Silvergate crypto bank has been in the spotlight for some time now, and the bankruptcy of this giant is now a serious possibility. But what does Silvergate Bank represent in the cryptocurrency ecosystem, how much weight does it carry, and more importantly, what impact would the end of its operations have on the crypto market

Silvergate, what is it?

Lately, the name of Silvergate is on everyone’s lips. This crypto-bank, which has until now operated in the shadow of individual investors, its services being mainly aimed at institutions and exchanges, has nevertheless a leading role in our ecosystem.

Founded in 1988, Silvergate started out as a small Californian bank offering traditional services and operating on a human scale with a small number of branches. Gradually, the bank evolved before making a 90-degree turn towards the cryptocurrency sector under the leadership of Alan Lane, who remains its current CEO.

At the time, when Bitcoin (BTC) and the crypto ecosystem were nowhere near as democratised as they are today, it felt like a small revolution, and that’s what has allowed Silvergate to become one of the leading crypto-friendly banks for crypto exchanges in the US to this day.

Alan Lane, Silvergate’s CEO, who was himself a personal investor in BTC, decided to set up the territory’s first crypto-bank. Silvergate quickly made a name for itself in the industry and success followed: in 2017, 4 years after its change of direction, the bank had 250 clients with nearly $2 billion in assets under management. Only two years later, Silvergate became a public company and listed on the New York Stock Exchange (NYSE), the world’s largest stock exchange.

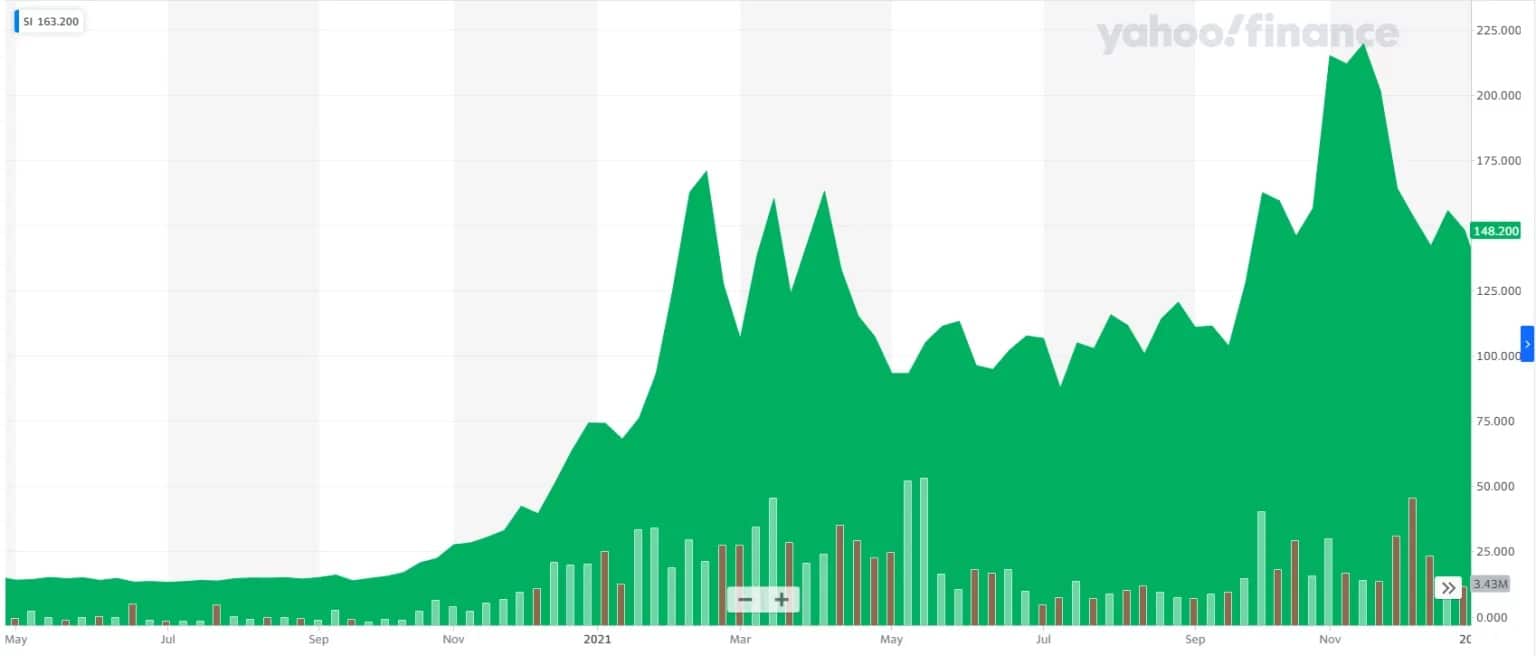

From 2019 to 2021, Silvergate’s stock, traded under the ticker SI, is up a whopping 1,580% due to the momentum the crypto market was experiencing during this period.

