Scams affecting the cryptocurrency world in 2021 have increased tremendously compared to 2020. This is largely due to rug pullers. But what are they? How to detect them? How to protect yourself from them

The colossal weight of rug sweaters

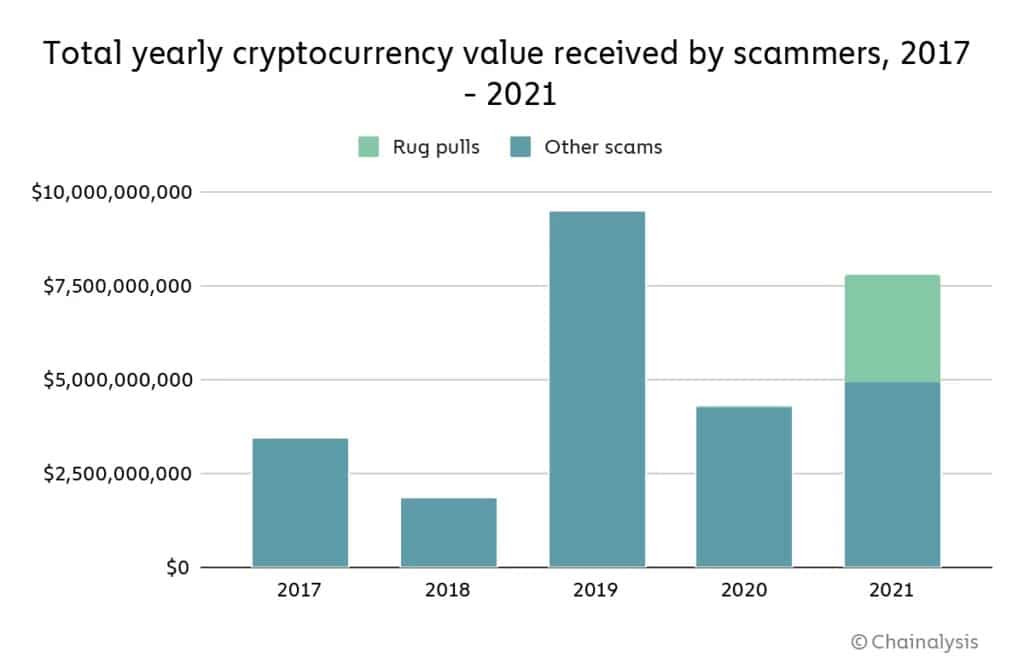

$7.7 billion was illegally taken from cryptocurrency holders in 2021. This represents an 81% increase compared to 2020. This significant increase is notably due to the emergence of rug pulls. The literal translation of this term is “rug pulling”, so we prefer its original name.

Figure 1: Total annual value of cryptocurrencies received by scammers

In fact, rugs pulls have become the most common scam in the decentralised finance (DeFi) ecosystem. They account for 37% of all cryptocurrency scam revenue in 2021, compared to just 1% in 2020. With rug pulls organised by malicious people, precisely $2.8 billion was taken in a completely illegal way.

How to define rug pulls

Rug pulls can be considered as a theft whereby the holder of a project, financing itself against the issuance of a cryptocurrency, abandons it, taking care to keep the money of investors for himself. These are usually projects created by malicious people with the sole purpose of defrauding unwary investors.

The cryptocurrency world is extremely susceptible to rug pulls due to the lack of real regulation in this area. Indeed, unlike traditional companies which are subject to strict legislation in the context of their transactions, the decentralised nature of projects financed through crypto-currencies implies that the control of the operations carried out on crypto-assets is left to private entities, totally independent of the States. This makes this ecosystem particularly vulnerable to scammers and hackers of all kinds.

At first glance, it is difficult to distinguish rug pulls from genuine projects. Worse, knowing that cryptocurrencies affiliated with rug pulls can grow exponentially before the scam is detected, it can easily fool investors looking to improve their returns.

What are the different types of rug pulls?

There are generally three types of rug pulls, namely cash theft, technical manipulation and illicit enrichment of project developers.

Cash theft

This is the most common type of rug pull. The developer of a project will register their fraudulent token on a decentralised exchange platform (DEX) while linking it to a high-performance blockchain such as Avalanche (AVAX), particularly in the case of Olympus DAO (OHM) forks.

In order for the created token to be tradable, the holder must set up a liquidity pool that includes funds. The holder will then create a media buzz around the new project in order to attract a plethora of potential investors to it. As investors buy the token, its value will increase. This will attract others, as they will think it is an opportunity not to be missed.

Let’s take the example of a token launched on the Avalanche blockchain. New investors will exchange their AVAX for the newly issued token, which will be used to feed the cash pool. When the token has increased in value sufficiently, and when it is deemed to be the right time, the team behind the project will remove all AVAX from the liquidity pool.

Investors will be deprived of the possibility to trade their tokens again, which are now worthless. They will not even be able to withdraw them for AVAX on another exchange platform since the token in question was not listed on another platform.

