Decentralised finance (DeFi) has recently attracted the attention of the Bank for International Settlements (BIS), which is studying the integration of central bank digital currencies (CBDs) in this sector. Project Mariana”, led by the BIS, aims to determine whether the use of MMAs with CBDMs could contribute to the G20’s goals of faster, cheaper and more transparent cross-border payments.

DeFi to dust off traditional finance

The Bank for International Settlements (BIS), which acts as both a “bank of central banks” and a forum for central banks, is working to integrate central bank digital currencies (CBDs) into the decentralised finance ecosystem (DeFi).

Specifically, the BIS is exploring the value of automated market makers (AMMs) through its subsidiary BIS Innovation Hub in the context of cross-border trading between selected countries using MNBCs. This study, known as “Project Mariana”, currently involves the Banque de France, the Monetary Authority of Singapore and the Swiss National Bank.

A pillar of decentralised finance, MAs allow crypto-currencies to be priced on decentralised exchanges (DEX) based on algorithms and liquidity pools instead of traditional order books. A method that would bring its share of benefits to traditional finance, according to the BIS:

“These are smart contracts that use pools of liquidity to trade digital assets, as opposed to the traditional process of matching buyers and sellers. As DeFi and its applications have the potential to become systemically important elements of the financial system, central banks must understand their impact. “

The BIS statement further explains that wholesale MNBCs (abbreviated here as wNMBCs) mixed with AMMs could be part of a new generation of financial market infrastructure, “contributing significantly to the G20’s goal of faster, cheaper and more transparent cross-border payments”.

How would it work?

According to the currently envisaged – and experimental – network architecture, it would naturally be blockchain-based and support its own automated financial market makers.

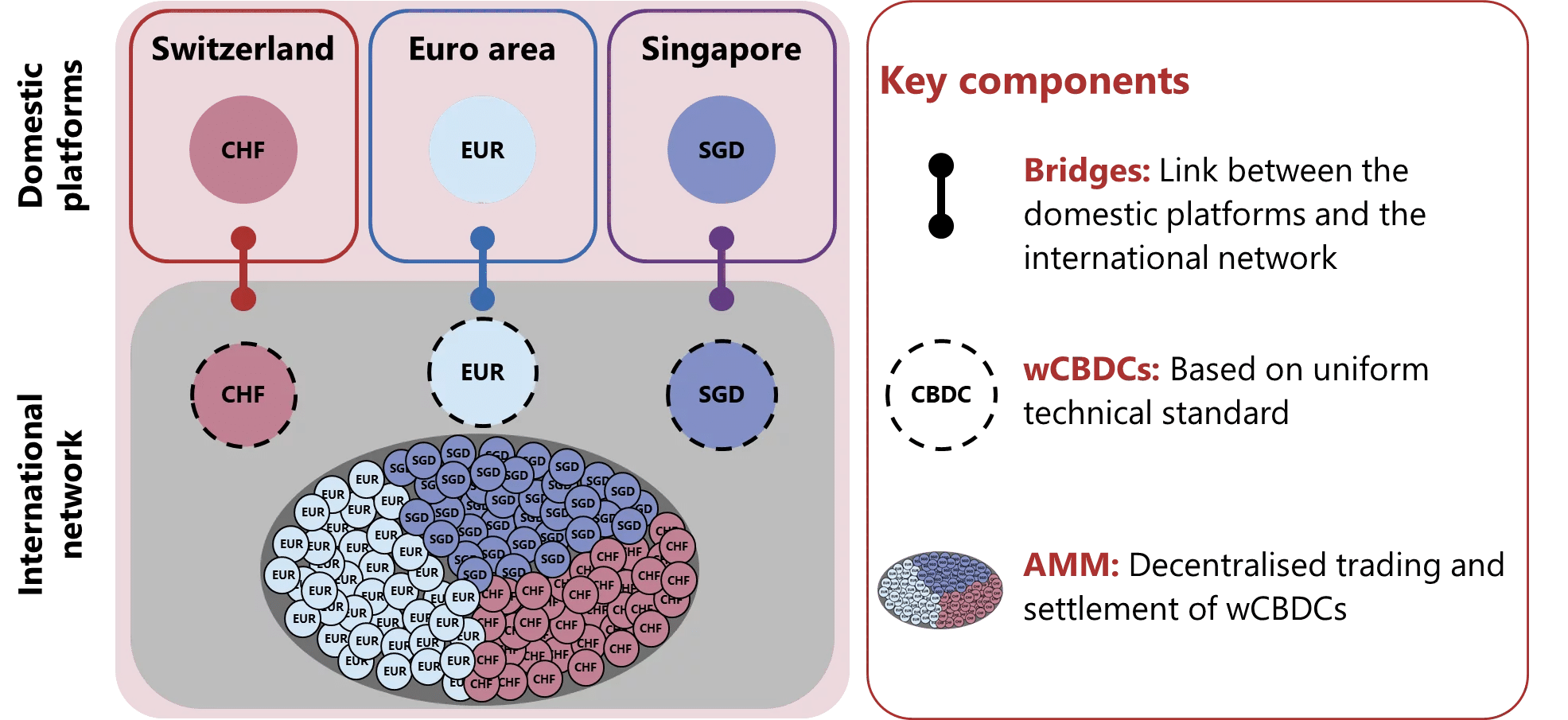

Via bridges linking the “native” platforms of each central bank, the international network would thus use MAs for the exchange and settlement of wMNBCs. Thus, wMNBCs can be directly exchanged into Swiss francs (CHF), euros (EUR) or Singapore dollars (SGD).

Diagram of the main components of this ecosystem

According to BIS documentation, each platform will be able to self-manage and agree its own internal standards, but still with interoperability offered with every wMNBC contained in the international network.

Currently undergoing testing, Project Mariana is expected to report its initial findings by mid-2023 to determine the extent to which this solution would be advantageous compared to the traditional system.