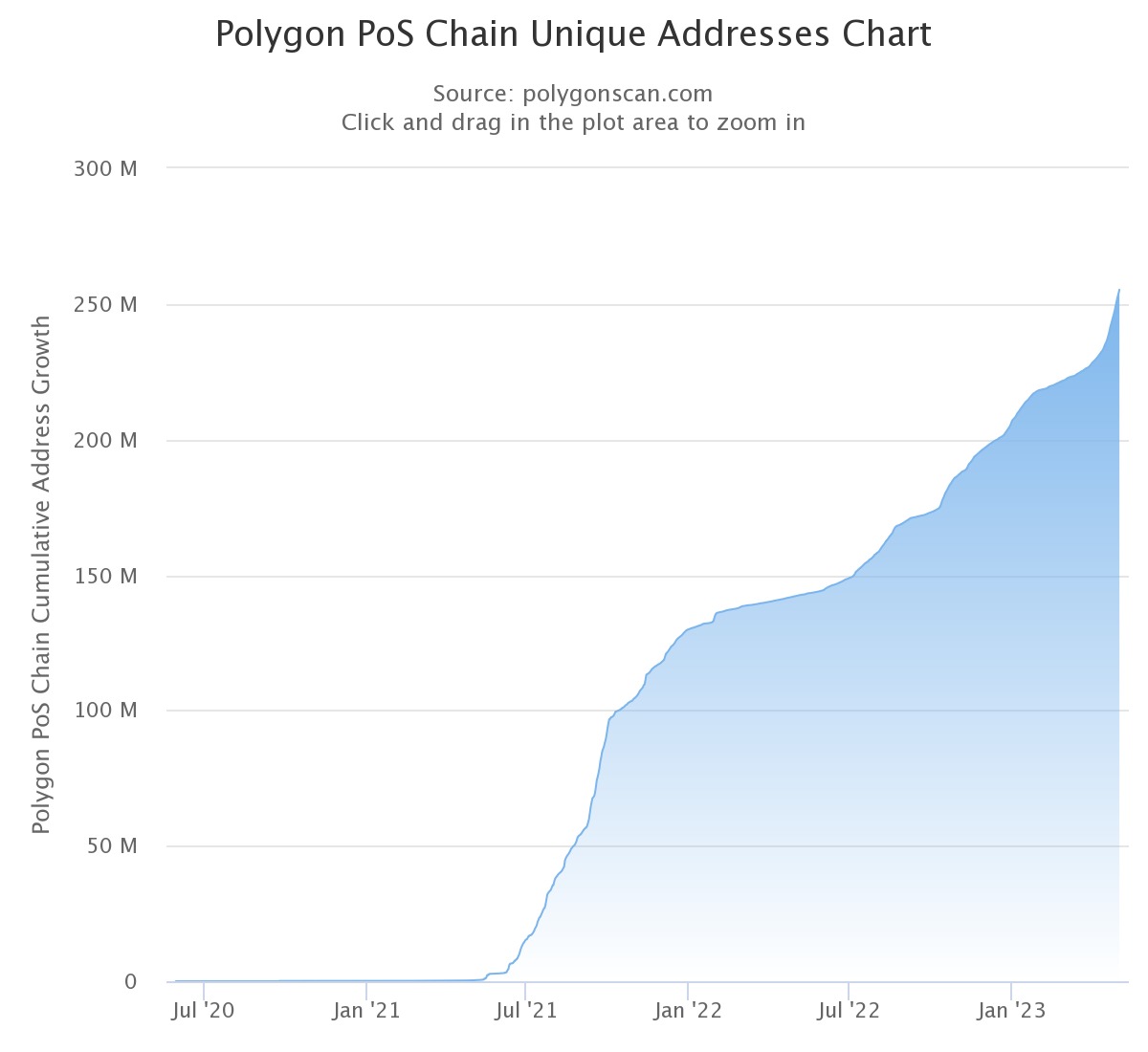

Polygon (MATIC) recently exceeded 250 million active addresses on its network. With more than 400 DeFi protocols on its network, what are the most interesting data to look at to judge sidechain activity in this first half of the year?

Polygon surpasses 250 million unique addresses

The Polygon sidechain (MATIC) is one of the most popular Ethereum Virtual Machine (EVM) compatible networks. This is due in particular to its low transaction costs and the security of Ethereum (ETH).

