Considered one of the main competitors of Binance, FTX has quickly established itself as one of the reference platforms in the crypto-currency world. Let’s find out what FTX offers, between tokenized shares, cryptocurrency trading and leverage. Here is our full tutorial and review of FTX.

Introduction to the FTX platform

The now famous FTX platform was founded in 2019 by Sam Bankman-Fried, a former professional trader who came through Wall Street and graduated from the Massachusetts Institute of Technology (MIT). The platform is also known for its famous maxim “by traders, for traders”.

FTX is a crypto-currency trading platform that offers a wide range of tools and possibilities such as the use of leverage, derivatives, futures, a spot market and much more. In addition to crypto-currencies, this platform also offers the possibility to invest in tokenised stocks such as Tesla, Apple, Google, PayPal or Netflix.

It also has its own token, the FTT, whose specificities and advantages it can offer will be detailed later in the tutorial.

FTX has quickly become a resounding and growing success: during the year 2020, it could see a total trading volume of $385 billion. The following year, 2021, $10 billion was traded daily on the platform and statistics report one million monthly active users.

Beyond the pure trading statistics, FTX offers aggressive marketing through partnerships in many areas such as sports, gaming and motor racing. As a result, the brand is gaining a leading position beyond the cryptocurrency world. It is now the official sponsor of many sports and e-sport teams.

Behind Binance, but far ahead of Kraken, FTX has established itself as the main competitor of Changpeng Zhao’s famous platform and the trend could well continue in this direction. Indeed, the number of FTX users is growing exponentially.

Another remarkable point is that since its creation, FTX has never been hacked and has never had a single security breach.

How to open an account on the FTX platform

You can register with FTX by clicking on the button below. In addition to supporting us, this will entitle you to a lifetime 5% discount on all your FTX related trading fees.

On the registration page, enter your email address, choose a secure password and click ‘Create Account’.

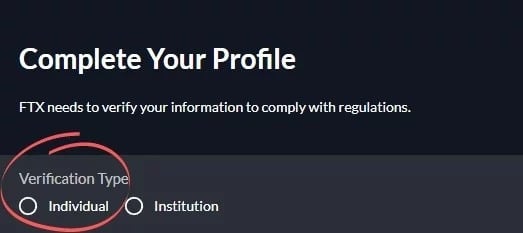

If you are registering as an individual, select “Individual”. Otherwise, select “Institution” if you are representing a company.

Then fill in the required fields with your personal information and validate. A window will open to inform you that you only have a restricted account.

In order to take advantage of all the possibilities of the platform, including trading, you will need to provide additional information (KYC) on your identity to FTX.

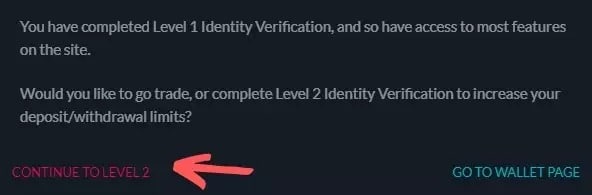

Click on “Continue to level 2”.

Then click “Start” to begin the identity verification process.

In order to confirm your identity, FTX needs one of your official documents, either a passport, driver’s licence or identity card.

Select the document of your choice. You can either take a photo of it from your webcam or download it from your mobile phone, in which case click on “Continue on mobile”.

Then scan the QR code that appears and complete the process via your phone by following the instructions.

Back on your computer, click on “Submit Information”.

You will then have to wait for the platform to check your documents, which is never very long, but can last a few days at most.

In any case, while waiting for your documents to be verified, you can familiarise yourself with the various tools available on FTX.

Buy cryptocurrencies in euros on FTX

FTX allows you to buy cryptocurrencies directly from its platform, but you will first need to deposit euros via credit card or wire transfer.

