In recent months, the US economy has been a source of growing concern, particularly because of the risk of bank failures, debt defaults and de-dollarisation, which could affect the dollar’s status as the world’s reserve currency. Against this backdrop, can assets such as gold and Bitcoin act as safe havens and offer effective protection?

Years of accommodative monetary policy

In order to control inflation, the US Federal Reserve (Fed) has been tightening monetary policy since March 2022, raising interest rates and reducing its balance sheet.

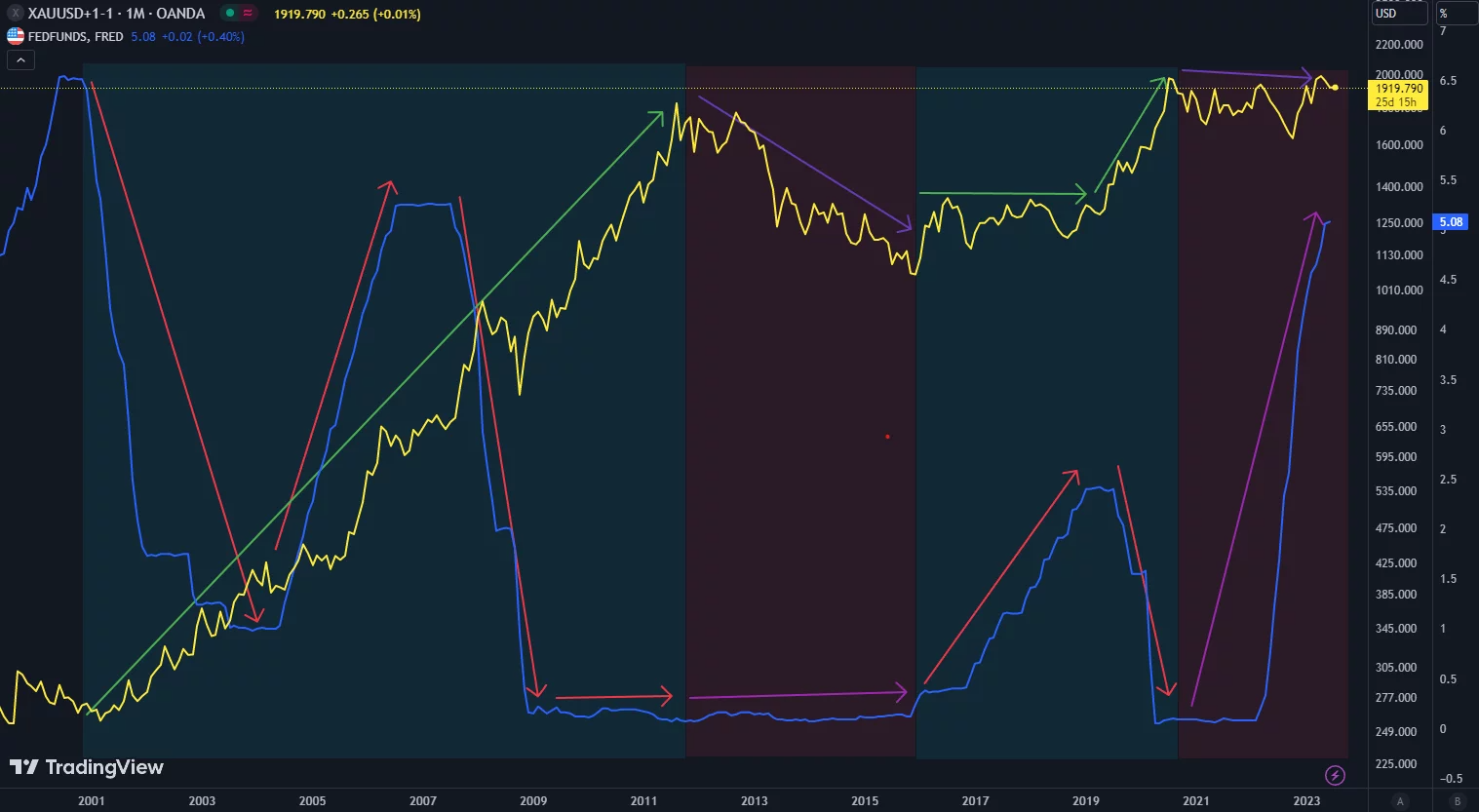

It is tempting to think that the price of an ounce of gold rises under accommodative monetary policies and falls under restrictive monetary policies. But the chart below shows that the price of gold (in yellow) is not strictly linked to fluctuations in interest rates (in blue). In fact, what attracts investors to gold is people’s uncertainty about the markets.

The price of an ounce of gold compared with US Federal Reserve (Fed) interest rates

For example, during the Covid-19 crisis, the uncertainty of economic developments led investors to protect themselves with gold. The price of an ounce of gold rose from $1500 in March to $2075 in August, then stabilised when the first vaccines were announced, reassuring investors.

Today, monetary tightening could have unpredictable consequences for the economy. This is the first time that interest rates have risen so quickly after such a long period of low rates. This uncertainty linked to the recent bank failures has created greater demand for the yellow metal, the price of which rose by more than 11% between March and May this year.

Faced with a succession of bank failures in 2023, the Fed announced that it would guarantee the deposits of customers of the affected banks, signalling a shift towards a more flexible monetary policy. This has also boosted the price of Bitcoin (BTC), which has risen by 60% since last March.

A few weeks ago, the US government had to raise its debt ceiling to avoid bankruptcy. But what if this ceiling could no longer be raised? Is that even possible?

Luke Gromen, founder of the macro-economic research firm Forest for the Trees, said in an interview with Blockworks: “Obviously, the US government is not going to go bankrupt,” he added, “The Fed will print the difference”. In his view, the US is already at the limit of its ability to repay its debt: “We were there in 2020. We were there in 2021”, and “We’re still there”.

