Silicon Valley Bank, one of the world’s largest banks and a specialist in financing start-ups, has liquidated $21 billion in securities in a panic. The financial markets have reacted very strongly to the news and Wall Street is panicking about a potential bankruptcy of the SVB.

Silicon Valley Bank on the chopping block

March 9 ended bleakly for financial markets as they faced a barrage of bad news, including a near-universal tax hike announced by the Biden administration to combat inflation. Cryptocurrency investors were not spared either.

But the announcement that has all markets worried is the fire sale of a $21 billion bond portfolio by Silicon Valley Bank, the 15th largest bank in the US. This emergency liquidation, which was supposed to strengthen the bank’s balance sheet, ultimately resulted in a massive loss of $1.8 billion due to the loss of value of the securities sold.

This loss is greater than the bank’s net income for the entire year 2021.

Following this loss, the SVB announced a massive share sale equivalent to $2.25 billion in order to avoid falling. However, this created panic among investors as massive withdrawals were quickly made and the bank’s NASDAQ-listed stock plunged in record time.

According to Bloomberg reports, Silicon Valley Bank CEO Greg Becker himself held a conference call with most of the bank’s customers yesterday, including venture capitalists, to reassure them not to withdraw their funds.

On the contrary, many VCs have urged their clients to withdraw their funds from the SVB, such as Founders Fund, Coatue Management and Union Square Ventures, in order to limit the exposure of start-ups to a potential bankruptcy.

Indeed, the majority of the SVB’s activities concern the financial support of start-ups. For example, we can read on its own website that “44% of US technology and healthcare companies that went public and were backed by venture capital firms used SVB”.

Start-ups whose activity was encouraged by favourable policies during the Covid crisis turned to SVB to hold their deposits, which then invested them mostly in US Treasuries and other securities.

What impact on the markets?

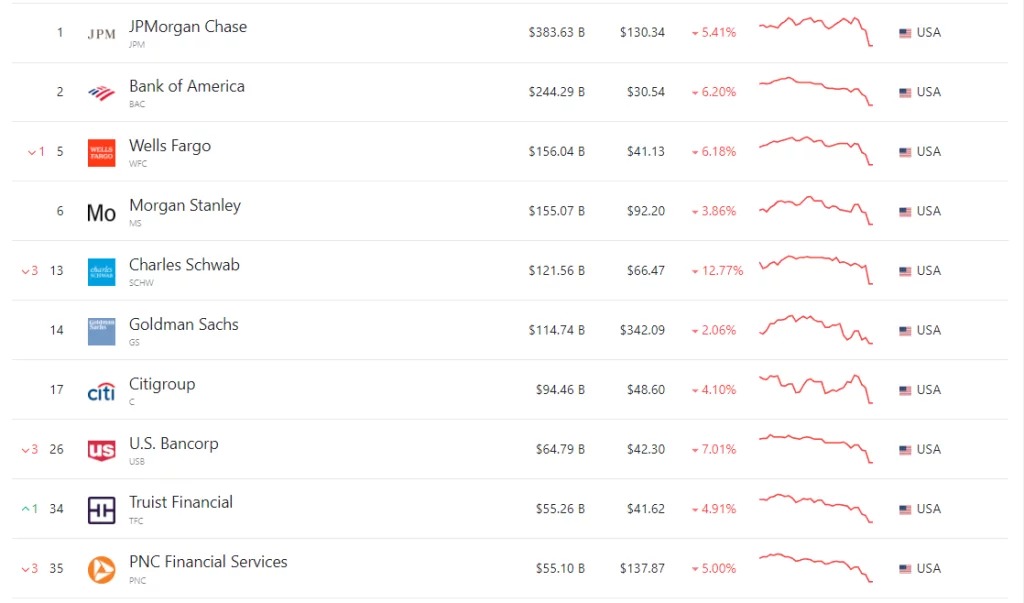

The market will have reacted very strongly to Silicon Valley Bank’s crash announcements, with contagion spreading first to the US banks. Thus, JP Morgan, Bank of America and Wells Fargo, the 3 main banking establishments in the United States, saw their share price fall respectively by 5.41, 6.20 and 6.18% over the last 24 hours.

Figure 1 – US banks by market capitalisation and share price performance in 24 hours

Banks around the world have seen their share prices fall, including European banks. In France, for example, BNP Paribas lost 5.3%, Société Générale 5.1% and Crédit Agricole 3.6%. Our German neighbours saw Deutsche Bank’s share price fall by 9% and Commerzbank’s by over 6%.

The KBW stock index has lost 8% since it began falling last night. The STOXX 600, the stock market index composed of the 600 largest European stock market capitalisations, has also fallen:

Figure 2 – Evolution of the STOXX600

In the crypto market, about $400 million was liquidated in various positions as a result of an overall decline in the crypto price. However, it should be noted that the crypto market has also suffered from the KuCoin case, in which the New York Attorney General declared Ether (ETH) to be a security.

According to some observers, should the bank fail to recover, including by receiving help from private companies, the US government will most likely have to find a solution itself so that the contagion does not become fatal to other market players.