Figure 1 – SI stock performance on the NYSE from May 2020 to December 2021

At this point, 90% of the deposits made at Silvergate come from the cryptocurrency sector, the overwhelming majority. The bank is becoming a reference in the institutional and exchange community, offering its services to Coinbase, FTX.US, Gemini, Paxos, Crypto.com and BlockFi, among others.

Silvergate’s clients (there will be 1,500 by 2022) also benefit from the Silvergate Exchange Network (SEN), a banking network set up by the crypto-bank that allows it to manage instant transfers between its various clients at any time throughout the year.

A great asset if you compare this to traditional banking networks, especially as more traditional banks have historically been hostile to companies operating in the cryptocurrency sector.

Thus, through 2022, Silvergate enjoys a steady expansion and a prominent place in the crypto ecosystem and registers as a leader in its industry by far.

Cascading disasters for Silvergate in 2022

But Silvergate’s smooth growth comes to an end during 2022. And unfortunately for the crypto-bank, this is more due to an unprecedented panic wind than internal mismanagement.

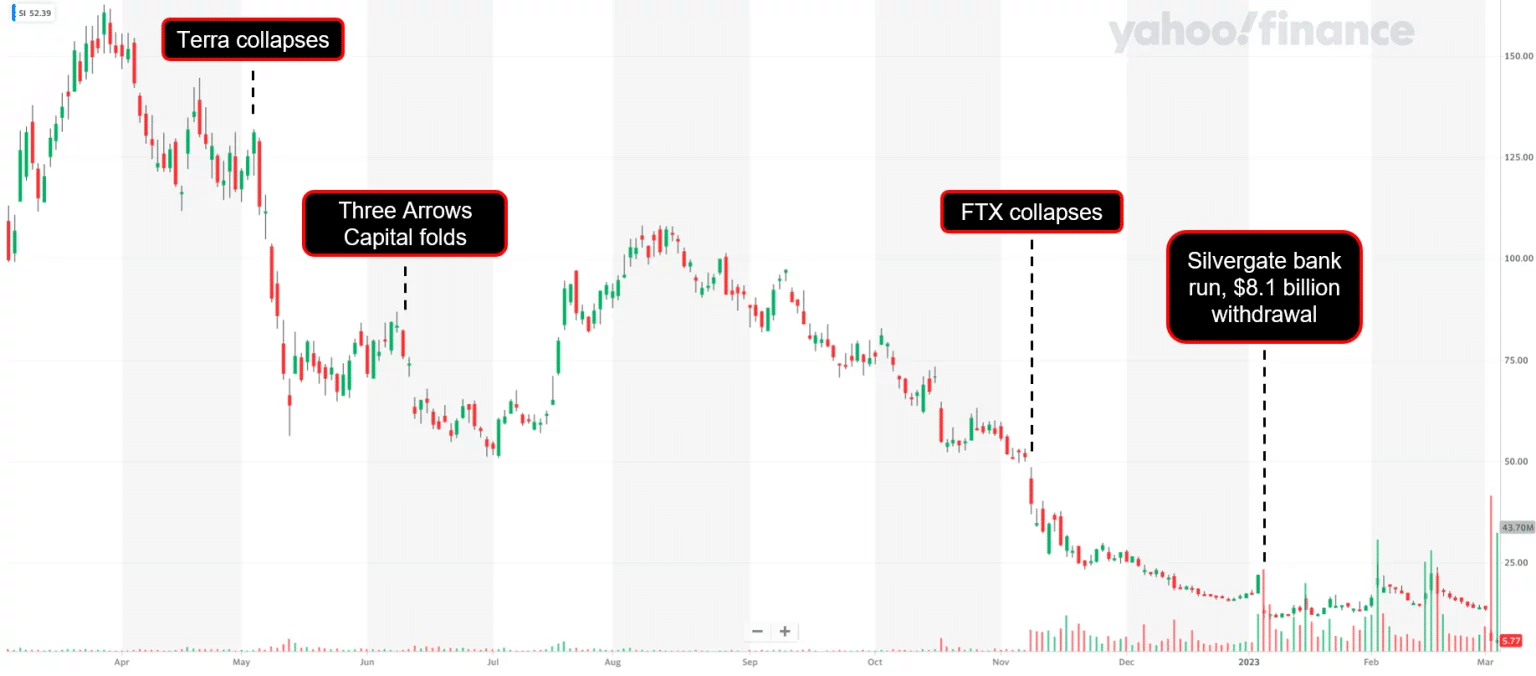

As the chart below shows us, Silvergate’s share value has continually fallen throughout 2022, wiping away one setback after another that the crypto ecosystem has experienced during this sad period.

Like the crypto market, Silvergate has had to deal with the collapse of Terra (LUNA) and then Three Arrows Capital (3AC), which was also exposed to a large number of players in the ecosystem.

Figure 2 – SI share price and key dates for Silvergate since the beginning of 2022

From June to August 2022, Silvergate has managed to weather the market turmoil and continue to make a profit. As such, the company recorded a net profit of $40.6 million in the third quarter of 2022, an encouraging figure given that the crypto-bank had reported a net profit of $75.5 million for the entire year of 2021.

