The price of BTC is trading in an extremely tight range, with volatility at historic lows. While long-term investors are demonstrating unwavering patience, speculators are anticipating a resumption of the rally

BTC stagnation tests speculators’ patience

The price of BTC has been trading in an extremely tight range, fluctuating between $29,000 and $31,000 since the end of June.

Figure 1: BTC daily price

While long term investors (LTHs) have slowed their activity and refuse to take profits at such low prices, the majority of BTC moved since June is made up of coins less than 6 months old.

Short-term investors (STH) clearly represent a dominant share of BTC market activity and seem eager to start a new wave of spending.

By positioning themselves in this way, STHs are demonstrating their impatience with the monotony of the current market and adopting behaviour that is risky, to say the least.

Speculators anticipate a rise

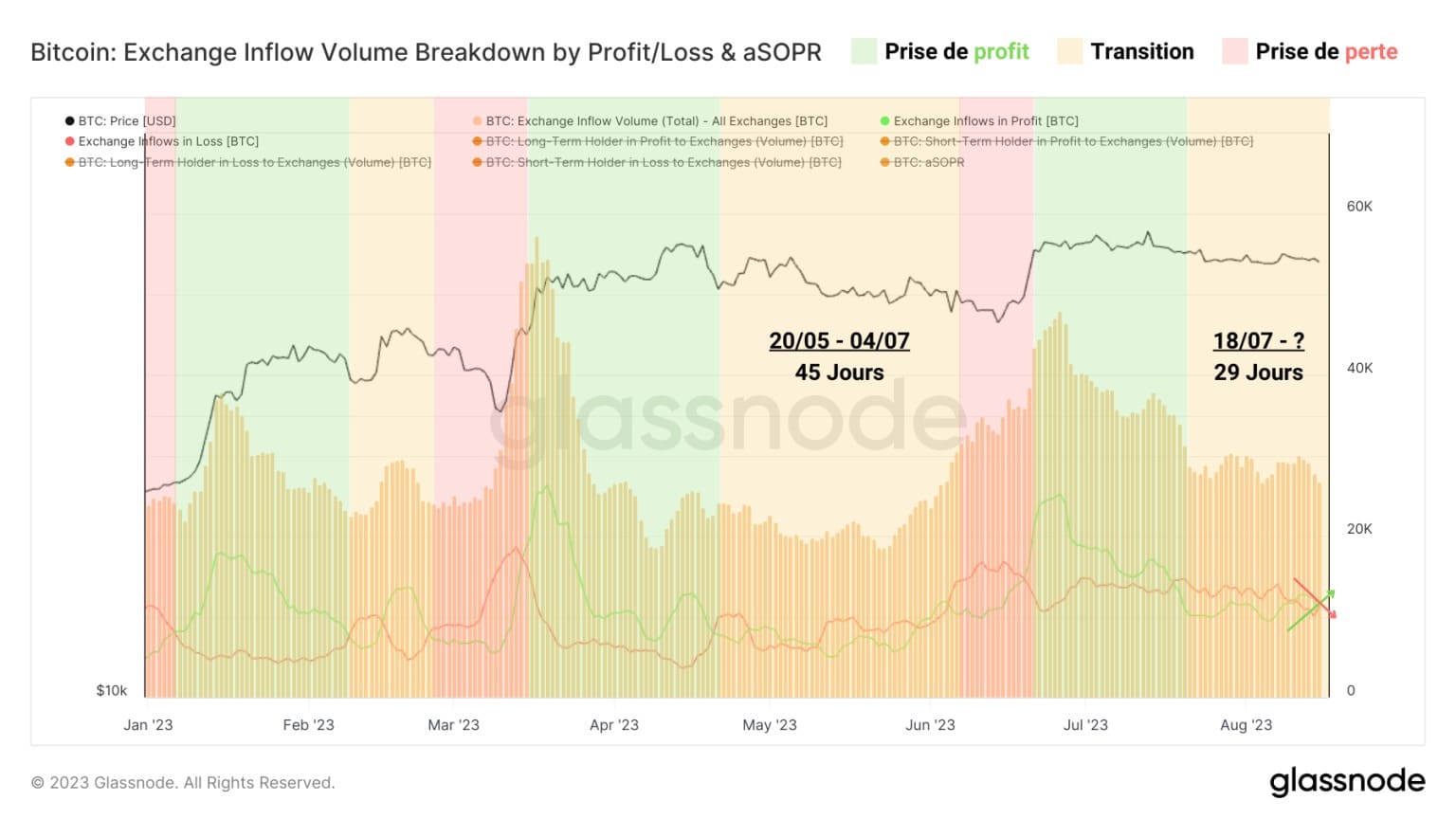

By observing the spending behaviour of participants via deposits made in profit or loss on exchanges, it appears that a transitional regime has been in place since the end of July.

Following a period of profit-taking in July, the selling pressure resulting from the gains made caused a slowdown in the price, leading to the monotonous phase we are currently experiencing.

In this context, neither buyers nor sellers are sufficiently dominant to encourage a palpable movement in the market.

Figure 2: Volume of deposits in profit/loss on exchanges

The current transition period has been underway for almost 29 days, which suggests that we could still experience a low-volatility environment for a fortnight at most, as we did when the price first climbed towards $30,000 last May.

Note, however, that profit deposits are up slightly this week, while loss deposits continue to fall, indicating that participants are not inclined to take losses.

