The shock of the bank failures in the United States was brief, radical and the reaction of the almighty Federal Reserve (FED) just as much. The FED’s monetary inflexion had structural consequences on macroeconomic expectations and on asset classes in the stock market, in particular the continuation of the bearish trend of the US dollar on Forex, a factor supporting the rise of crypto-currencies.

The U.S. Federal Reserve (FED) pivot is near

An initial assessment can be made of the recent banking stress in terms of its impact on the financial markets since the first announcements of bank failures on March 9 in the US. In terms of performance, four big winners occupy the podium:

- The credit market (bond prices are in a clear upward recovery) ;

- The euro-dollar exchange rate, which appreciated by 400 pips (the decline of the US dollar against a basket of major currencies);

- The price of precious metals rising, especially gold and silver metal;

- The price of Bitcoin (BTC) topping the podium with more than 20% increase;

There is a market logic that explains the presence of these assets in the group of winners, their inverse correlation link with the dynamics of the US dollar on the foreign exchange market and the cycle of nominal interest rates on the credit market.

Indeed, the first and immediate consequence of the banking stress was a radical shift in the FED’s monetary policy expectations, with abundant recourse to the FED’s balance sheet (a sharp increase in the level of liquidity on the market) and a vertical fall in market rates. Market rates have fallen, as the market is now considering that the FED’s terminal rate was reached this week with the increase in the FED funds rate from 4.75% to 5%.

It is still possible (depending on the next inflation update) that the terminal rate will be 5.25%, but the market is now projecting a FED pivot this summer (i.e. the start of a downward trend in the FED funds rate).

Ultimately, these new cost of money expectations and the continued decline of the U.S. dollar in Forex are two fundamental factors that are combining to drive the price of the group of winners described earlier in the article.

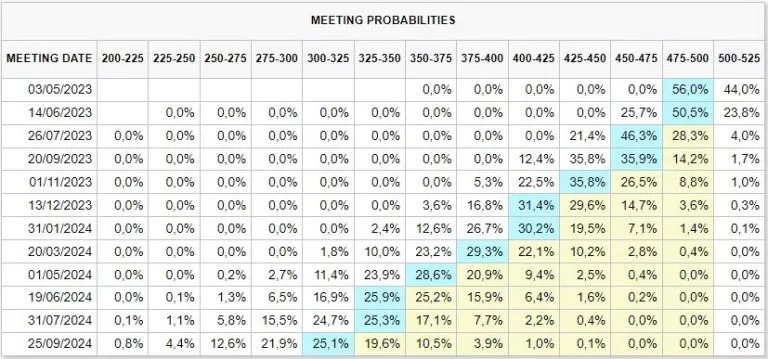

Below is a chart with the new projections for the FED’s key interest rate based on the upcoming policy decision dates

Chart that comes from the CME FED WATCH TOOL and projects the upcoming interest rate cycle of the United States Federal Reserve (FED)

Will the altcoins season finally start?

The performance of crypto-currencies over the past two weeks has been overwhelmingly driven by the bullish performance of the bitcoin price. The arbitrage that has taken place against some stablecoins and in favor of BTC has supported the price of the latter, as well as the cross-asset data presented in the first part of this article.

At this stage, the troops (altcoins) are not yet following the general in chief (BTC), and this is a missing criterion for a complete bullish argument.

The technical analysis of the bitcoin price is bullish as long as the new support of $25300 is preserved, but it would take a takeover by the altcoins and an increase in futures trading volume (only spot volume is currently up) to validate the bullish reversal for good.

This altcoin season may soon begin as BTC’s dominance has returned to the top of its range; watch this space.

Chart that exposes the comparison of Bitcoin dominance with Ethereum dominance