Vertically on the rise since the end of last October, the price of Bitcoin (BTC) has broken the $38,000 barrier thanks to a weekly bullish gap opened at the beginning of the week. BTC is playing at full speed with the validation of the first spot ETF in early January, as well as a rapid pivot by the FED and ECB expected in the first half of 2024.

Bitcoin still the leader

Bitcoin (BTC) is double leader on the financial markets and has held this position throughout 2023. Leader in comparison to major assets in all asset classes (equities, bonds, forex, commodities) and above all broad leader within its own camp, with dominance rising from 40% to over 55% in the space of 12 months.

High finance has therefore not gambled on the full return of confidence in the crypto market, but rather on the scenario of bitcoin as a diversification asset on the stock market, particularly against precious metals or even bonds. All of this reinforced by a bond crash that has only just ended in the autumn of 2023 with the market’s interest rate peak.

Futures contracts, options contracts, exchange-traded funds, ETFs, ETPs… So many investment vehicles that have given BTC an institutional character, a character that altcoins have little or nothing of, like Ether (ETH).

In other words, if the first spot bitcoin ETF is not validated by early January (the market is playing this scenario with a current probability of 90%), then a large part of the bullish castle built by BTC this year will collapse.

Bitcoin’s dominance hits a wall

But let’s be optimistic and imagine that the ETF from BlackRock et al. will be available on the market from January 2024. So when will BTC pass the baton to altcoins for a proper catch-up?

I think this handover will take place when BTC’s dominance reaches the 58% resistance, the March 2021 stall threshold, as shown in the first chart below, with a clear rebound in Ethereum’s dominance.

Graph representing bitcoin’s dominance and comparing it to that of Ethereum

The bitcoin price has now retraced more than 50% of the 2022 bear market on an arithmetic scale and more than 61.8% on a logarithmic scale. The challenge now is to demonstrate that the $38,000/$40,000 level is support, with next target resistances at $44,000 and $48,000. In the short term, the market should hold below resistance at $44,000.

Graph showing Japanese candlesticks in daily bitcoin price data

Federal Reserve, last annual decision on Wednesday December 13

If the topic of spot BTC ETFs is an internal one for the ecosystem, that of the Federal Reserve’s expected pivot in 2024 is a topic for the financial markets as a whole. The FED will unveil its final monetary decision of the year on Wednesday December 13, and is expected to confirm its Terminal Rate at 5.50%.

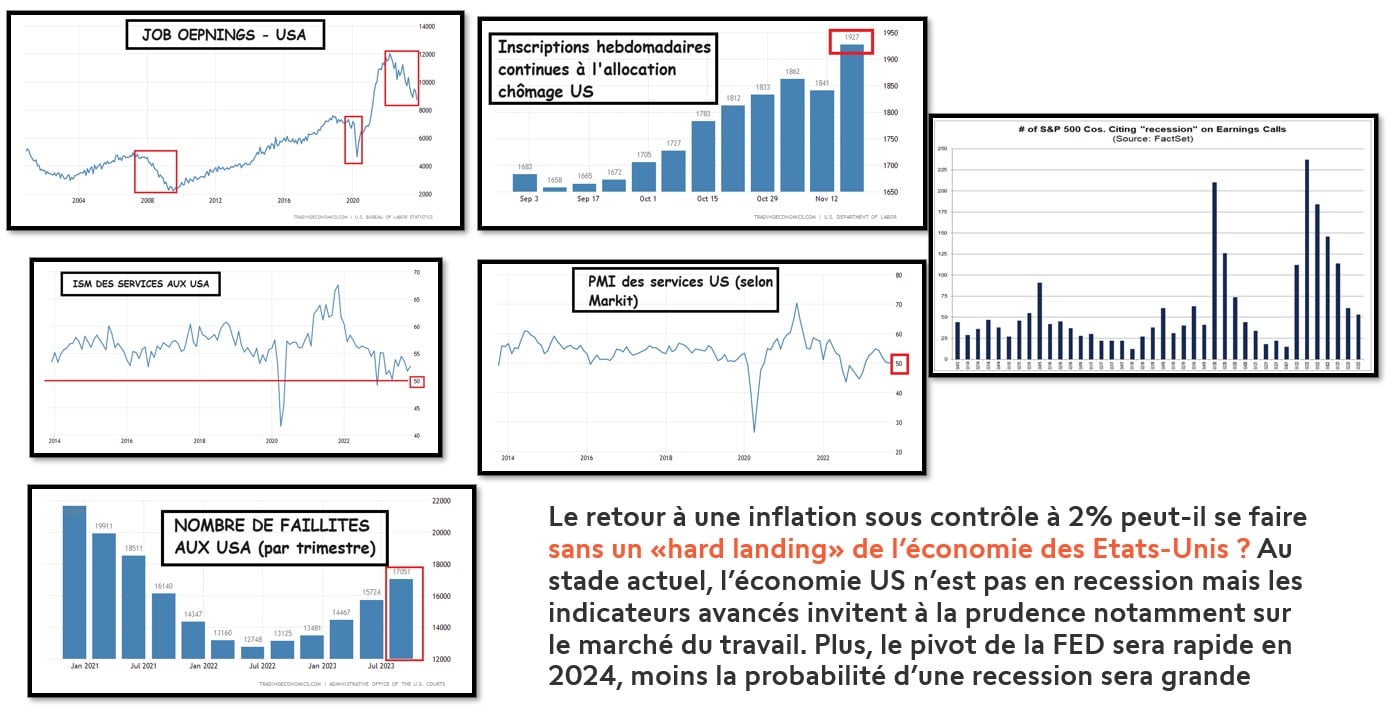

The market will be paying close attention to the FED’s updated macro-economic projections, particularly in terms of inflation and unemployment rates for the US economy. Will disinflation be achieved without economic recession?

In any case, this is the challenge of the coming year from a global-macro perspective, and a necessary condition for preserving the uptrend of risky assets on the stock market.

Infographic on the current macro-economic situation of the US economy