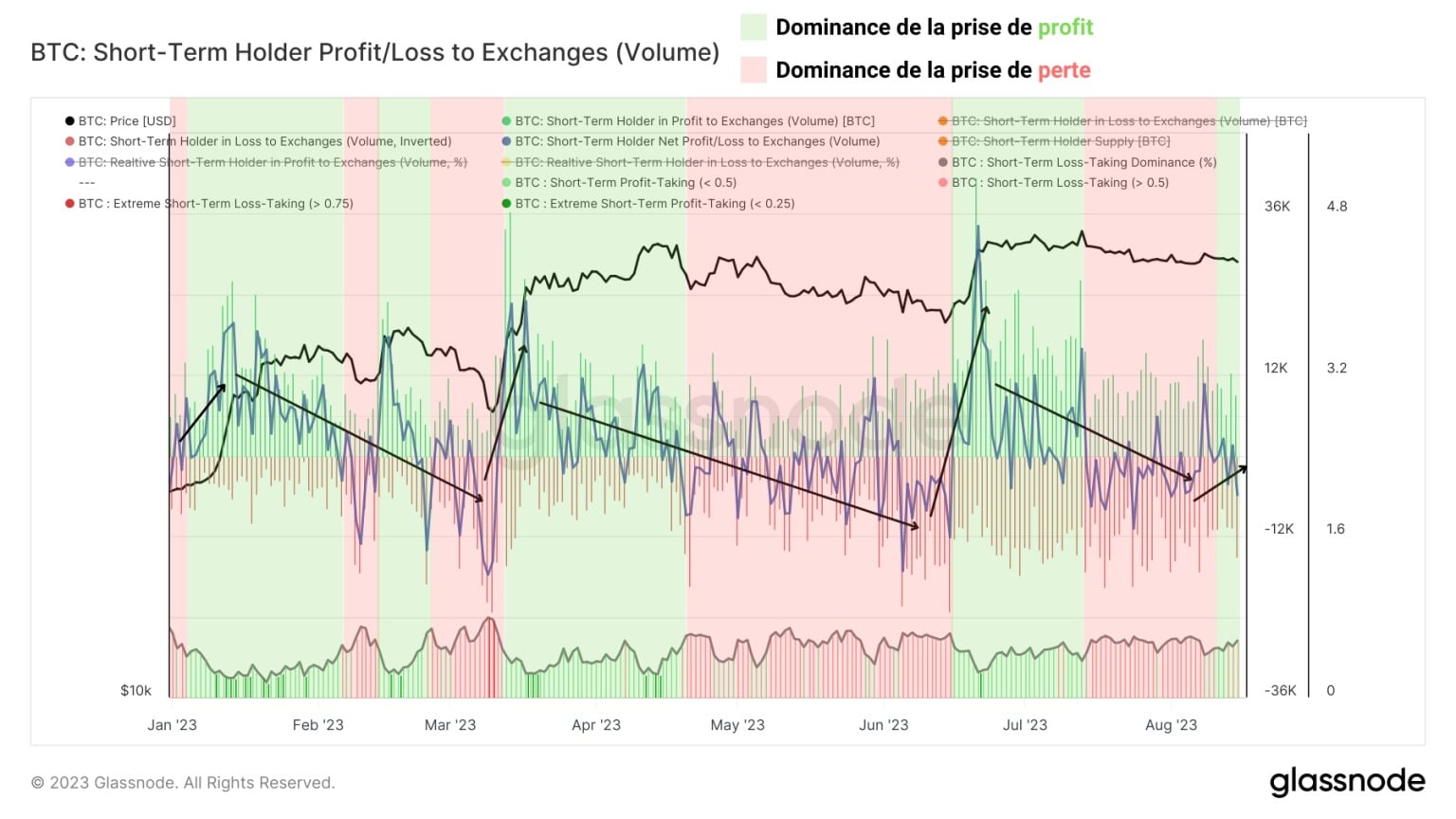

What’s more, we can see that short-term loss-taking behaviour is slowing down and seems to be reversing since the first week of August.

Indeed, analysis of STH profit/loss deposits to exchanges indicates that the dominance of loss deposits, which accompanied the price drift towards $29,000 in July, has recently receded.

Figure 3: Volume of net profit/loss deposits from STH to exchanges

A wave of BTC deposits in profit has begun, corroborating the deposit data discussed earlier. This suggests that short-term holders, the most active entities at the moment, are anticipating a potential rise in the price of BTC in the coming days.

Indeed, it is common to observe a dominance of deposit volumes in profit during the days preceding a rise in the BTC price as STHs anticipate periods of high volatility and stand ready to make gains once the rally has begun.

That said, this behaviour remains risky: even if the structure of the market favours a bullish bias, a correction below $29,000 is quite conceivable.