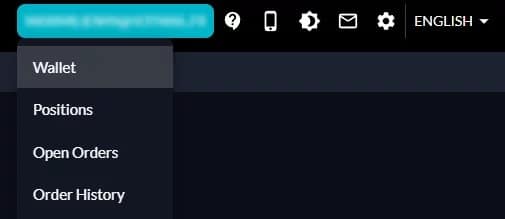

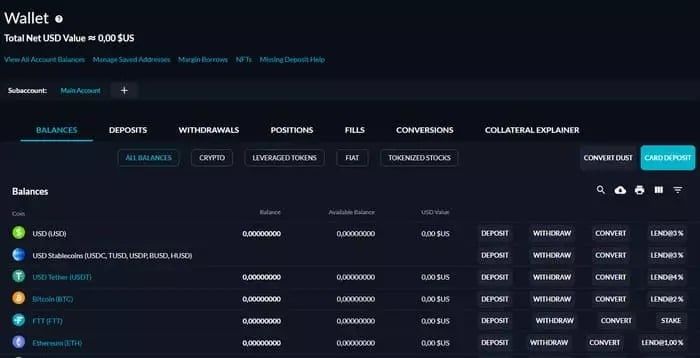

To do this, go to the “Wallet” tab.

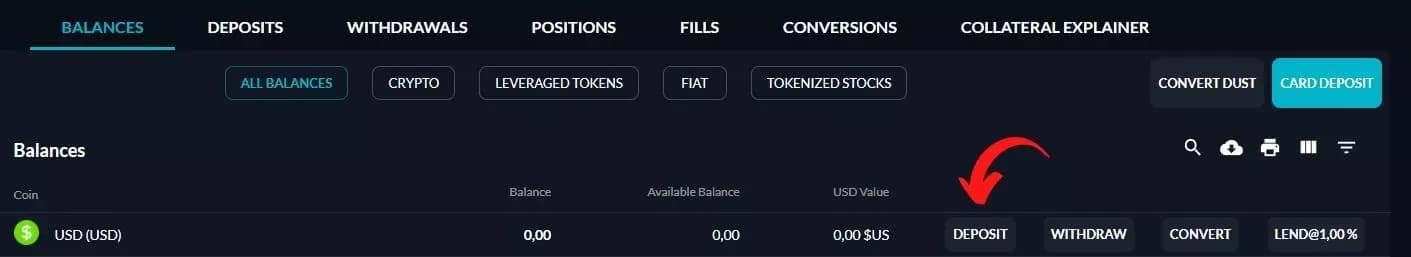

On the “USD” line, click on “Deposit”.

Note: No matter what currency you pay with, it will automatically be transferred to USD on FTX.

The page that opens gives you several options: deposit stablecoins backed by the US dollar, make a credit card deposit or make a wire transfer.

As an example, we’re going to buy cryptocurrencies by credit card with FTX. You will need to click on “Deposit via Card” and then fill in your credit card details.

Note that the card you use must be in the same name as the one you declared when you registered with FTX.

Once you have filled in your card details, click on ‘Submit’. An automatic process will verify your card information, which should take no more than a minute.

Then choose the amount of USD you wish to deposit and confirm.

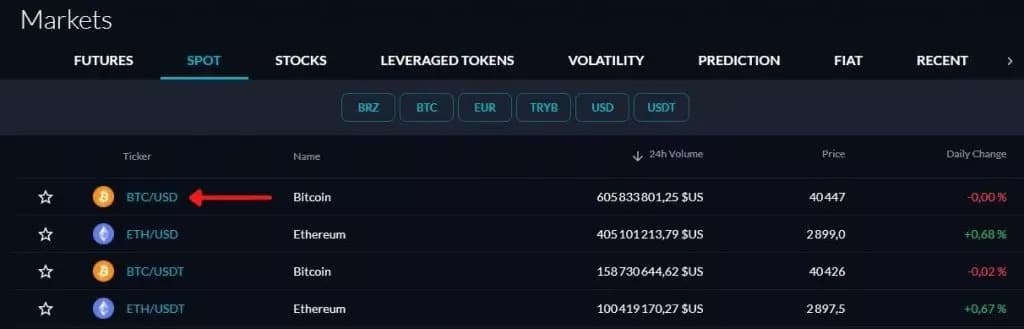

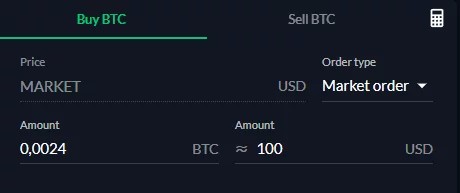

Once you have the USD in your wallet, go to the market tab, then go to the “Spot” section. Let’s take the example of the BTC/USD pair

Next, in the order list, choose “Market order”.