But the worries start to get serious with the collapse of the FTX empire led by Sam Bankman-Fried, the man who defined himself as a philanthropic billionaire, but who ended up using his own clients’ money for totally illegal purposes, between buying real estate and embezzlement with his various companies.

On 6 December 2022, US senators began investigating Silvergate’s role in the financial transactions between FTX and Alameda Research. The senators accused the bank of “serious failures” to monitor and report suspicious activity between the two entities under the aegis of Sam Bankman-Fried. At the same time, Silvergate reveals that FTX’s deposits alone accounted for approximately 10% of its total assets under management at the time of publication of a report.

As of January 2023, the company is trying to keep its head above water by stabilising its balance sheet. As a result, the crypto-bank found itself forced to lay off 40% of its staff, a massive layoff accompanied by $8 million in expenses to fund various compensation and other benefits for its former employees.

Ten days later, it was announced that Silvergate had reported $1 billion in net losses for the fourth quarter of 2022 alone, and that its share price had fallen dramatically. The verdict is clear: the year 2022 will have resulted in a net loss of 948 million dollars for the bank.

Why such a difficult last quarter? Because Silvergate’s customers simply triggered a bank run because they feared the bank’s potential insolvency. In other words, they expect the bank to be unable to pay its debts and therefore, mechanically, to allow them to withdraw their funds. Deposits have also been lower with the crypto-bank, which has totally disrupted its accounting plan.

Note that the Federal Deposit Insurance Corporation (FDIC), the agency responsible for guaranteeing US customers’ bank deposits up to $250,000, should logically be able to play its part should the worst-case scenario occur, although such a sum is relatively small compared to the deposits made by Silvergate customers.

What does the future hold for the Silvergate crypto-bank?

Most experts expect Silvergate to file for Chapter 11 bankruptcy protection in the United States while it finds a way to recover, if at all. This protection, which is widely used, allows companies unable to pay their debts to continue operating until they can repay their debts. Their activities also come under the supervision of a court.

The bank could consider short-term loans from other banks, but these require liquidity guarantees, which Silvergate is unable to provide.

At present, the bank is in a situation where its liabilities, i.e. the volume of customer deposits, are continually being reduced as a result of massive withdrawals. The bank’s bond holdings are steadily declining in value as a result of rising interest rates in the United States, placing Silvergate in a kind of vice with an unfavourable outcome.

In addition, Silvergate is being abandoned by its major clients, such as Coinbase, Paxos, Galaxy Digital, Bitstamp, Circle, Crypto.com and Gemini, to name but a few.

At Coinbase all client funds continue to be safe, accessible and available.

In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

– Coinbase (@coinbase) March 2, 2023

If, by chance, the crypto-bank were to find a potential lender, however, the value attributed to shareholders would continue to decline in value, which could cause a default on the institution’s short-term debts. To cope with this, the bank would be forced to sell more bonds, which would lead to a downward spiral of diminishing capacity.

Thus, it is now impossible for Silvergate to pull itself out of the hole. The only possible solution would be for it to be bought out by a healthy bank, but this would pose several problems.

Firstly, it is unlikely that a bank with healthy revenues would consider damaging its reputation by taking over Silvergate given the image that the crypto sector now has in the institutional world following the numerous failures and scandals of 2022. Furthermore, assuming a bank deigns to buy Silvergate, it would face increasing regulatory constraints given the SEC’s crusade since the collapse of FTX.

It should also be noted that $200 million is currently floating around in preferred stock, a significant amount that would have to be negotiated by a potential buyer, further complicating matters.

Finally, given the speed at which Silvergate’s situation is deteriorating, it is likely that class action lawsuits will be filed against the crypto-bank, which a potential buyer would have to pay for if they were to buy the institution.

However, it is very likely that Silvergate is already working to find a potential buyer, and buyout terms are always negotiable especially in such a scenario where no other exit door seems to exist.

As for the impact on the cryptocurrency market, this is complicated to assess. However, as shown in the chart below, which highlights the drop in the crypto market’s market capitalisation following the delay in the publication of Silvergate’s Form 10-K, the ecosystem is extremely sensitive to announcements on this subject.

It is therefore difficult to imagine the impact that a hypothetical Silvergate bankruptcy could have, but it would inevitably be very painful for the ecosystem.

Figure 3 – Evolution of the total market capitalisation of the cryptocurrency market

In conclusion, it should be noted that if Silvergate fails to find a buyer, crypto exchanges will be in big trouble as the crypto bank was the gold standard in the US. Furthermore, traditional banking institutions are now fleeing the crypto ecosystem due to the setbacks encountered by FTX, as was the case with Signature Bank or Metropolitan Bank.

Therefore, as things stand, if Silvergate were to go under, it is highly likely that it would not find a replacement, which would be extremely detrimental to the cryptocurrency industry as a whole.