The illicit enrichment of developers

From a liberal perspective, knowing that the crypto-asset market is unregulated and thus truly free, this does not necessarily look like a scam. Nevertheless, knowing that a token has been issued for the sole purpose of scamming investors, it can be put in this category.

In this case, the project owner shows hypothetical investors a platform or functionality of the cryptocurrency when it is only under development and will therefore soon be available. In reality, the token is worthless as it is not backed by any project, except a dummy one.

The project team will then allocate as many tokens as they can. Nevertheless, with the expectations raised by the promises of the project creators, investors put their funds into it, which greatly increases the value of the issued cryptocurrency. Subsequently, the dishonest project owner converts their tokens into legal currency, and gradually or all at once, the value of the crypto-assets will therefore decrease. Investors are thus left with worthless tokens representing a completely fictitious project.

The technical manipulation

The other type of scam consists of the founder of a project disabling the ability to sell the tokens issued in the project. In this type of scam, the developer will exploit the “approval” function of the smart contract linked to the token. Through this manipulation, investors will no longer be able to use their tokens after they have purchased them. Indeed, when buying such a cryptocurrency, the investor thinks he is free to buy, sell, or convert his asset as he wishes.

Unfortunately for him, he will discover soon after that the possibility to sell the token is now restricted to the developer or to the people he has chosen through the smart contract. Then, once the value of the asset is high enough, the malicious holder sells all the tokens and takes all the funds invested.

What are the indicators of a rug pull?

Some features are common to the rug pulls shown above.

The overnight appearance of the project

The most serious cryptocurrency projects take a long time to develop and grow. Bitcoin is the most absolute proof of this. As such, rug pulls generally tend to come out of nowhere. And in order to reach a wide audience, they usually use memes, cultural phenomena or trends. The Play To Earn game based on Squid Game is a typical example. Such projects are often accompanied by unfulfillable promises.

Low liquidity

The larger the project’s liquidity pool, the quicker it will be to convert the token into cash. Therefore, when a project has low liquidity, care should be taken not to invest in it, or to be extremely cautious.

It is also important to favour initiatives that have a cash-lock mechanism. The latter allows a certain amount of tokens to be set aside, which is necessary for the pool to function properly. It therefore assures investors that developers cannot empty the pool at once.

Aggressive media strategy

A strong project issuing cryptocurrencies must have as its main argument how it can be used as well as the issues it seeks to address. In the case of rug pulls, as they are scams, they are most often useless.

Developers therefore resort to extremely aggressive marketing. This will result in an omnipresence on social networks, partnerships with unscrupulous influencers or even paid advertisements. The aim is to reach the largest audience, if not to be able to offer anything else.

The skyrocketing value of the token

The world of cryptocurrencies is not so different from that of regulated stocks. As with any business, the value of an asset increases according to the law of supply and demand. An honest project will thus have an explainable growth process. Unlike potential rug pulls where the value of the token will increase in an unexpected way. This is usually due to developers or some complicit traders using “fear of missing out” (FOMO) to attract even more investors.

Anonymity of founders

Knowledge of the team behind the project is crucial in assessing its viability. While the founder of Bitcoin, Satoshi Nakamoto, is anonymous, this is not the case for most other projects, such as Ethereum, where the founders are well known. As a general rule, those who prefer to use pseudonyms are suspect, as they may intend to evade possible legal action. Handy for scammers, isn’t it

How to avoid losing money on rug jumpers?

It is important to remember that investing in cryptocurrencies is a risky business. Losses are therefore quite possible. This is all the more reason to be cautious with rug pulls. Once the various signs outlined above are mastered, it becomes easier to detect them to avoid succumbing to them.

It is important to examine the project by first understanding what it is about in concrete terms. It is important to check whether the team members are known, whether the liquidity is high. You should also look at who the main holders of the tokens are and whether there are any listings on exchange platforms. Taking a look at the project’s white papers, reviews and social networks is also important.

The final point is to avoid new altcoins that have not undergone a code audit. This is usually a process whereby a third party company analyses the smart contract code behind the token or protocol. They will then publicly confirm that the governance rules of the smart contract are sufficiently protective of investor funds and that they sufficiently support the developers in their mission.

It is also possible to find information on sites that detect or list rug pulls and other scams that parasitise the world of crypto-assets. The best thing to do is to do your own research

What are the most famous rug pulls?