Fill in the “USD” field with the amount you wish to trade and place your order. The order will be executed instantly and your BTC will be credited directly to your wallet

The FTX interface

Although it may seem a little confusing at first, the FTX interface is relatively simple.

![]()

First, let’s look at the top bar of the site.

- “Markets”: to see the market in real time;

- “Wallet”: to manage your FTX portfolio;

- “OTC”: over-the-counter function. This is a function for experienced traders who wish to invest large amounts of money, so it is not recommended for beginners;

- “Support”: support tab on the site if you have any problems;

- “FTT”: here you can buy and store FTT tokens;

- “NFTs”: marketplace for non-fungible tokens (NFTs). It is currently only available to users residing in the United States;

- “Docs”: this tab will open a new page to the various tutorials on the FTX platform.

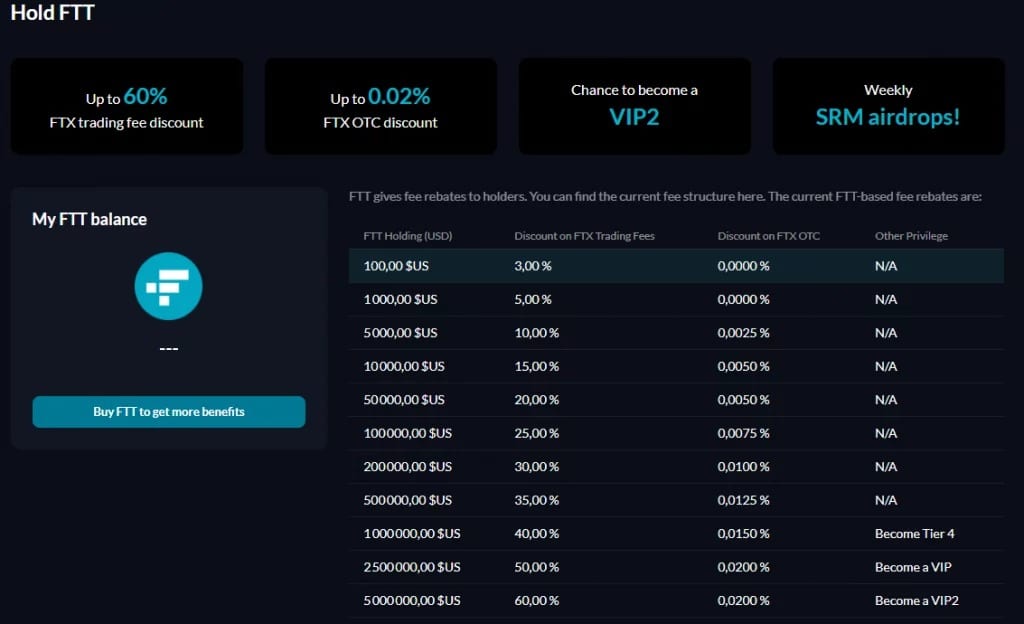

The roles of the FTT, the FTX platform token

The main benefit of owning FTT tokens is the reduction in transaction fees on FTX, which can be as much as 60% depending on the number of FTTs you own.

FTT staking offers many benefits, including increased earnings for referrals, free withdrawals from the platform, chances to win cryptocurrencies at regular airdrops, governance voting rights or a discount on orders made as a market maker.

Understand the “Markets” part of FTX

The Markets function is essential to any trading platform. It allows you to monitor real-time prices and trading volumes of crypto-currencies.

- “Futures”: this is a major feature in trading, and specifically on FTX, which translates to “futures market”. If you are unfamiliar with the term, we recommend you read our dedicated fact sheet to better understand this principle;

- “Spot” – a trading function without leverage or margin which translates into “spot market”. Unlike futures contracts, assets are directly traded here. In this way, they are directly subject to the current market price;

- “Stocks”: Here you can buy tokenised shares of different companies such as Tesla, Apple, Pfizer, Amazon or Netflix for example. This is an almost exclusive feature of FTX that is only available on very few cryptocurrency trading platforms;

- “Leveraged Tokens”: these are ERC-20 tokens with pre-set leverage, usually on x3 levers. This is a feature introduced by FTX to limit the risks of traditional leveraged trading, but is intended for experienced users;

- “Volatility”: a special feature that allows you to bet on the volatility of Bitcoin;

- “Prediction”: here you can bet on the victory of a candidate in the presidential elections of certain countries. If the candidate wins, the contracts will become worth $1, but will drop to $0 if the candidate loses;

- “Fiat”: tab dedicated to stablecoins. The price of stablecoins is based on fiat currencies, so there is very little volatility in the stablecoin market. You can buy stablecoins directly from this tab;

- “Recent”: History of stocks you have clicked on previously.

