One week after the Shapella update, more than one million ETH have been removed from staking. While this may seem like a lot, the information from the on-chain analysis shows that staking is more popular than ever.

The opening of staking withdrawals does not affect the price of ETH

Since last week with the Shapella upgrade on the Ethereum blockchain, it has been possible to withdraw one’s ETH deposited in staking. To date, nearly 1.07 million ETH have been withdrawn, representing a value of more than $2.2 billion at the time of writing.

However, it is clear that the price of the asset is not particularly affected and, on the contrary, has recorded a very respectable performance over the current month, with a 14.8% increase since April 1st:

Figure 1 – ETH price in April in H4 data

Admittedly, the current rally has been slowing down for the past few days, but if there is a drop in prices, it would be due to a natural market correction rather than a real dumping induced by ETH destaking.

How is staking really evolving

?

In reality, most indicators seem to show that investor confidence in Ethereum has been boosted by the latest update.

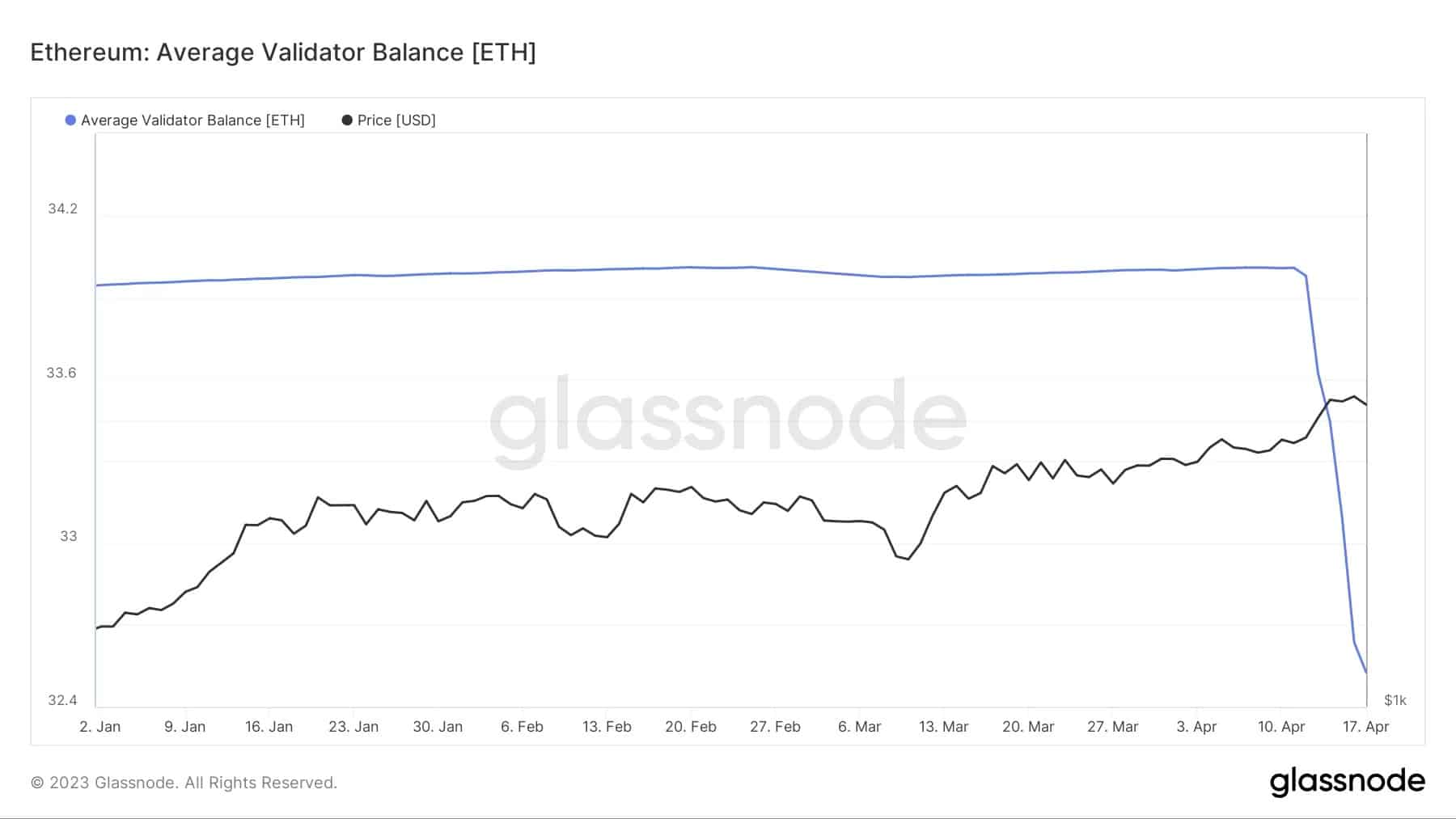

Looking at withdrawals in more detail, it is interesting to note that the average number of ETH staked per validator has dropped from 34 to 32.5. This is not insignificant, as 32 is the minimum number of ETH required to run a validator, suggesting that in reality, the current withdrawals may correspond to the rewards received since the rollout of the Beacon Chain smart contract:

Figure 2 – Average ETH stakes per validator

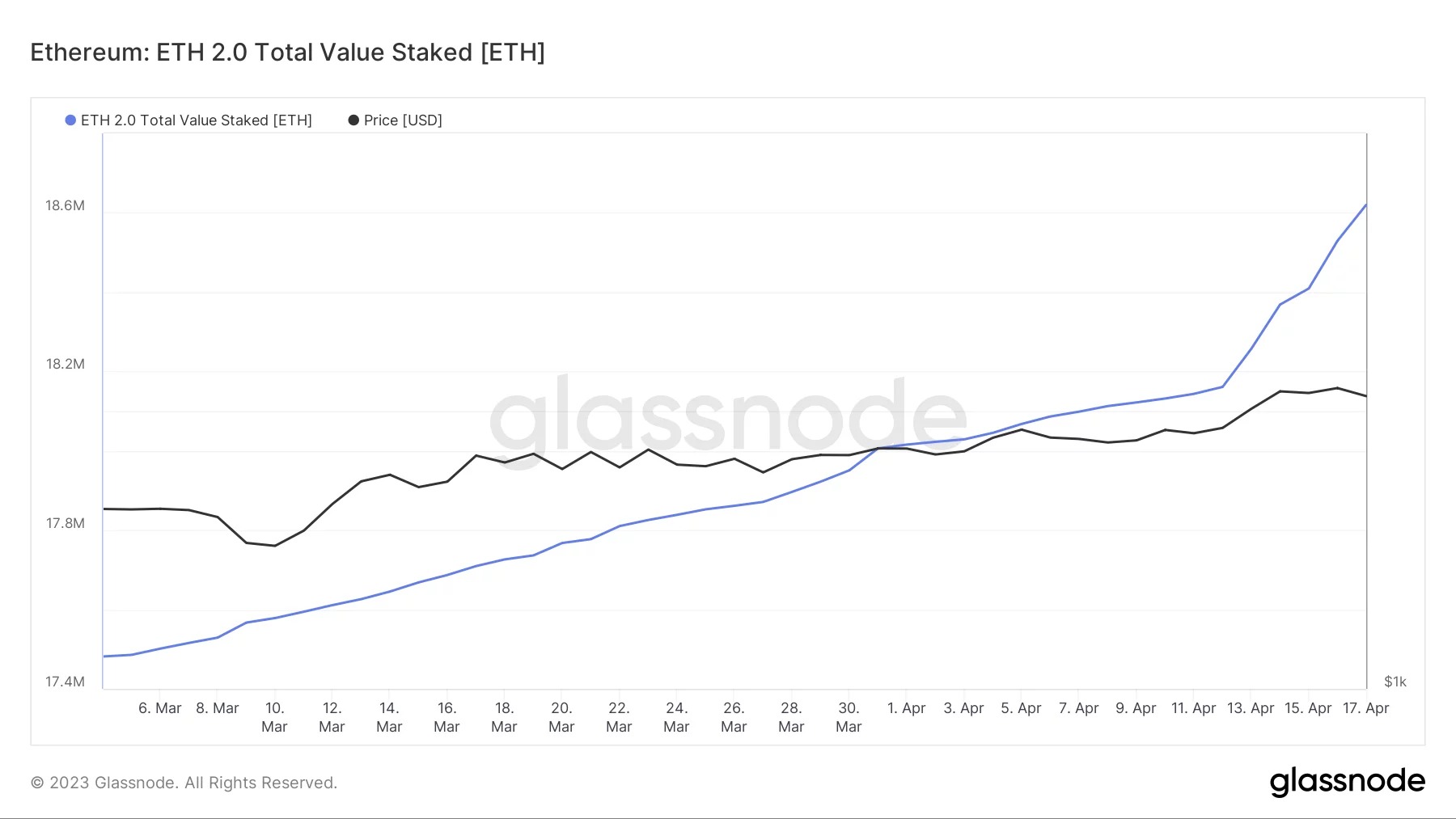

Furthermore, focusing on the number of ETH removed from staking is not enough, one should also look at the number of new entries. On this point, the trend has accelerated, and there has been an increase in deposits over the last few days:

Figure 3 – Cumulative ETH staking

Thus, more than 18.6 million ETH are currently staking on the Beacon Chain smart contract, representing more than $38.9 billion and 15.6% of the total capitalisation.

Withdrawals that take time

In addition to all the above, there is an important subtlety to consider: the Shapella update allows withdrawals. But this does not mean that all third party services that facilitate liquid staking upgrade instantly.

For example, on the Binance side, BETHs can be exchanged for the associated ETHs from April 19 at 10am Paris time, but on the blockchain side, this process takes time due to a queue. Thus, it is clearly explained that these withdrawals can take up to 15 days.

Coinbase does not seem to have given a date, but also states that it may take some time. As for Lido, the main provider in this area, the interface allowing withdrawals should be deployed during May, and these should then take 2 to 6 days to be processed.

Thus, even if there were a real desire for a mass exit, this queue would naturally limit any hypothetical selling pressure on this particular case.

*** Translated with www.DeepL.com/Translator (free version) ***