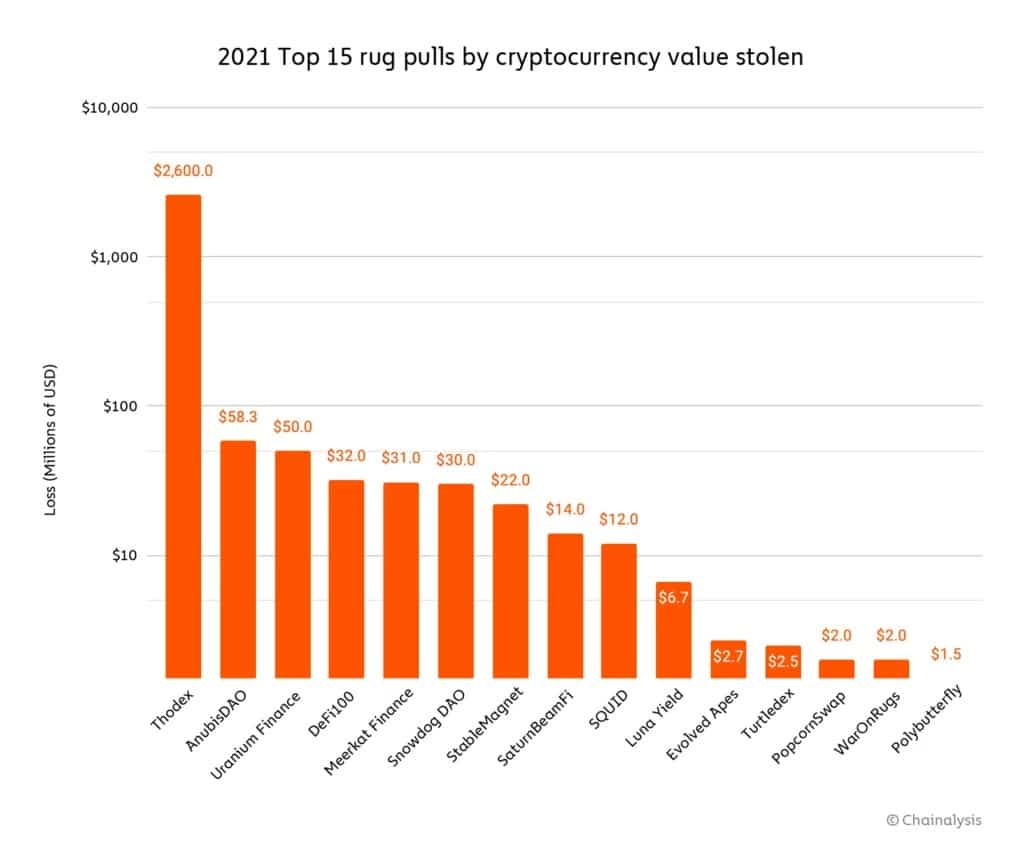

Various rug jumpers have been in the news. The most popular ones are shown in the chart below and the most talked about ones will be presented in more detail.

Figure 2: Top 15 rug jumpers by value stolen in 2021

Thodex

Thodex is the most important rug jumper of the year 2021. It is originally a Turkish trading platform. Its CEO mysteriously disappeared after the exchange hindered its users’ ability to withdraw their funds. For the victims of this scam, the total loss amounts to over $2 billion in cryptocurrencies.

Anubis DAO

Anubis DAO is the 2nd largest rug pull of 2021. The value of funds stolen from investors is as much as $58 million worth of crypto assets. As of October 2021, the developers of this project claim that they are building a decentralised, floating cryptocurrency that is backed by a basket of assets.

Thanks in part to its heavily Dogecoin (DOGE)-inspired logo and what it evokes in some of the community, the project raised nearly $60 million from investors even though Anubis DAO had no website, no known developers, and even less whitepaper.

Investors then received ANKH tokens in exchange for their funding from the cash pool. However, just over 20 hours later, all the funds collected, mostly in the form of Wrapped Ethereum (wETH), disappeared from the fraudulent project’s cash pool.

Squid Game

One of the most talked-about scams was the rug pull that built on the success of the Squid Game series. The SQUID token was intended to be the basis for a “Play-to-Earn”. The token grew rapidly in the first few weeks after its launch. In fact, its value increased by almost 33,600%, from one cent to 3.36 dollars. This growth was such that the altcoin eventually reached $2,856, with a daily volume of over $11 million.

Once this value was reached, the majority of SQUIDs suddenly disappeared. They were exchanged for BNB from Binance by a mysterious address. This led to a massive drop in the SQUID price. The developers of the project became unreachable. More than 43,000 investors who had put their money into the SQUID token realised at the same time that they could no longer sell it because of the anti-dumping mechanism imposed by the founders in the token’s smart contract. The total loss was $2 million.

Figure 3: SQUID price evolution following its rug pull

Conclusion on cryptocurrency rug pulls

Rug jumpers therefore represent a real danger to the cryptocurrency ecosystem. Taking advantage of the inexperience of investors by making them promise huge profits, some malicious people do not hesitate to scam them.

Caution is therefore the key word when deciding to invest your precious money in a project. It is also important to monitor the progress of the project to avoid any unpleasant surprises.

To go further and better prepare yourself for this kind of situation, find our guide to recognize all the scams related to the world of cryptocurrencies.