The Bitcoin price has been in a sideways transition phase below its ATH since mid-March, a usual sequence and in line with its historical cycle. Halving and news around the FED pivot will continue to create price action over the next few weeks, without threatening the long-term bullish target of $100,000.

Halving and timing of the FED pivot, the 2 dominant fundamental factors

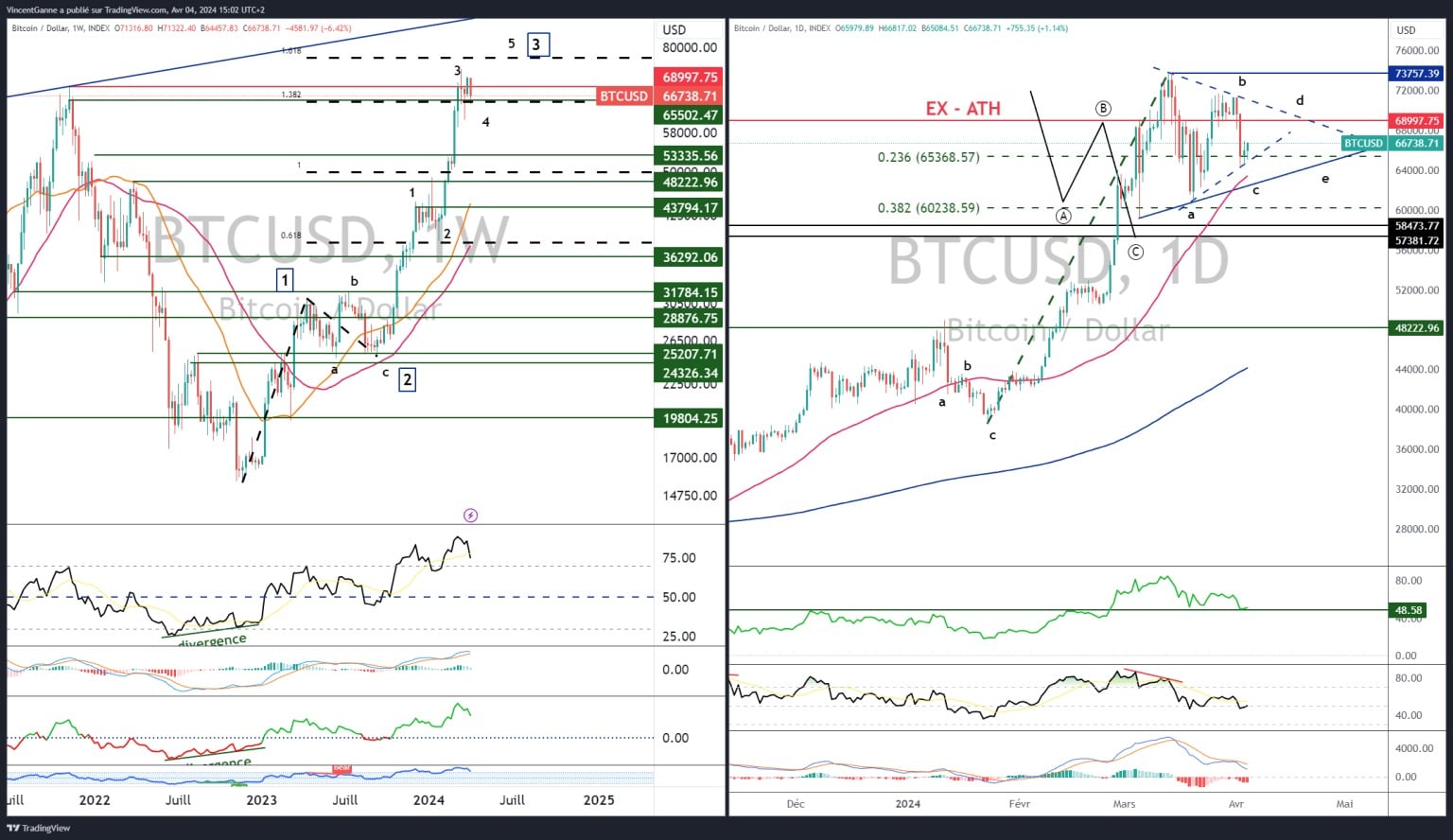

Since mid-March, the Bitcoin price has interrupted its vertical uptrend that began in late January, to enter the development of a volatile sideways sequence near its former all-time high.

Most traders and investors who came in late (those who made their first purchase above $70,000 when the bullish reversal had been technically validated since the spring of 2023…) are expressing some stress-related emotions as Bitcoin corrected from $73,000 to $61,000.

These reactions are typical of beginners who have no hindsight on the underlying trend, who enter the market late in the day, with their hearts in their mouths, and who know neither how to manage their financial risk nor their emotions. In short, they don’t take the stock market very seriously.

And yet, Bitcoin does nothing out of the ordinary. On the contrary, it is perfectly respecting its usual price action cycle, i.e. a profit-taking phase when it is 3 to 4 weeks from its next halving and, above all, in contact with its ex-ATH. Bitcoin corrections of 15-30% are commonplace and will continue to occur, especially when the market has hundreds of % of upside under its feet.

So keep a cool head and keep the big picture in mind, the underlying trend that will take us towards $100,000 in 12 months’ time. From a statistical point of view, keep in mind that BTC’s true bull run generally begins 80 to 100 days after halving, which takes us to next June.

The price/halving ratio and all the developments surrounding the forthcoming pivot by the US Federal Reserve (FED) and the European Central Bank (ECB), these are the 2 factors that will continue to have an influence on the BTC price, without however calling into question the bullish cycle that has still not entered its mature phase.

Bitcoin’s wave “4” is still under construction

From a technical analysis point of view, the construction of wave 4 is a certainty, but there are still several hypotheses for the amplitude and shape of this pause wave. Chartist triangle, zig-zag 3-step correction, flat formation, etc.

Bitcoin’s technical choice could be made this Friday, April 5 with the US NFP report update at 2.30pm.

Chart revealing weekly and daily Japanese candlesticks for BTC/USD