Binance.US is facing a class action lawsuit from investors who lost money in the collapse of the UST. It is accused of allegedly misleading marketing and possibly marketing unregistered financial securities without the necessary approvals.

Binance.US under fire after UST case

On Monday, the law firm Roche Freedman LLP filed a class action lawsuit in a California court against Binance.US over the UST collapse. A group of aggrieved investors are suing Binance.US and its CEO, Brian Schroder.

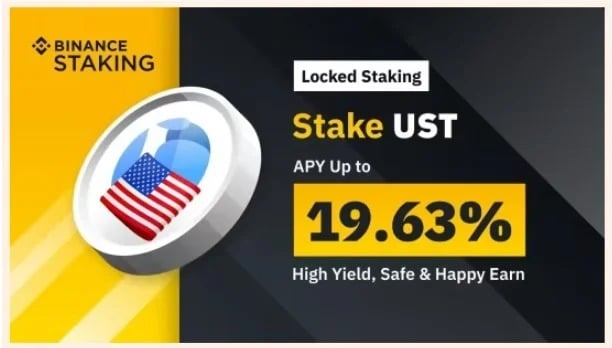

This complaint is based on two main points. First, that Binance.US allegedly marketed unregistered securities through the stablecoin UST and second, that the advertisements made in this regard were misleading.

Example of an advertisement issued by Binance

It is therefore the aforementioned security character of the UST that is considered misleading by the complainant collective. The document presented by the law firm refers to the emotional and financial distress caused by the crash of the Terra ecosystem on individual investors.

Moreover, the exchange is also accused of being linked to the project through its investment in Binance Labs. It is also blamed for the fact that the platform receives transaction fees on its products, regardless of the market direction, thus creating an interest in advertising them.

Of course, all these financial losses are to be deplored and the event is certainly a disaster. But it is also worth remembering that when it comes to investing, everyone is supposed to act according to their own conscience and be able to take responsibility for any losses.

Moreover, the vast majority of the ecosystem was caught off guard in this case and even the biggest platforms lost a lot. Binance’s investment in Terra, which was valued at $1.6 billion, has all but evaporated, as its CEO and founder, Changpeng Zhao (CZ), said on 17 May:

Poor again.https://t.co/88v2U2vjfM

– CZ Binance (@cz_binance) May 17, 2022

The case of the UST as an unregistered title

In addition to the marketing dimension, Binance.US is also accused of marketing unregistered financial securities to the American public. The group of plaintiffs claims that the platform is not in compliance with the Securities and Exchange Commission (SEC).

In the case of UST, reference is made to the Howey test, which would qualify it as a financial security. In short, to meet this test, a financial vehicle must for example:

- Request a cash investment;

- Allow for a possible profit;

- To represent an investment in a joint venture;

- Seeing one’s performance linked to the actions of others.

While the first two points are rather obvious, the other two need to be clarified. The character of investment in a joint venture is argued by the fact that Terra was financed by different investors. As mentioned in the blockchain whitepaper, the pooling of these funds was to allow the ecosystem to grow.

Furthermore, the performance of the UST or at least its pegging to the dollar was, according to the plaintiffs, dependent on Terraform Labs. Indeed, this is illustrated by the arbitration system set up for this purpose, inducing investors to participate in the process through a financial consideration. It is also explained that UST owners were entitled to expect shares from Terra to keep the share price from collapsing.

However, there is no guarantee that Binance.US and its CEO Brian Schroder are risking anything in this UST complaint. But it is interesting to note that in the wake of these events, various parties are looking for culprits to justify the losses incurred.

What is certain is that one way or another there will be legal consequences. Whether it be through the various regulatory processes or court decisions against certain players in the ecosystem.