In a survey published this week, Chainalysis shows how volumes generated by decentralised exchange protocols (DEX) have surpassed those of centralised platforms (CEX).

Chainalysis compares volumes between CEX and DEX

This week, Chainalysis published a survey, in which it compares the volumes of centralized cryptocurrency exchange platforms (CEX), to those of decentralized exchanges (DEX). The survey shows that DEXs have become a dominant part of the blockchain ecosystem over the past two years.

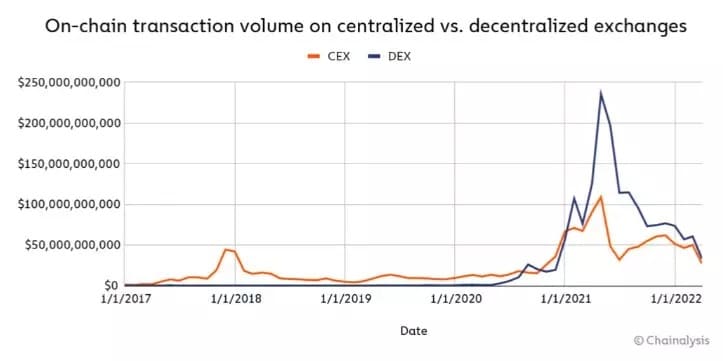

Figure 1: Evolution of the volume generated by DEX and CEX

Figure 1 shows the volume of transactions that DEXs and CEXs have generated over the last 5 years. Since the emergence of decentralised exchanges, with Uniswap (UNI) as the first massively adopted protocol, there has been an explosion in their use.

Exchanges in decentralised finance (DeFi) have even surpassed CEX by far in 2021. At the height of the bull run, there was a peak of almost $250 billion in volumes for the former, compared to just over $100 billion for the latter.

In a second step, Chainalysis studies the volume split of these two players, on on-chain transactions.

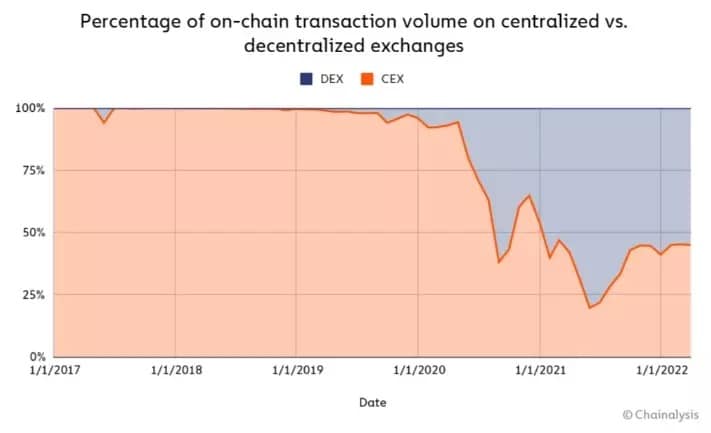

Figure 2 – Share of on-chain transactions between CEX and DEX

Here again, the observation is clear: although the fall in prices is tending to restore a certain balance, decentralised platforms have managed to capture a significant share of the market, sometimes even more than 75%.

However, the notion of on-chain transactions is important in this study. Centralized platforms use the order book to enable person-to-person trading. This means that we have accounting that takes place outside the blockchain, and therefore is not included in the results of the study.

The reasons for these differences

The first reason for the explosion in the use of DEX in recent years is that they didn’t exist before. Or at least, no platform was able to break through before Uniswap came along.

But the fundamental need, which has enabled the emergence of such protocols, is this notion of full ownership of one’s digital assets. This is not really the case with CEX, because of its custodial and centralised nature. Thus, a large part of the community prefers to carry out the custody of its cryptocurrencies itself.

Another area to consider is transaction fees. While when trading on Binance for example, these fees will largely accrue to the platform, and possibly to the person whose affiliate link was followed, this is not the case in DeFi.

This is not the case in DeFi. DEXs do not operate with an order book, but with liquidity pools, fed by community investors making their assets available. In exchange, they receive a share of the transaction fees proportional to their investment, which allows them to generate a return.

Chainalysis estimates that this type of revenue, capturing between 0.05% and 0.3% of the amount of capital traded, ranges from $50 million to $150 million per month for liquidity providers. This metric is calculated over a two-year period, looking at data from the 5 largest DEXs:

- Uniswap (UNI) ;

- Sushiswap (SUSHI);

- Curve (CRV);

- 0x Protocol (ZRX);

- dYdX.

Finally, it should also be noted that decentralised platforms generally offer a greater diversity of assets, where CEXs do not always list them.

Is the trend sustainable?

As Figures 1 and 2 show, the market share split between the two types of platforms has tended to even out in recent months. This can be partly attributed to the market situation, which sees on-chain activity slowing down.

It should also be remembered that Chainalysis’ analysis does not take into account the share of CEX volumes taking place outside of the blockchain, which effectively obscures part of the information.

In any case, while it is certain that these two economic models will coexist in the future, the dominance of DEX is not a given. Indeed, regulation is gradually interfering in the industry, and non-custodial addresses are regularly unfairly singled out.

Moreover, the arrival of new users in the ecosystem takes place essentially through centralised platforms. So, in view of all this, it will be interesting to compare all this data again in the years to come.