The stock market year of 2022 is nearing its end, a year investors are already eager to forget. With stocks, bonds and cryptos falling together, it is indeed the worst stock market year since 2008. However, is there any hope of an end-of-year rally to cheer up the market?

The year-end rally, a concept between myth and statistical reality

The end-of-year holidays are just around the corner, spirits are high and the volatility/trading volume pairing is starting to decrease significantly in the stock market. For investors and traders on the financial markets, this period is the starting point for a retrospective, a work of assessment of the past year, in order to better project the major trends of the next year.

What can we learn from this year 2022 on the financial markets in a few words? It was one of the worst years since the 2008 financial crisis with a joint fall in equities, bonds and cryptos, a double-digit fall for these three asset classes.

The bear market of 2022 is first and foremost the vertical rise in interest rates, a tool used by Central Banks to reduce public enemy number one, namely inflation. This drastic tightening of funding and liquidity conditions has led to the worst bond crash since the 2008 financial crisis as well as a 25% average decline (according to the major Western stock market indices) in the stock market.

For the crypto market, the bill is much higher, with a 65% drop in the price of bitcoin this year and a threefold decline in institutional participation as measured by the asset under management (aum) of large ETFs.

Long penalised by cross-asset correlation factors (in particular the rise of the US dollar on Forex, the floating exchange market), the crypto market has been suffering since November from an endogenous crisis of confidence in centralised platforms.

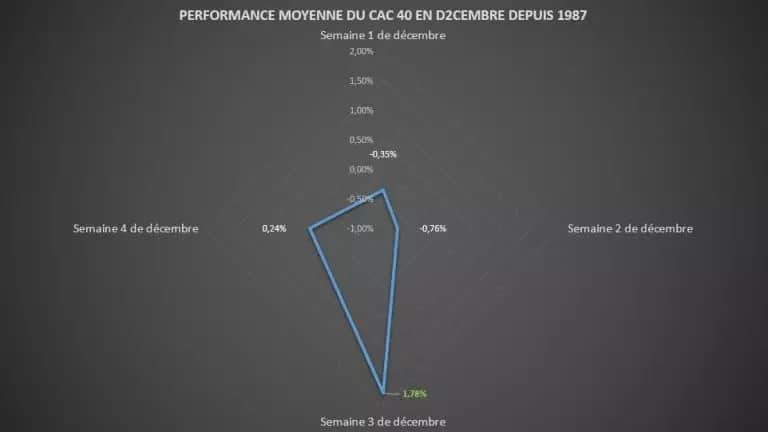

In addition to the above, the market has been in a state of flux for the past few months, with the CAC 40 and S&P 500 indices rebounding technically since Wednesday’s trading session, and the CAC 40 is now in a position to close out the year. The CAC 40 price is thus respecting its seasonality, which gives it a positive average performance at the end of December, a statistical fact that is often called the Christmas rally. However, this statistical fact does not apply to the crypto market

Chart showing the average performance of the CAC 40 in each trading week of December since 1987 (source, Vincent Ganne)

Bitcoin, a year 2022 to forget, the worst in 10 years in the stock market

Let’s go back to the bitcoin price for which we saw above that it was down 65% this year and more than 74% since its former all-time high (the latter dates back to Monday 8 November 2021).

This year 2022 is one to forget for Bitcoin as it is, by some measures, the worst in 10 years. I turned again to the seasonality data (the average stock market performance over a period of time) and here is the bottom line: 2022 is the first year in 10 years with 4 consecutive quarters of negative performance for BTC.

So here is my conclusion: long live 2023! I am convinced that this new year will be the year of the revival of the long term bull market. Until then, I wish you all a Merry Christmas

Chart showing the average quarterly performance of the bitcoin price since 2013 (source, Coinglass)