Between 29 and 30 April this year, Polygon exceeded 250 million unique addresses, which, in terms of adoption, puts it ahead of Ethereum with 230.5 million, but behind the BNB Smart Chain with 317.8 million :

Figure 1 – Number of unique addresses on Polygon

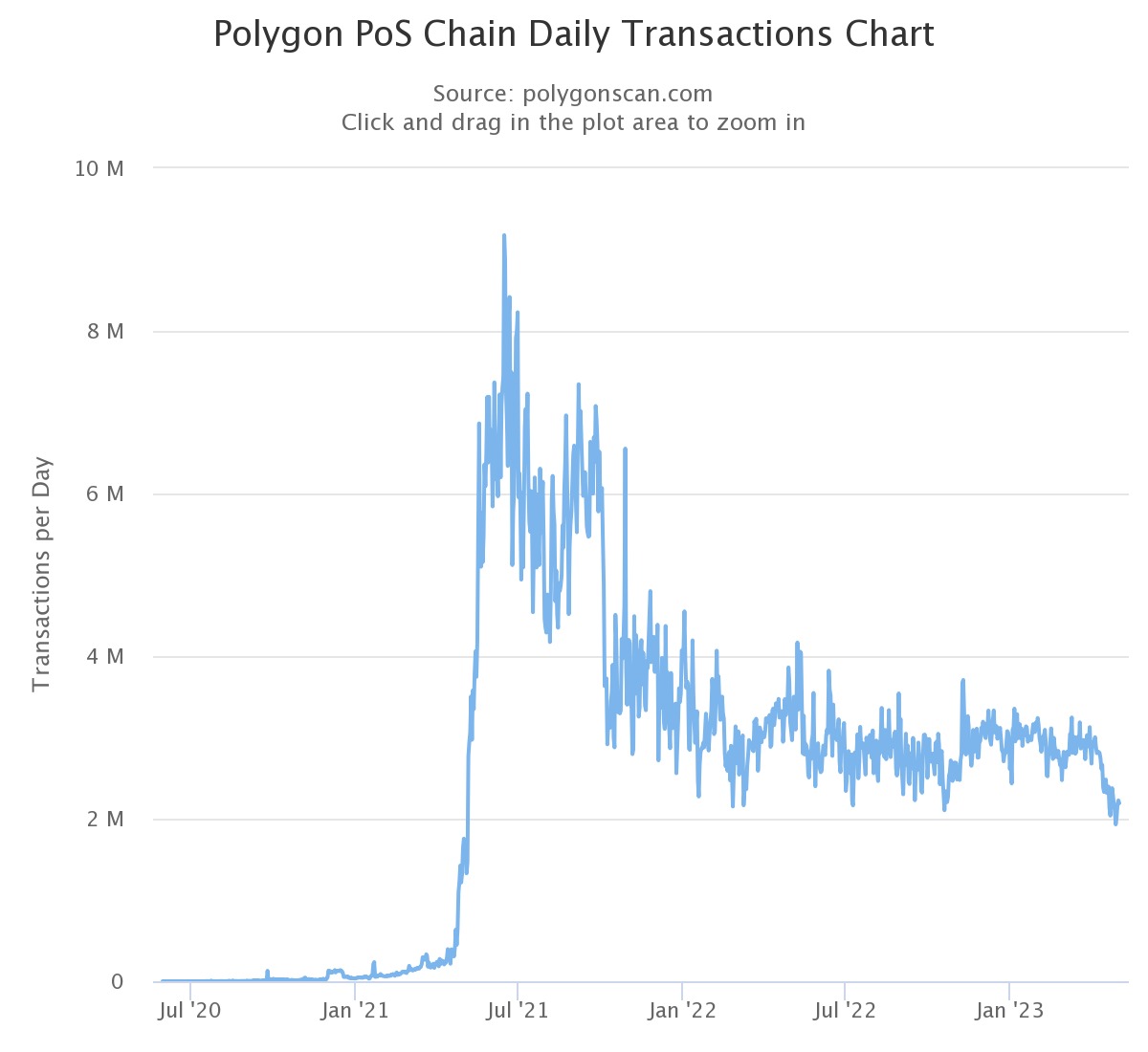

In terms of daily transactions, the sidechain has hovered around 2 million in recent days, representing a relatively low level of activity since the start of the bear market, as the chart below shows:

Figure 2 – Daily trades on Polygon

The number of active addresses per day has been between 300,000 and 400,000 over the last two weeks.