Using the FTX Wallet

In this interface you can track the value of your FTX wallet, manage your current positions, transfer assets out of FTX or register a bank card to make purchases.

Let’s see what you can find on the homepage.

The cryptocurrencies here are listed by default. You can choose to display only tokenized stocks, only stablecoins, etc.

For each asset, you will have the following three columns:

- Balance: the total value of what you own of a certain token, including your orders and open positions;

- Available Balance: the available value of what you actually own, which excludes open orders and positions;

- USD Value: the cumulative value of your dollar assets.

To the right of these columns you will find the following options:

- Deposit: allows you to buy a certain asset with your bank card or deposit funds from another platform;

- Withdraw: allows you to withdraw cryptocurrencies to transfer them to another wallet (MetaMask for example);

- Convert: this is a swap function. You can exchange one token for another, for example USDC for FTT;

- Lend: allows you to make a loan of a certain cryptocurrency for other users to trade on margin;

- Stake: allows you to use the staking function of the FTX platform. For example, you can profit from SOL, RAY, SRM or FTT tokens.

Please note that you must have Level 2 identity verification on FTX to withdraw or deposit funds

The orders available on FTX and how to use them

Trading on FTX is divided into two main parts: futures and spot contracts.

Let’s look at what separates them and what you can do with each.

For this example, let’s click on the BTC/PERP Perpetual contract in the Futures tab.

- The chart: Here is a chart from the TradingView website. You can change the time unit, add different technical tools like Bollinger Bands or simpler tools like the average price. You can also manually draw resistance or trend bands;

- Orderbook: this tool allows you to see in real time the orders placed by market makers in order to have an overview of the current supply and demand on a cryptocurrency pair;

- Real time buying and selling (market trades): this window allows you to see the buying and selling history of the platform’s users on the chosen pair;

- Leverage: allows you to trade with leverage. We will explain this in more detail below;

- Your buy and sell orders: this is where you will place your buy and sell orders on the chosen pair.

The first three tools are provided as a guide. Let’s look at how to place a buy order on the BTC/PERP pair (where Perp stands for Futures).

Let’s go to tab number 5

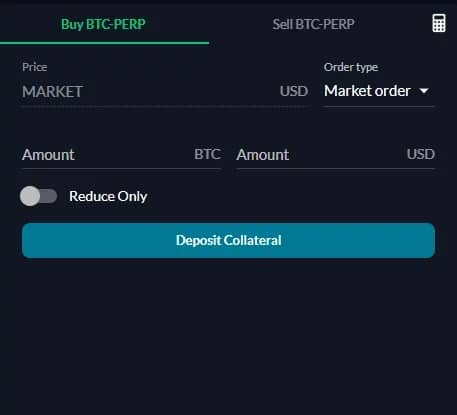

At the top of this window you will find the ‘Buy BTC-PERP’ and ‘Sell BTC-PERP’ tabs.

To the right of ‘Price’ is the ‘Order type’ tab. We will use this tool to determine which order type we will place.

Let’s take a look at the different orders offered by FTX and what they are.

Limit type order

This order allows you to buy or sell at a price that you determine in advance. For example, if you put 30,000 USD in the “Price” field, your buy order will be triggered as soon as the Bitcoin reaches the price of 30,000 dollars.

This is a very handy tool that can allow you to set a price in advance that you don’t want to exceed, so you don’t have to scour the market.

In the case of a sell order, if you put $70,000 in the “Price” field, then you will sell 1 BTC for $70,000 if the market ever reaches that price.

Market order

The market order allows you to buy a cryptocurrency based on the lowest possible bid, without taking into consideration the current price of said cryptocurrency.

