As Bitcoin’s halving approaches, fees on the market’s 1st blockchain are on the rise, even surpassing those spent by Ethereum users. This reflects a growing interest in the many applications developed on Bitcoin or its 2.

layers.

The flippening of Bitcoin on Ethereum

We’re only a few hours away from halving, and we’re already seeing an increase in Bitcoin user activity on the blockchain. They’re looking to take advantage of what could be the last few moments when transaction fees remain relatively low.

In recent days, fees on the Bitcoin blockchain have risen considerably and remained high for several days. In the last 3 days, Bitcoin users have paid more fees than Ethereum users.

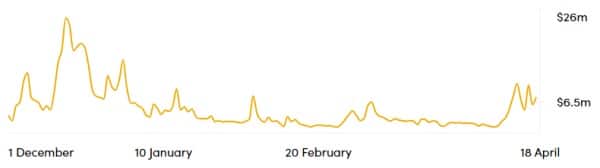

Bitcoin blockchain fees in dollars since December 2023

In fact, daily fees harvested on the Bitcoin blockchain have reached as high as $10 million, a level last seen in the month of December 2023.

Ethereum, for its part, is a blockchain known for its very high transaction fees, which can sometimes exceed several hundred dollars during periods of heavy network congestion.

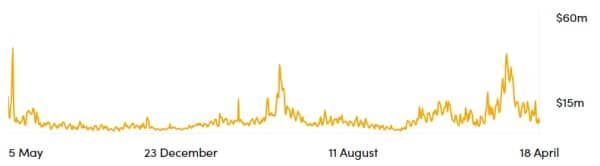

Ethereum blockchain fees in dollars since May 2022

Although Ethereum fees are lower than Bitcoin fees in the short term, this is not the case in the medium term. In fact, the Ethereum blockchain collected over $38 million in fees on March 5, 2024, which was a record since May 2022.

How can we explain such a sharp rise in Bitcoin fees?

First of all, it’s important to remember that while Bitcoin is gaining in adoption, transaction fees are likely to remain high. What’s more, high fees are essential for the survival of miners, the key players in securing the network.

In fact, approximately every 4 years, the BTC reward in a block is divided by 2, halving the miners’ income – a process known as halving. This mechanism was designed to make Bitcoin a deflationary currency and thus preserve its value over time.

Since the last bull market, more and more use cases for the Bitcoin blockchain have been created:

- These include the Ordinals protocol, which enables the creation and exchange of fungible and non-fungible tokens (NFT);

- Bitcoin is also used to time-stamp and thus prove the existence of a document on the date its hash was recorded on the blockchain;

- The use of miniscript, a writing language enabling more complex BTC transactions, notably used by the Liana wallet to facilitate inheritance transfers without intermediaries;

- The development of the Lightning Network, a Bitcoin layer 2, which enables near-instantaneous transactions;

- There is also the advancement of DLC, smart contracts that enable leveraged trading without intermediaries, developed by entities such as 10101 and DLC Markets ;

- Finally, the creation of new sidechains, such as Stacks.

Finally, the Rune protocol is probably largely responsible for the recent high fees. Created by Casey Rodarmor, also behind the Ordinals protocol, Rune aims to offer a more flexible, faster and cheaper solution in terms of transaction fees than its predecessor.