During this bear market, the cryptocurrency industry has been plagued by mass layoffs, however, this is not a generalization. In this roundup, we will also report on exclusive stories from Bybit, Sorare, and Coinhouse, to understand how these companies are faring during this period

The bear market and its impact on our ecosystem

Since Terra’s collapse, the market has entered an even more pronounced bear market than the one that began in November 2021. This episode has identified numerous flaws among the various players in the cryptocurrency market, leading to a wave of layoffs.

Whether as a preventive measure or because of real difficulties, the cuts are sometimes significant, often exceeding 20% of the staff.

The reason given is generally the same: the current phase of uncertainty in the market.

However, these redundancies are not necessarily the norm in the industry, as we shall see with Sorare and Coinhouse. We were therefore keen to interview players who are both hiring and firing, so as to get opposing views.

The latest on layoffs in the cryptocurrency industry

Not all crypto companies that have resorted to layoffs are in the same boat. Some companies will certainly not recover from the difficulties they face, such as Singaporean platform Holdnaut, which is shedding 80% of its staff. Moreover, it is necessary to recontextualise, here 80% is ‘only’ 40 people.

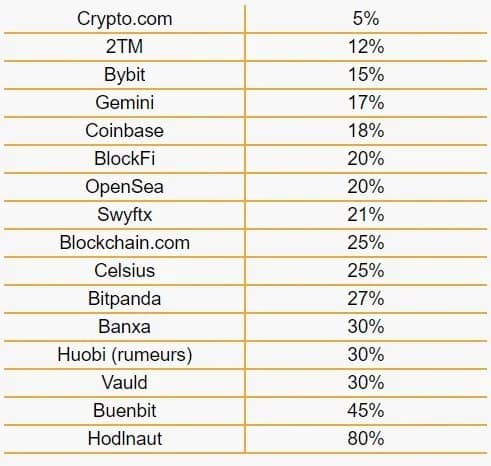

So let’s start with a non-exhaustive table of the different companies that have laid off:

Summary of layoffs in the cryptocurrency ecosystem

Note that the numbers are based only on public disclosures, which complicates the investigation. Crypto.com, for example, may have shed more than 1,000 people instead of the 260 announced, although this is difficult to confirm.

Coinbase began by freezing hiring and cancelling job offers, only to shed 18% of its workforce. In June, Bitpanda, which had more than 1,000 employees, announced that it was reducing its workforce to 730. The platform had not planned to do this a few weeks earlier.

However, these choices are not always due to poor financial health. In the case of Bybit, these decisions are motivated in particular by too rapid a growth :

“Bybit remains a company in excellent financial health, 3ᵉ largest crypto exchange platform in the world in terms of traded volume. But the workforce had grown at an uncontrollable rate (increasing about fivefold in a year) creating duplication in the organisation, damaging the very efficiency of the business and obviously impacting profitability.

Bybit’s situation was far from bad, but not taking such decisions at the time could have led to real difficulties in the years to come. Governing is about anticipating and foreseeing.

As a result, the company has made 300 redundancies or non-renewals, which represents about 15% of the workforce last spring. These decisions were difficult for Bybit, as our contacts within the company told us, it is never easy to let go of a large number of colleagues.

However, the people targeted were primarily contracts that were about to expire. Support programmes were put in place for rapid reintegration into the workforce, and financial compensation was provided.

Recruitment is to resume by September, until which time it is frozen.

On the other hand, Bybit goes back to the possible damage that could have been caused by the Terra, Three Arrows Capital (3AC) or Celsius cases:

The bankruptcy of 3AC had little impact on us, as it represented a minor role in our business […]. The same is true for Celsius. Terra affected us more severely as the exchanges had to work around the clock to deal with the technical failures of the blockchain, the defaults on the UST liquidity pools and the panic of the users […]. However, we are very satisfied with the way we handled this incident. “

Companies hiring

Other companies are experiencing this bear market very well. We can cite the example of giants like Binance with 672 job offers on its site at the time of writing. Kraken is also doing well, with 180 offers.

But French players such as Coinhouse are doing just as well. Its communications director, Johann Ouaki, tells us that the company’s presence on the market since 2015 has enabled it to anticipate the situation with a certain maturity. Its strength also lies in stable products so that it is not limited to the volatility of cryptocurrencies.

We also asked him if the current situation was holding back Coinhouse’s good momentum:

“Not at all, on the contrary, bad contexts often force creativity and acceleration. We are in a dynamic that is conducive to imagining new things, both in terms of partnerships and in terms of products or marketing approach. “

Also on the French side, Sorare is doing well with a number of new hires, as Brian O’hagan, head of growth, reports:

“We’ve been working on a number of new projects for a while now.

We are recruiting for all positions. We have over 100 positions to fill by the end of the year in Paris and New York. The rarest profiles are the most difficult [to find]. For example, [we’re] looking to recruit Go developers (a relatively new programming language) and that’s a challenge. “

If you look at the company’s recruitment ads, there are several areas that are indeed looking for new staff, including:

- Development;

- Marketing;

- Finance;

- Content creation.

In addition, Sorare has been profitable since its inception and the arrival of baseball should accelerate this momentum. In the first half of 2022 alone, the platform recorded more volume than in the entire year of 2021:

“For example, despite the market slowdown, Sorare has seen explosive growth over the past year: in the first half of 2022, we increased transaction volume by more than 274% compared to the first half of 2021. “

For his part, Johann Ouaki of Coinhouse looks back at the changes caused by the bear market. He also insists that this is seen by the company as an opportunity to improve :

We are seeing new behaviours from our customers. Many questions are being asked and this curiosity, which is ultimately very healthy, requires us to strengthen our approach, which has historically been based on education and support. In terms of negative impact, we are seeing more reluctance on the part of new entrants in particular, but education and support are once again the key to enabling us to move forward. “

As for Celsius, 3AC or Terra, the company also specifies that it has not been impacted beyond the global earthquake on the market. Indeed, Coinhouse had no exposure to these various projects.

While layoffs necessarily make more noise in this anxiety-ridden market atmosphere, we still see many players working to build to define the future of the cryptocurrency industry. Beyond the losses, a bear market should also be seen as a chance to become more successful.