The cryptocurrency market generally benefited from the momentum generated by Ripple’s lawsuit against the Securities and Exchange Commission (SEC), but it was short-lived. Indeed, the fall in Bitcoin (BTC), XRP and all the altcoins in general was just as rapid, with more than $180 million liquidated in the last 24 hours.

Crypto market shaken by announcements

Ripple’s (XRP) recent victory in its long-running case against the US Securities and Exchange Commission (SEC) briefly boosted the market. While the main focus of the case is to determine whether XRP is a security or not, the judge ruled on Thursday that XRP should not be considered as such on the secondary market.

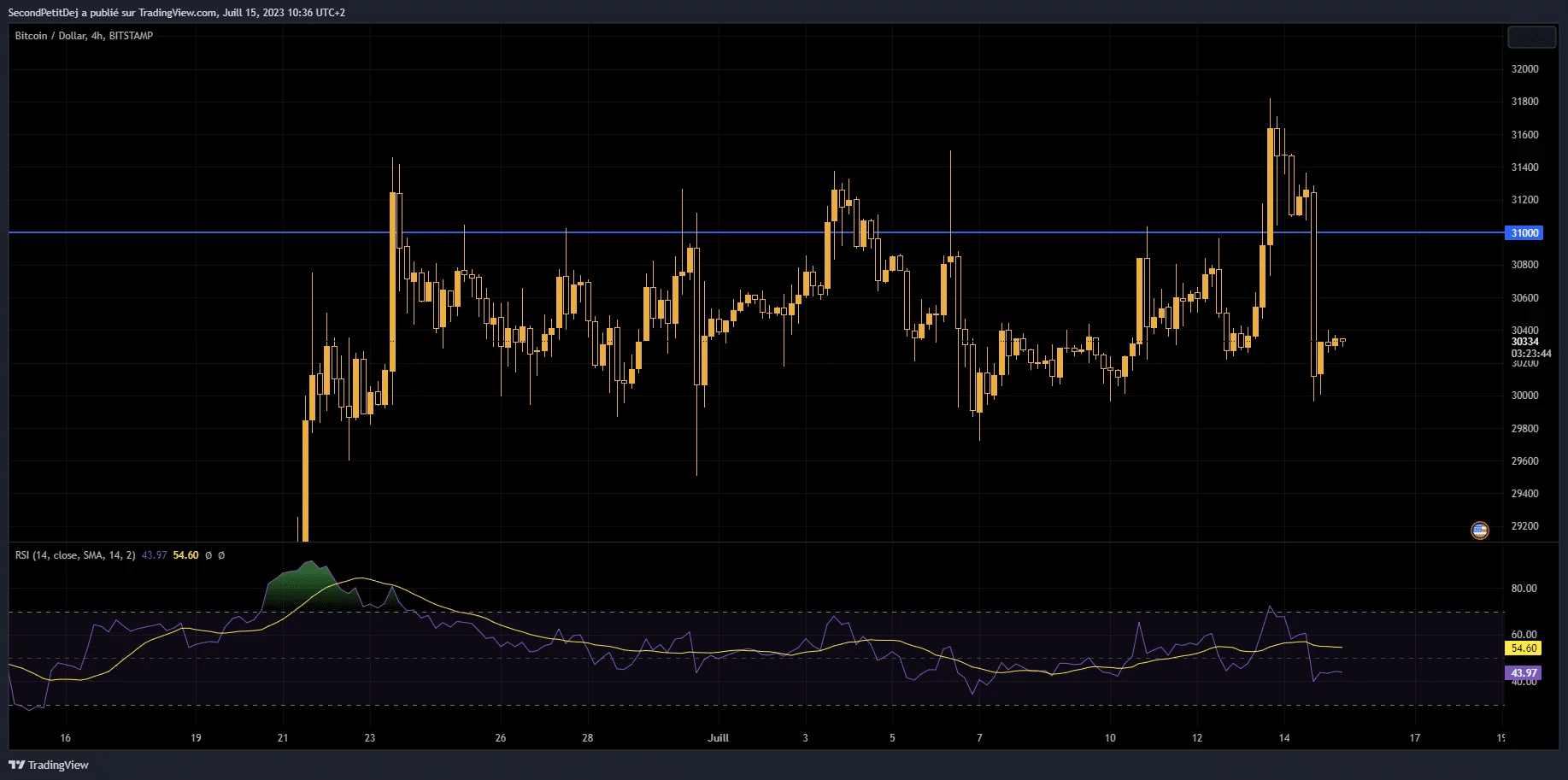

The market quickly got into a frenzy, and the Kraken and Coinbase platforms even decided to re-list Ripple’s XRP in order to make it available for trading. Over the course of the day, Bitcoin (BTC) reached $31,800 and the XRP briefly exceeded $0.93, a point it had not touched since December 2021.

For its part, the price of Ether (ETH) broke through the $2,000 barrier, something it had not done since last May.

However, the rise was only temporary, and the market quickly corrected itself: BTC fell back below $30,000 yesterday, Friday 14 July, and XRP lost 30% in the process, dropping below $0.67.

Figure 1 – BTC price evolution in h4

As a result of sudden market movements, the rise in the XRP triggered a surge in liquidation of short positions on 13 July. Following yesterday’s correction, we can see that more than $180 million has been liquidated in the last 24 hours, mainly on long positions.

Figure 2 – Liquidations observed on the crypto market over 48 hours

XRP’s market capitalisation naturally swelled following the announcement, to the point of pushing Ripple’s cryptocurrency ahead of Binance’s BNB in the top 10 most capitalised cryptos. However, the trend was reversed again yesterday, although the 2 assets are still neck and neck.

Moreover, Bitcoin’s dominance has fallen below the symbolic 50% threshold, whereas the king of cryptocurrencies had surpassed this mark on 20 June on a sustained basis.

All in all, the cryptocurrency market seems to be struggling to maintain a sustained uptrend, despite a string of positive announcements of late, from Bitcoin cash ETFs, recent statements by BlackRock CEO Larry Fink, the new Ripple entourage and, more generally, institutional adoption.