Terraform Labs and its co-founder Do Kwon have been convicted of fraud for deliberately misleading investors about UST, Terra’s stablecoin, and for lying about the use of their technology by South Korean company Chai. For the time being, Do Kwon remains in Montenegro awaiting extradition.

Terra and Do Kwon guilty of misleading investors

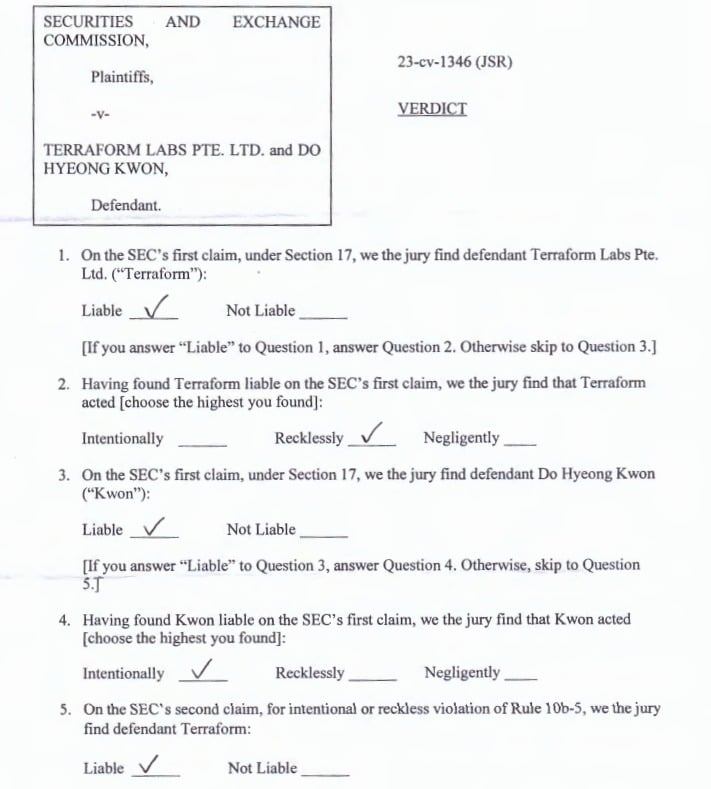

After a 2-week trial in a New York court, Terraform Labs and its co-founder Do Kwon – absent from the trial since ‘still required to remain in Montenegro – were found guilty of fraud for deliberately lying to investors about UST, the algorithmic stablecoin of the Terra ecosystem backed by the LUNA token.

Indeed, by May 2022, the UST had lost its peg to the dollar and the LUNA token had lost its value almost instantly, despite Terraform Labs’ attempts to stabilize their 2 cryptocurrencies by selling assets from their reserves, then partly made up of Bitcoin.

Court document stating that the jury found Terraform Labs and Do Kwon guilty

In less than a week, $40 billion went up in the air in what was the beginning of a long bear market, as the repercussions of Terra’s collapse were felt by many blockchain projects.

Terra was a fraud, a house of cards. And when it collapsed, investors lost almost everything.

Devon Staren, SEC attorney

Aside from Terraform Labs’ responsibilities in the collapse of its financial ecosystem, the jury also ruled, with supporting evidence, that the company had lied when it claimed that Chai, a South Korean app, used its blockchain for transactions.

Chai’s former product manager was present at the trial. He confirmed that Terraform Labs had made numerous misleading statements about Chai’s use of the technology offered by the Terra blockchain.

Terraform Labs doesn’t intend to stop there

Terraform Labs, which filed for bankruptcy back in January, took to X to express its disappointment at the jury’s verdict, and said it was examining possible remedies in the time ahead. In addition, the company stated that the Securities and Exchange Commission (SEC) had exceeded its rights in this lawsuit:

Terraform Labs Statement on Verdict in SEC Proceedings:

We are very disappointed with the verdict, which we do not believe is supported by the evidence. We continue to maintain that the SEC does not have the legal authority to bring this case at all, and we are carefully…

– Terra Powered by LUNA (@terra_money) April 5, 2024

For its part, the US regulator asserted that the Terra affair was merely the result of a lack of compliance, and that it would continue to use “the tools at its disposal” to protect investors.

Note that during the trial, exhibits proved that Jump Trading, a company specializing in high-frequency trading, had indeed injected money to defend the UST peg when it collapsed. However, Terraform Labs had always maintained that UST’s structure gave it total autonomy, and that it therefore needed no outside intervention to maintain its dollar price.