It’s hard to predict the future, but Bitcoin and gold are often considered to be the most anti-fragile securities on the markets, and will be coveted by investors because of the uncertainties mentioned above.

Have gold and Bitcoin already won?

Although the US dollar has strengthened against other currencies in recent months, this move could be challenged by monetary policy easing. A pivot by the Fed would make the dollar less attractive, in favour of the safe havens of gold and Bitcoin.

A few days ago, the CEO of asset manager BlackRock, Larry Fink, confirmed his interest in Bitcoin, saying: “I think the role of cryptos is to digitise gold in different ways”.

What’s more, in recent years and especially in recent months, there has been a trend towards de-dollarisation. Indeed, more and more states such as Brazil, China, Russia and Iran are taking sides.

The BRICS and Zimbabwe are even about to create a gold-backed currency to move away from the US dollar in their international trade.

Like these emerging powers, investing in gold and Bitcoin can be a good protection against the consequences of de-dollarisation.

Of all the ways of gaining exposure to gold, physically holding gold remains the safest method, whether by keeping it yourself or entrusting it to a third party such as GOLD AVENUE. Exclusively for TCN readers, take advantage of a €50 discount on all orders over €500 at GOLD AVENUE (one-off offer limited to 500 new customers available until 31 December 2023).

Gold and Bitcoin stand the test of time

Gold, often criticised as obsolete since the end of the convertibility of the US dollar into gold in 1971, has continued to prove its value. Despite numerous declarations announcing its ‘death’ and designating it as ‘has-been’, the price of gold has continued to rise, demonstrating its resilience in the face of every economic and geopolitical crisis that has arisen since then. Indeed, gold has always demonstrated its strengths, making it a solid store of value over time.

Moreover, thanks to its divisibility and portability, Bitcoin has greater potential to become a currency in its own right, unlike gold, which is often used as a benchmark for other currencies.

Finally, as safe havens, investing in gold and Bitcoin could offer excellent protection against future economic and monetary uncertainties.