Let’s stick with the BTC-PERP example: if you fill the “Amount” field with 1 BTC, then you place an order to buy one Bitcoin at the current lowest bid price in the order book.

The execution of this order is instantaneous.

Stop-loss (limit and market) and take profit orders

These orders add an interesting component as they allow you to choose when your order will be triggered. This is similar to the limit order, except that here your order will only appear in the order book once the trigger price is reached.

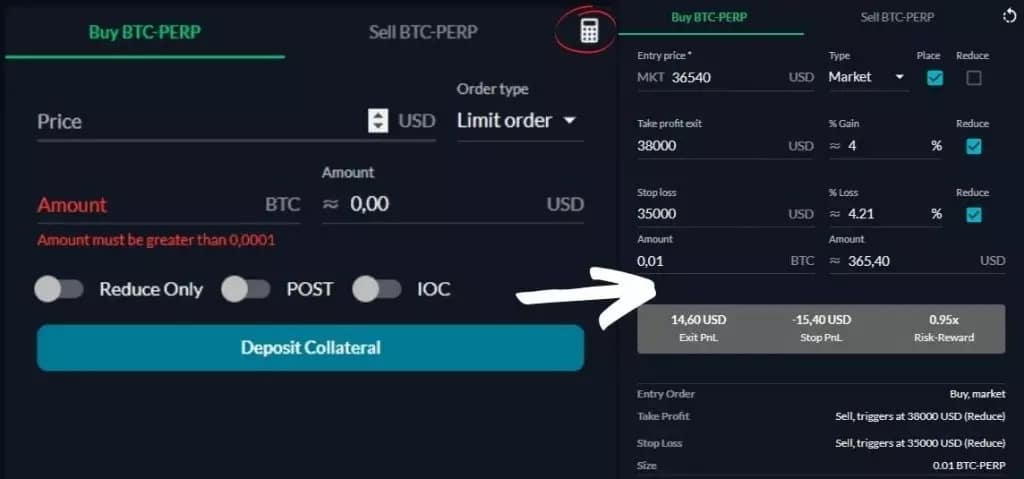

To use it, click on the small calculator at the top right of the window.

In the new screen that appears, stay on “Market” to place yourself in relation to the market, otherwise select “Limit” to manually define where you want to enter.

Fill in the ‘Take profit exit’ field with a value higher than the market and then set the stop loss value. This should be less than the current market price.

In the screenshot above, if BTC/PERP rises to a value of $38,000, then our order will be placed and we will have about a 4% gain.

If BTC-PERP falls to $35,000, then our order will be placed at that point and we will have lost approximately 4.2% to the market price.

Finally, click on “Place order” to confirm your order

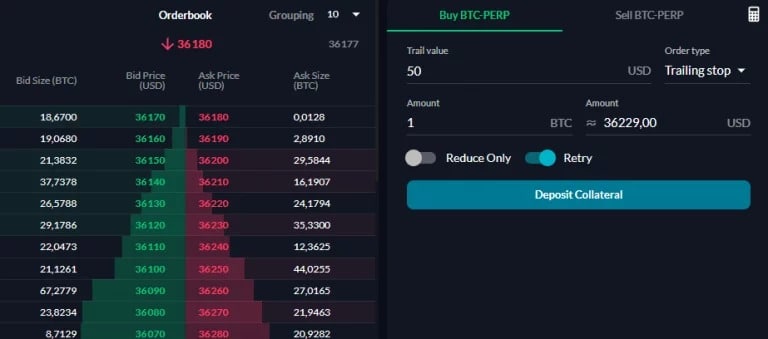

Trailing stop orders

With the trailing stop order, the trigger price will automatically be placed according to the current market price.

In the current scenario, BTC/PERP is trading at $36,180. We will choose a value of 50 in the “Trail value” field, which means that if the BTC-PERP price rises towards $36,230 ($50 above the current price), then our order will be triggered and placed in the order book. On the other hand, if the price drops to $36,130, then the order will be readjusted at the next level.

At the next level, our order will only be triggered if the BTC/PERP rises to $36,180, and so on.

In the case of a sale, a negative value must be entered in the “Trail value” field.

This is a very useful tool for opening or closing a position, but is still subject to slippage effects.

Adjusting leverage on FTX

FTX offers two solutions for users who wish to take advantage of leverage, leveraged tokens and manual leverage.

