Has Bitcoin’s (BTC) rise to $30,000 since March 2023 signalled the end of the bear market? According to profit and loss data, the market is at a tipping point, with a high probability of an uptrend over the next few months. We take stock of the situation.

A bull market in the starting blocks

After a very difficult 2022 for the cryptocurrency sector, could the bull market be starting to show its face? According to data on the profits and losses made by investors in Bitcoin (BTC), we are at a tipping point that could lead to a long-term rise in prices.

First of all, it should be remembered that realized profits and losses are used as an indicator to understand the state of the market. They are derived directly from the purchases and sales made by investors. They are therefore the opposite of unrealised profits and losses, another indicator that only takes into account positions that have not been closed.

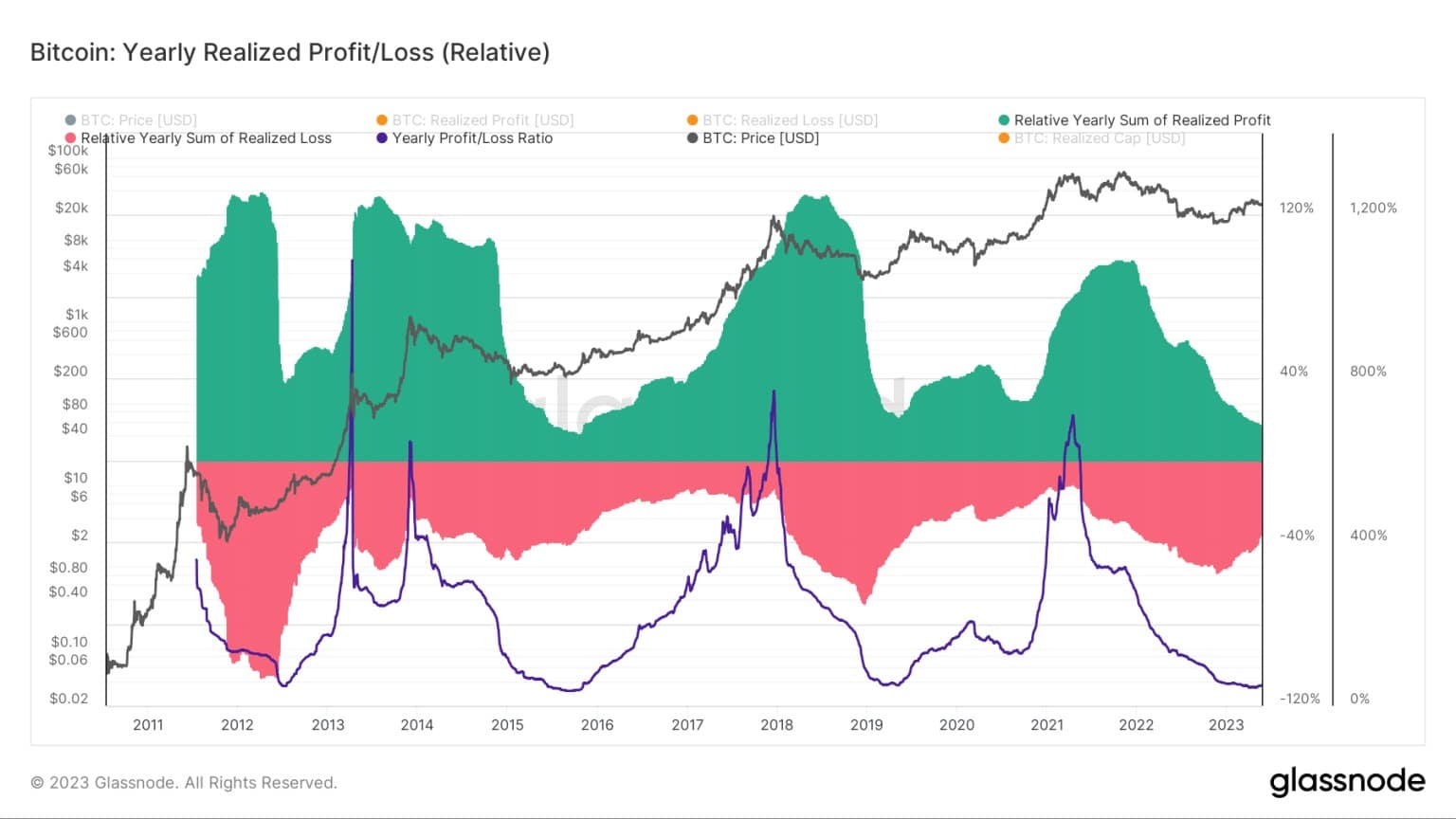

Taking a closer look at annual purchases and sales of Bitcoin between 2011 and 2023, there are two key periods for anticipating market trends:

When the annual sum of realised profits (in green on the chart) exceeds losses, Bitcoin is in an uptrend;

When the annual sum of realised losses (in red on the chart) is greater than the gain, the price of Bitcoin is approaching the lowest point it could reach.

Figure 1 – Annual realised profits and losses on the cryptocurrency Bitcoin (BTC)

To take advantage of the best opportunities the market has to offer, the key time not to miss is the short period when annual realised losses exceed annual realised profits. In previous cycles, this period has been around 6 to 12 months.

According to the data for our current cycle, annual realised losses have been dominant since September 2022. If the gradual decline in losses that began in December 2022 continues over the next few months, we can expect a reversal in favour of bullish investors.

