Decentralised finance protocol Aave has taken another major step forward by officially rolling out its decentralised stablecoin GHO, following an overwhelming vote of support from its community. From now on, users can mint GHO by depositing cryptocurrencies as collateral on Aave.

Aave rolls out its GHO stablecoin

Decentralised finance protocol Aave has made official the launch of its decentralised stablecoin GHO following an overwhelming vote in favour from its community. As stated in Aave’s press release, GHO (pronounced GO) can be minted by users when they deposit cryptocurrencies as collateral on the protocol.

The Aave DAO has successfully launched @GHOAave on the Ethereum Mainnet. Congrats to the Aave community on this historic moment! pic.twitter.com/Br3QGqMU8X

– Aave (@AaveAave) July 15, 2023

Like Aave, the GHO stablecoin was designed to be totally decentralised, which is why its creation, deployment and future are entirely managed by the protocol’s decentralised autonomous organisation (DAO). As a result, any changes implemented on the GHO will have to be voted on within the DAO, which will determine whether a particular proposal should be accepted, rejected or even refused.

The GHO was deployed today on the Aave V3 market with a maximum issue set at USD 100 million, a ceiling that can subsequently be modified via the DAO system just mentioned. In addition, AAVE token holders will be able to benefit from a 30% discount on the GHO borrowing rate if they decide to deposit their tokens as collateral, ensuring a virtuous circle for the protocol.

“As Aave’s native decentralised and over-collateralised asset, GHO has the potential to become a leading stablecoin and, in the future, an important payment layer for the internet. “

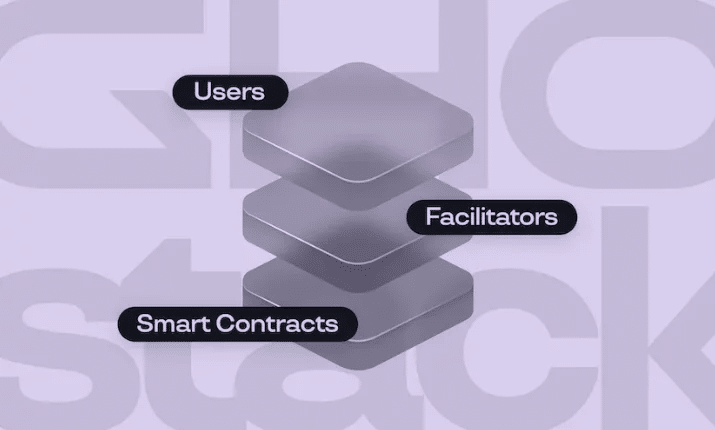

The GHO will be introduced through “facilitators”, entities hand-picked by the Aave DAO, who will have reserves of GHO (called “buckets”). To begin with, GHO will be distributed through the Ethereum V3 Pool and FlashMinter Facilitator.

As its name suggests, the first is based on the liquidity pool of the Aave V3 market on Ethereum (ETH). FlashMinter uses flash loans to provide instant liquidity.

This step forward by Aave demonstrates the interest shown by DeFi platforms in the creation of dedicated decentralised stablecoins, with Curve having deployed its own (crvUSD) last May.