Manually set leverage

First of all, it is important to understand the principle of leveraged trading.

This method consists of amplifying the initial investment capital by borrowing funds from the platform. For example, if I want to invest $100 with a leverage of 100, then the platform allows me to get an investment capacity of $10,000.

Leverage method tab with x3 leverage selected

Presented like this, one might be quickly tempted to imagine easy gains. However, this method is not without risk, as the potential for losses is proportional to the potential for gains.

Indeed, if your position ends up being liquidated, then you will have lost your initial investment ($100 in our example) in addition to the necessary collaterals you deposited in your portfolio.

FTX works as follows with the leverage method:

If you have $1,000 in collateral in your current account, then your positions cannot exceed an amount proportional to that base, i.e.:

- Leverage x3: $3,000;

- Leverage x5: $5000;

- Lever x10: $10,000;

- Lever x20: $20,000.

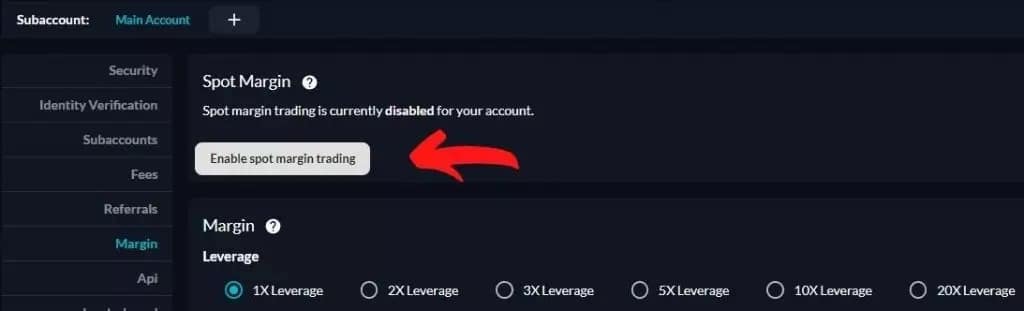

The FTX platform also offers the possibility to borrow on the spot market to enlarge your positions via the “Enable spot margin trading” option found in the settings. Be careful though, you are adding risk to the already existing risk

In February 2022, FTX offers leverage of up to x20. This may not seem like much compared to other platforms that offer x100 or even x200 leverage, but we don’t recommend going beyond x3, and above all, invest a reasonable amount of your capital with this method.

The gains can be significant, but the losses can be very heavy, and as such, the leverage method is strongly discouraged for novices.

Use leveraged tokens

FTX also offers ERC-20 tokens with built-in leverage in the “Leveraged Tokens” tab located in “Market”.

The tokens are offered as follows:

- BULL : x3 ;

- BEAR: -x3 ;

- HEDGE: -x1 ;

- HALF: x0.5

Let’s take the example of the BULL/USD pair, so with x3 leverage. If the bitcoin price rises by 1%, then BULL/USD will gain 3%. Conversely, if the bitcoin price falls by 1%, then BULL/USD will fall by 3%. In concrete terms, the market movement will always be multiplied by 3 on a BULL pair, whether it is up or down.

The risk of liquidation is reduced on leveraged tokens thanks to the balancing system put in place by FTX: every day, at 2am UTC, the platform will automatically readjust the leverage in relation to the initial market price.

Notes and opinions on FTX

The FTX platform seems to be popular, as evidenced by its ever-increasing valuation, which reached $32 billion in February 2022.

It is good to see that FTX has played it safe for its users: in July 2021, it decided to lower the maximum leverage to x20 instead of the initial x100. Today, it also offers its users the possibility to create sub-accounts on the platform in order to reduce the risks in case of liquidation.

The platform also has rather low transaction fees compared to the majority of trading platforms, which is not a negligible point. Remember that these rates can be even more attractive if you stake FTTs.

The FTX trading platform may be impressive at first glance, but the diversity of its tools is what makes it unique. It continues to gain ground against competitors in the industry, and may well catch up with the Binance platform in the not too distant future.

If you are familiar with the world of cryptos, FTX will be able to satisfy you thanks to its spot market and futures market options, but also with its tokenised shares and its tokens with integrated leverage which allow you to reduce the risks induced by classic levers.