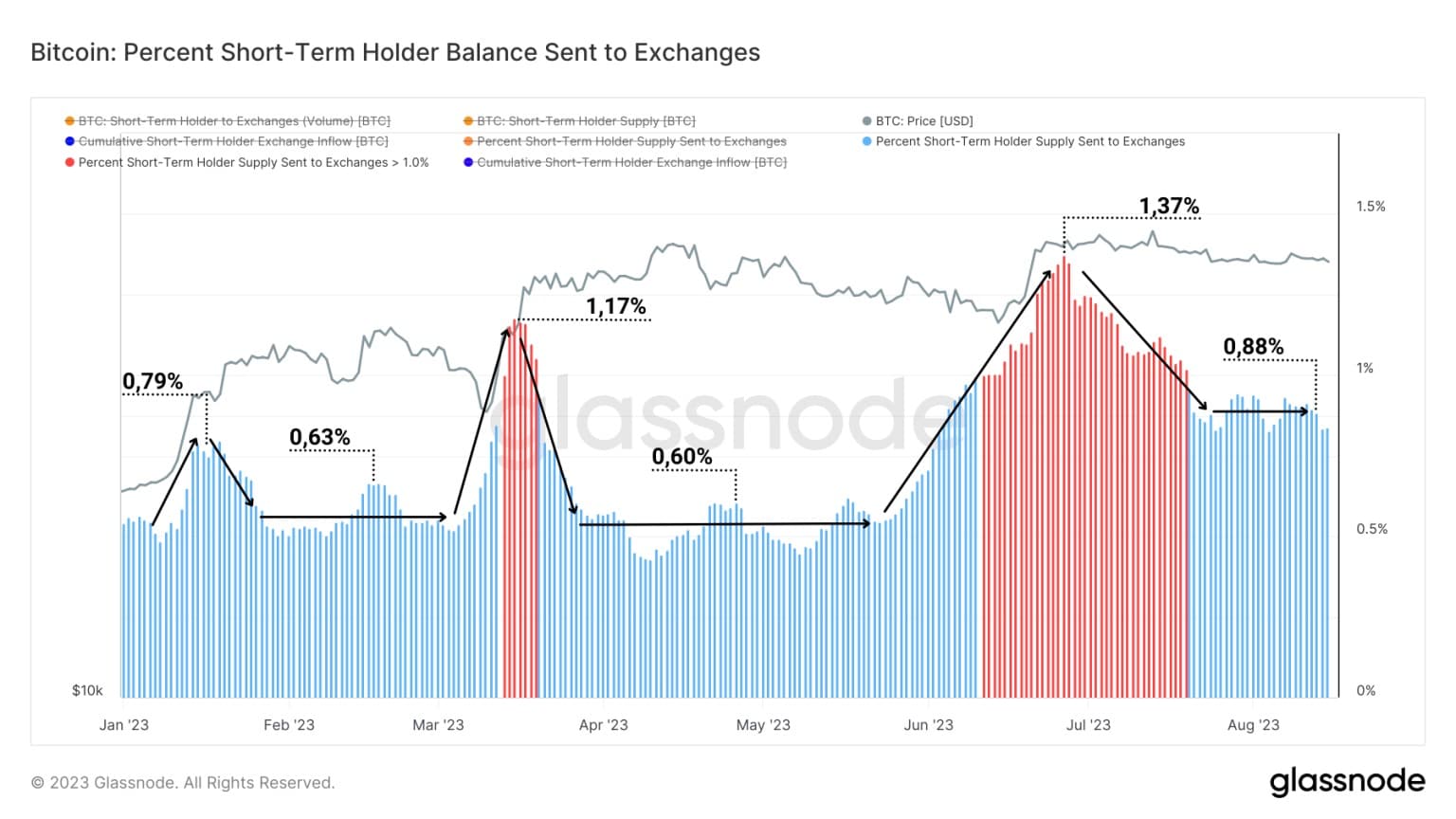

It is also important to note that, since the start of 2023, the rate of STH spending has been gradually increasing after each profit-taking episode.

Figure 4: STH spending rate on exchanges

These periods are generally marked by deposit volumes in excess of 1% of the total supply held by short-term holders (in red).

For example, the chart above shows that the two biggest short-term spending periods of 2023 occurred at the end of March (BTC rising towards $28,000) and the beginning of June (BTC rising towards $30,000).

Currently, the moderate rate of spending (0.88% per day) suggests that STH trading activity remains relatively sustained and that the low price volatility is failing to dampen their ardour.