Finally, note the strong correlation between the annualised profit and loss ratio (blue line) and periods dominated by annual losses. When this ratio falls below 125%, realised losses outweigh profits, marking the best time to start taking positions in the market.

Today, this ratio is stagnating at around 50%. The market is slowly starting to recover, having passed its lowest point on 04 April 2023, when the ratio was 45%.

A bull market already on course

While the annual profits and losses show that the market is on track to complete its convalescence, some indicators confirm that the bear market is a thing of the past. Starting with the price of Bitcoin, which has been bouncing between $26,000 and $31,000 since March 2023. The last time these prices were seen was in June 2022.

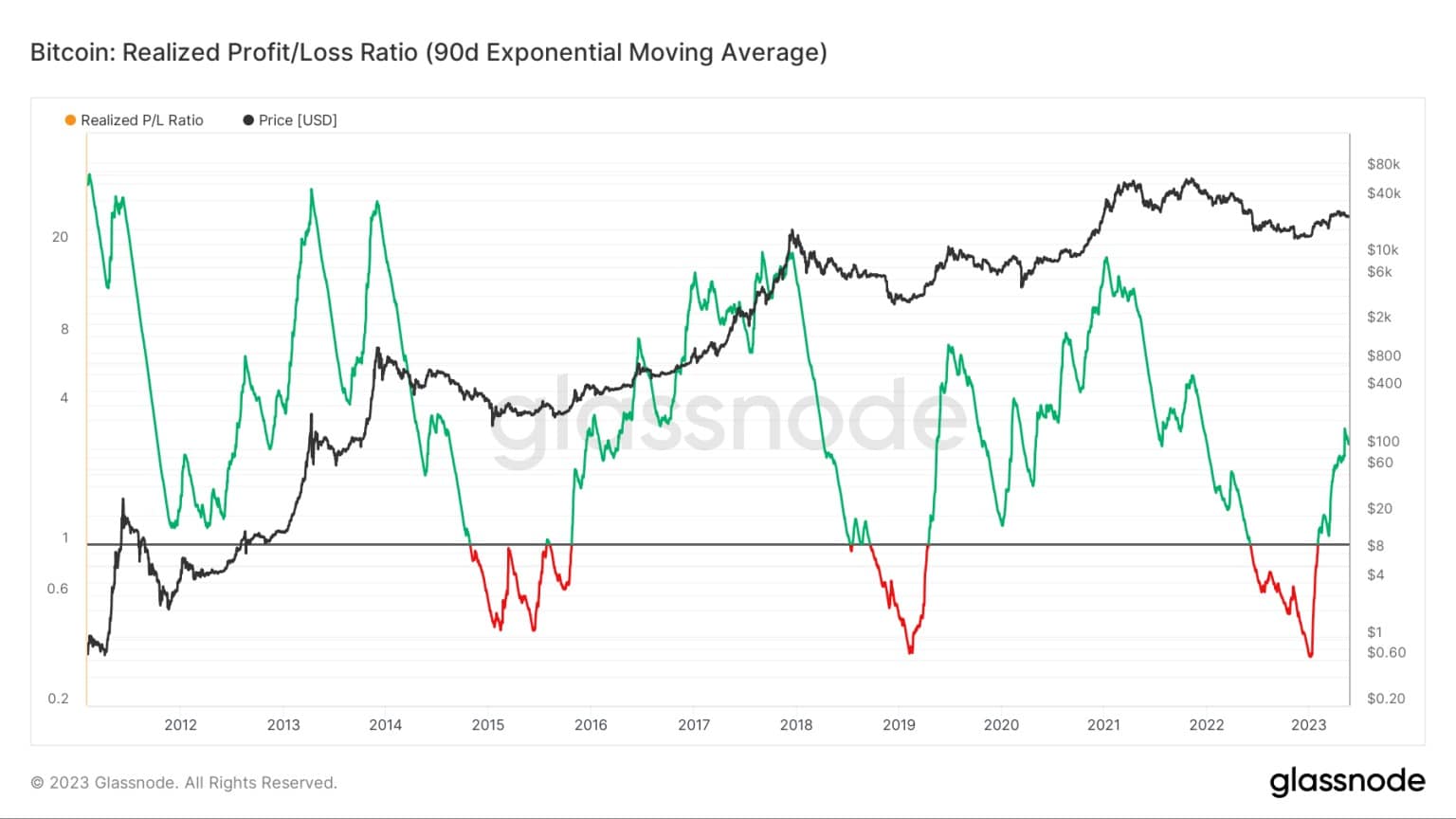

What’s more, the ratio of quarterly profits and losses on the Bitcoin market shows that profits have outweighed losses since 1 February 2023.

In fact, this ratio began to rise when Bitcoin broke the $20,000 barrier in January 2023. At the time of writing, it stands at 2.75: this means that for every loss made, there are 2.75 profits made.

Figure 2 – Ratio of quarterly profits and losses

Why is there such a difference between this chart and the one analysed above? The main reason lies in the temporality of the data analysed. Whereas the first chart details profits and losses on an annual basis, the second chart brings together information gathered over just one quarter.

Since the timeframe is shorter, the data in the second chart is more faithful to the current state of the market. As a result, if the trends of previous cycles are repeated in the current cycle, the bear market can be considered a distant memory.

Note that this technical analysis requires rigorous fundamental analysis to confirm these hypotheses. In addition, let’s not forget that the actions of the Securities and Exchange Commission (SEC) and the future regulation of cryptocurrencies in the United States are capable of strongly influencing the price of cryptocurrencies through their decisions. Not to mention the risk of a black swan, which could occur at any time.