Furthermore, in terms of the number of MATICs burnt since EIP-1559 was recognised on the network, nearly 9.7 million units have been destroyed, which is approximately the same amount in dollars at the current asset price

From decentralised finance (DeFi)

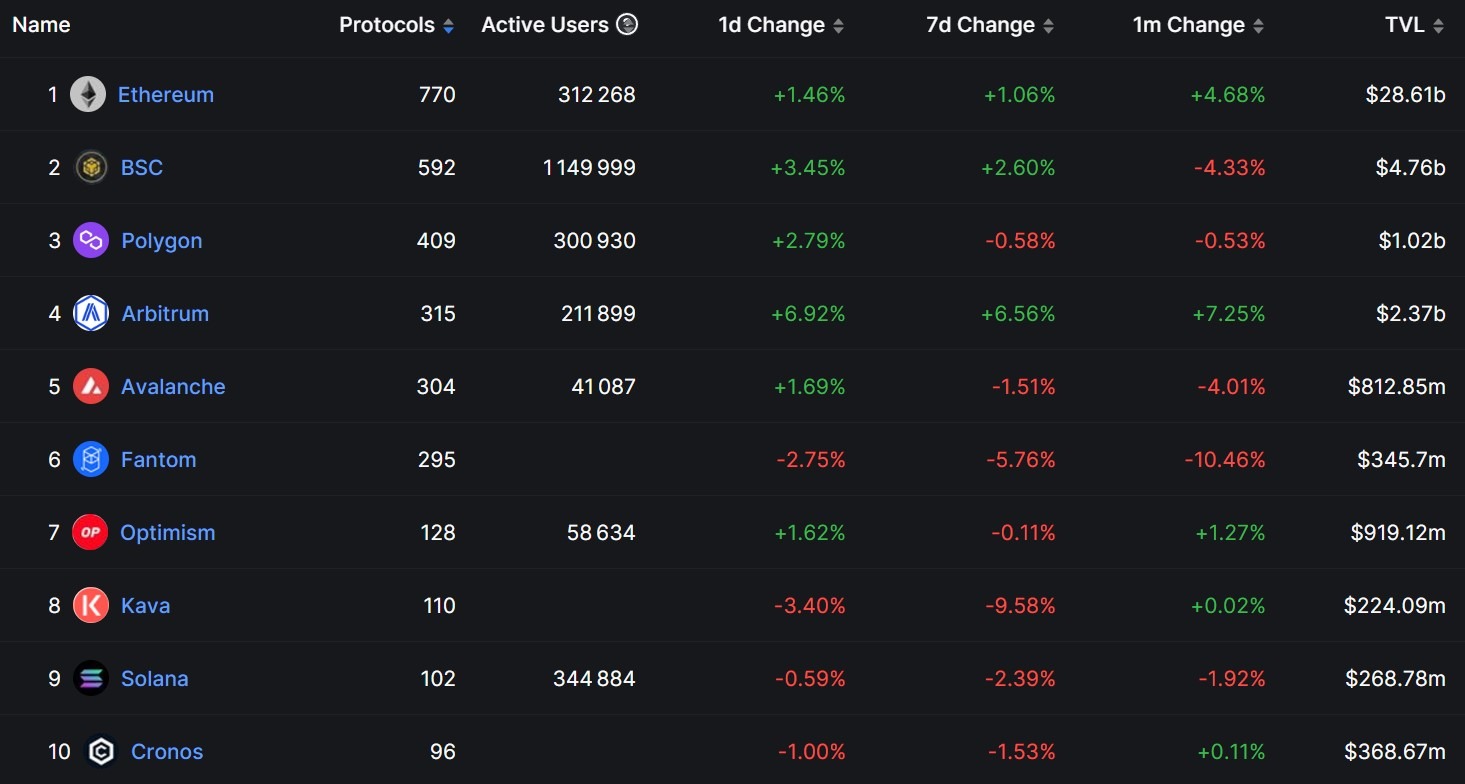

From the point of view of total locked value (TVL), Polygon ranks 5th among decentralised finance blockchains, according to DefiLlama, between Arbitrum (ARB) and Optimism (OP).

This TVL currently stands at $1.02 billion, a division by almost 10 since an all-time high (ATH) reached on 15 June 2021 with $9.89 billion:

Figure 3 – TVL on Polygon

If we now look at the applications present on the network, Polygon would count 409, a value which places the sidechain in 3rd position, behind Ethereum and the BNB Smart Chain :

Figure 4 – Top 10 blockchains by number of DeFi applications

Among these applications, the Aave lending and borrowing protocol comes out on top, accounting for 33% of the liquidity on Polygon, with a TVL of almost $339 million.

As for decentralised exchanges (DEX), Quickswap came in ahead of Uniswap, with a TVL of more than $149 million compared with around $99 million:

Figure 5 – Top 10 DeFi protocols on Polygon

The MATIC itself is currently trading in a range around one dollar, after a major rally at the start of the year that saw it rise from $0.75 to $1.55 in less than two months:

Figure 6 – MATIC price

While Polygon is increasingly being chosen by non-crypto-native players such as Google, Siemens, Starbucks and even Disney, it is an ecosystem worth keeping a close eye on, especially with the current development of its zkEVM, which could find a place among Ethereum’s layer 2s.