Investors remain patient

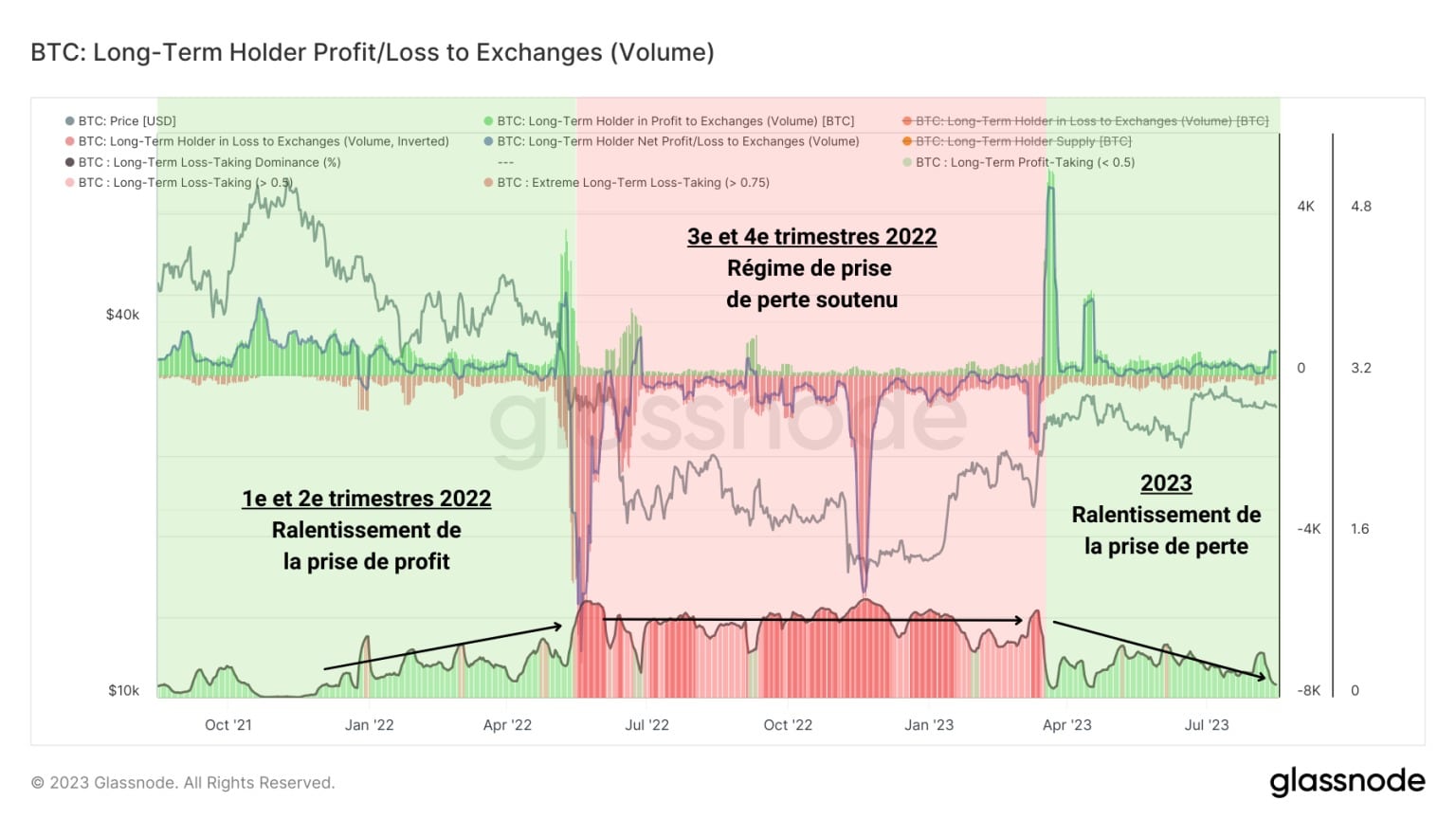

The study of LTH profit/loss deposits to exchanges suggests that the sustained loss-taking regime seen in the second half of 2022 is over.

While loss-making deposits have fallen sharply, loss-taking behaviour is reducing so that profits, though few in number, now dominate.

Figure 5: Volume of LTH net profit/loss deposits to exchanges

This suggests that long-term holders have emerged from a period of severe financial stress but have not yet begun the coordinated and prolonged profit-taking that characterises long-term bull markets.

Although they are in a favourable situation for taking profits, it seems that long-term investors are not inclined to spend their BTC at such low prices.

