Following a recent partnership between MakerDAO (MKR) and a US bank, we wanted to know more about institutional interest in decentralised finance (DeFi). In this exclusive interview with Sébastien Derivaux, in charge of “Asset-Liability Management” at MakerDAO, we review the protocol’s activities vis-à-vis traditional finance.

Institutions are coming to the MakerDAO protocol

Last July, MakerDAO took a big step towards the adoption of decentralised finance (DeFi) by institutions. The governance agreement to partner with Huntingdon Valley Bank (HVBank) effectively paved the way for an IDA 100 million loan from a regulated bank.

Last week, HVBank began releasing these funds, and the unprecedented nature of this case led us to want to know more about the relationship between MakerDAO and traditional finance. So we asked Sébastien Derivaux, who is in charge of the “Asset-Liability Management” of the protocol and whom we thank for his answers.

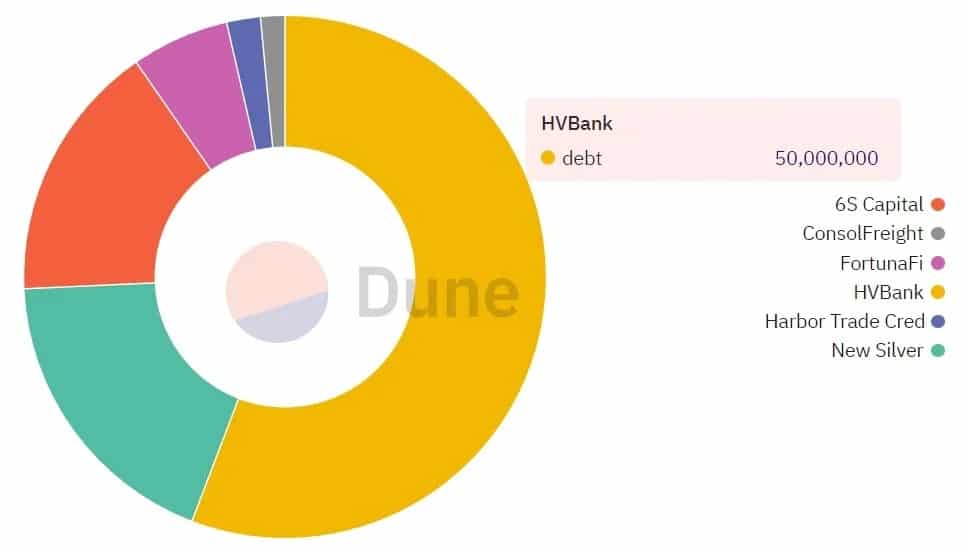

At the time of writing, HVBank has already borrowed AED 50 million. The graph below is actually the positions of Real World Asset (RWA) Foundation, a legal entity created in the Cayman Islands by MakerDAO to administer its real world assets:

Breakdown of RWA Foundation positions

Does HVBank keep some of the allocated funds to use on various DeFi applications? Are these funds exchanged into fiat via an OTC transaction?

” No, actually the MakerDAO loan is a participation in loans that HVBank makes. They are changed into fiat by Genesis upstream. HVBank gets dollars. “

Genesis Trading is indeed a specialised player in the OTC trading of digital assets, so there is no risk of moving the DAI price by trading them in large quantities for dollars. As mentioned, this liquidity, provided by MakerDAO, in effect grants rights to the claims that the bank makes on its own customers.

However, we could imagine a scenario where HVBank’s customers are not able to repay their debt. This would have a direct impact on the guarantees provided to MakerDAO for this loan:

How is a possible systemic risk addressed if the debt of HVB’s clients, used as counterparty, were to default?

There would be an impairment at MakerDAO, HVBank does not have to cover that risk. We have $80 million in capital to absorb losses. “

Of course, it should be understood that this loss would be charged to RWA and not to the community depositing their cryptocurrencies on MakerDAO. So there is no “Celsius-like” risk for example.

MakerDAO’s relationship with Société Générale

Has Maker been approached by other institutions for operations similar to the one carried out with HVBank?

“Yes, the most important one being Société Générale (via its subsidiary Forge), which is going to do a 20-30 million IAD against a native Ethereum bond secured by real estate loans in France. “

The bond in question is valued at $40 million and has the following ISIN code: FR0013510518. It is a so-called Housing Finance Bond (HFB) and is tokenized on the Ethereum blockchain (ETH). This OFH was issued on 14 May 2020.

This relationship between MakerDAO and the French bank had been initiated back in the autumn of 2021 and is set to become a reality in the coming days. Every business day, a trusted third party will be responsible for assessing whether the bond meets the collateral requirements. If it does not, SG-Forge will have five business days to provide additional collateral or face liquidation.

MakerDAO’s projects with institutional players

Do such transactions require MakerDAO to conduct compliance actions for Huntingdon Valley Bank in particular?

“The biggest thing is Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. There is not that much regulation for this operation. “

We also learn that MakerDAO hires the services of the legal consultancy Ogier, as well as the law firm Latham & Watkins. Indeed, such operations require some compliance with regulators.

Can we say that in a way, MakerDAO is turning towards traditional finance?

“These are really step-by-step advances towards finance on Ethereum. On this deal, we’re operating very off-chain, so it’s not at all what we want to do in 5-10 years. We’re taking it step by step. “

Are there any actions in place to encourage institutions to carry out this type of on-chain project? By extension, does MakerDAO carry out consultancy actions to support them?

Not at this stage, we are very reactive and not proactive. There’s so much to do already “

So, for the moment, the protocol is rather trying to respond to requests initiated by traditional financial players, without necessarily going after them on its own.

What is the state of mind of the institutions that MakerDAO deals with? Are they enthusiastic about the idea of exploring these new technologies or, on the contrary, rather wary?

“I think the majority of institutions are exploring the subject. They are all enthusiastic up to the highest level, but it’s quite slow, because they have to analyse everything carefully from a compliance and image risk point of view. The maintenance of the ICD peg is also a recurrent topic. We are not yet at the stage of industrial solutions, we are at the stage of craftsmanship where it is different each time. So it’s still quite slow. Step by step, we are accelerating.

So we are only at the beginning of this new finance. These different elements tend to show a complementarity between these two universes, rather than a dichotomy. Nevertheless, it is the stage of experimentation that is the order of the day, the interest of traditional finance in crypto-currencies is recent, and even more so for DeFi. Thus, it is gradually that such partnerships will develop in more detail.