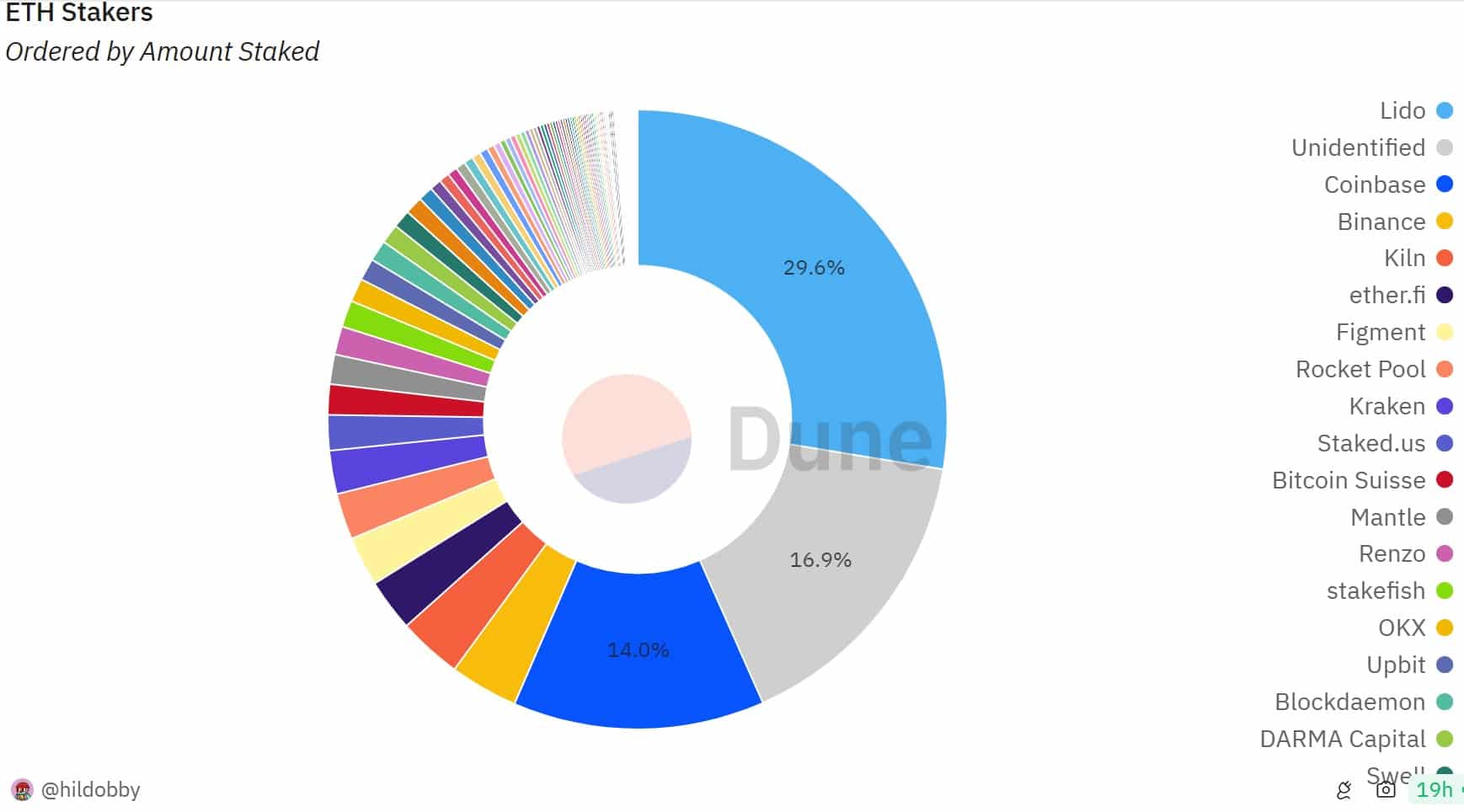

Lido, the historic leader in Ether (ETH) staking, has seen its market share fall below 30%. This development is due to the emergence of new players on the market, such as Swell and Ether.fi, as well as to the rise of non-custodial staking.

Lido loses ground on Ethereum staking: towards greater decentralization?

Lido, the leading liquid staking solution on the Ethereum blockchain, has seen its market share shrink from 32% in December 2023 to 29.57% today. This move comes as the influx of new stakers on Ethereum diversifies, reducing the concentration of power in the hands of a single player.

Until now, Lido has largely dominated the Ether (ETH) staking market. This situation worried the industry, as an entity holding more than 33% of ETHs could potentially influence the operation of the Ethereum blockchain.

There are several factors contributing to this development. On the one hand, the arrival of new players on the market, allowing for greater decentralization of staking on Ethereum. Players such as Coinbase (14.04%), Binance (3.75%) and Kiln (3.5%) are also nibbling away at Lido’s market share. An unidentified player currently holds 16.9% of ETH stakes.

On the other hand, the rise of non-custodial staking services, where users hold their own private keys, is attracting more and more users concerned about security and decentralization.

The different players in Ether (ETH) staking

Staking on Ethereum: the importance of diversity

The influence of Lido worried the community, who feared that the protocol was taking too much power over the operation of the Ethereum blockchain.

Vitalik Buterin, co-founder of Ethereum, stated that no staking pool should hold more than 15% of the total number of ETHs staked by 2022.

Speculative controversial take: we should legitimize price gouging by top stake pool providers. Like, if a stake pool controls ☻ 15%, it should be accepted and even *expected* for the pool to keep increasing its fee rate until it goes back below 15%. https://t.co/cOtuM7Occd

– vitalik.eth (@VitalikButerin) May 14, 2022

Ironically, Lido’s decentralized autonomous organization (DAO) had itself tried to limit its influence by proposing a staking ceiling in May 2022. But this proposal was overwhelmingly rejected by the community (99.81% of votes against).

It’s important to note that Lido remains the market leader in Ethereum staking, with over $8 billion worth of ETH staked.

The decline in Lido’s market share is an encouraging sign for the health of ETH staking. More competition means a better distribution of power and less risk of centralization. Nevertheless, it’s important to remain vigilant in the face of complex new staking mechanisms, such as “restaking”, which could conceal risks and security loopholes.