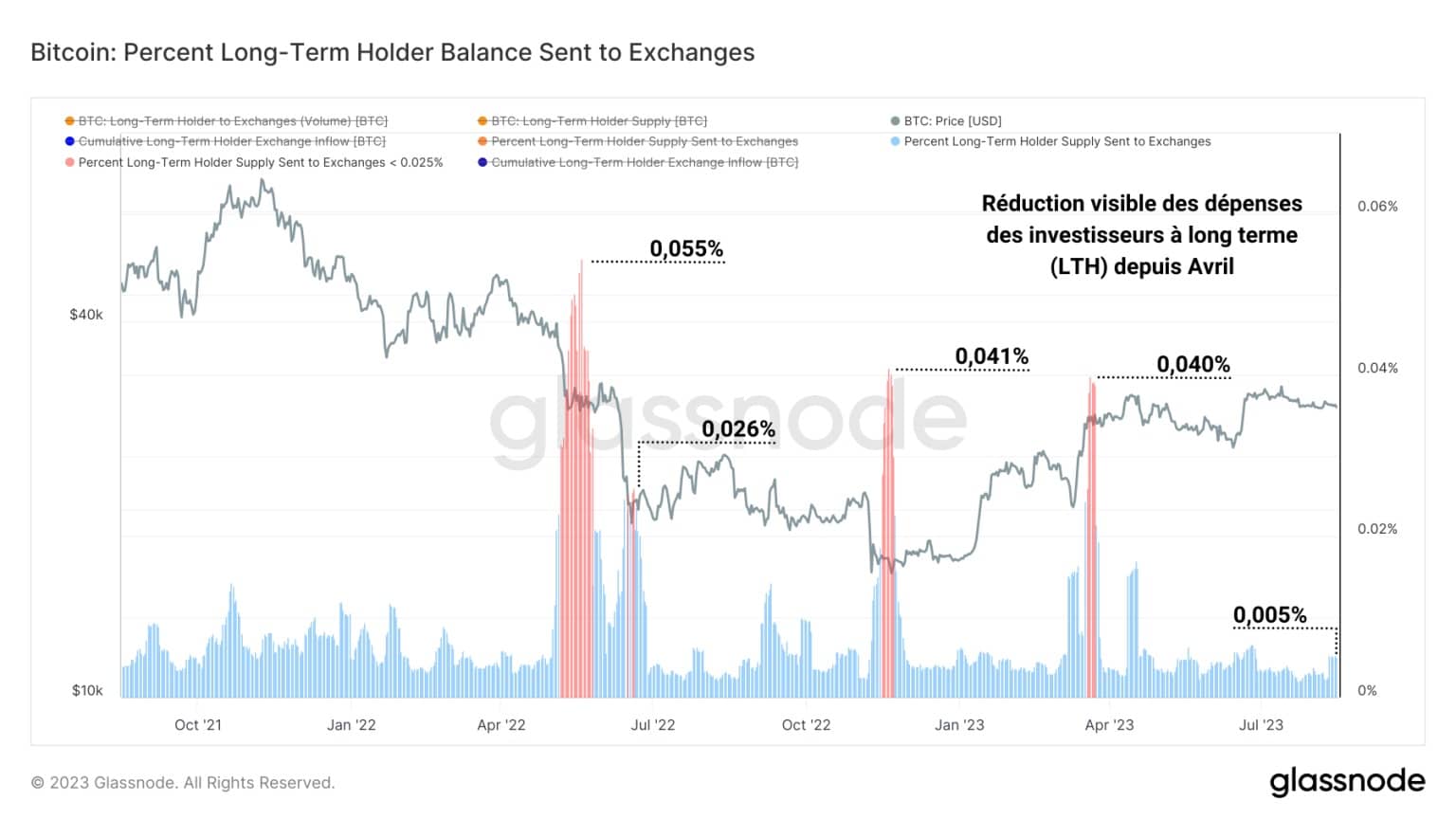

Indeed, in addition to visible profit-taking in May, the LTH spending rate is particularly low, suggesting that current price levels are not sufficient to encourage massive profit-taking.

Figure 6: LTH spending rate on exchanges

The graph above shows that the behaviour favoured by long-term investors since 2022 is accumulation and saving, as the cohort’s spending rate rarely exceeds 0.025%.

Despite a substantial latent return for the oldest HODLers, seasoned investors understand that the price of BTC is still a long way from its ATH and that very interesting selling opportunities will open up for the most patient.

With the market right on the long-term bull/bear pivot point, it’s too early to expect coordinated profit-taking from this cohort.

Summary of this on-chain analysis of Bitcoin

This week’s data shows that the $30,000 resistance represents the long-term bull/bear pivot, the break of which would indicate confirmation of a strong bullish bias.

Trading activity by short-term investors (STH) remains relatively brisk, and the low volatility of the price is failing to dampen their ardour.

Their behaviour suggests that they are anticipating a rise in the price of BTC in the days ahead, in reaction to their average cost base of just under $29,000.

Although they find themselves in a favourable situation for making profits, long-term investors (LTH) do not seem inclined to spend their BTC at such low prices and are awaiting confirmation of the market’s decision.

Their absence in the face of a market that is too immature leaves the way clear for STHs, who are already poised to make gains even though nothing is certain at the moment.