Is Bitcoin (BTC) mining too concentrated around a handful of players? Yes, according to several analysts, who note that the majority of hashrate now originates from two major pools. What risks might this represent?

Is Bitcoin (BTC) mining too concentrated?

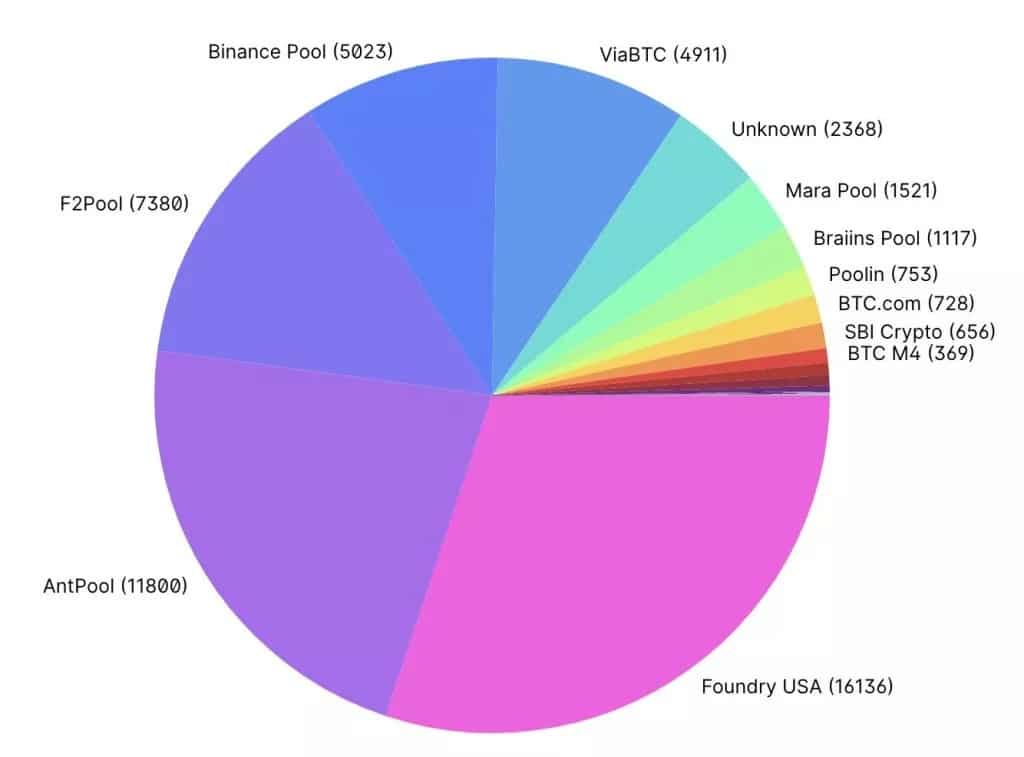

Analyst Chris Blec published a short report this week, showing how the Bitcoin network hashrate is controlled. At present, it is concentrated around two major mining pools: Foundry USA and Antpool, which gather more than half of the hashrate. 3 other major players share more than a quarter of the hashrate: F2Pool, Binance Pool, as well as viaBTC :

Bitcoin hashrate distribution by mining pool

As a reminder, mining pools have gradually become the norm on the Bitcoin network, as it has evolved. As the power required to create a block is now too high to mine solo, players join mining “pools”, which allow resources to be pooled.

Too much concentration

The first risk associated with this is, of course, that of concentration. If two entities control more than half of the power used to mine Bitcoin, this means that a flaw in one of them will profoundly affect the network. Moreover, as these entities are centralized, they have de facto power over the cryptocurrency. In 2020, a mining pool created controversy when it began to stop processing transactions from blacklisted wallets.

For many, this gives entities a very significant power of censorship, whereas the Bitcoin network was precisely created to be incensurable. It’s likely that Satoshi Nakamoto didn’t imagine at the time of his creation that the network would grow to such a scale, and that individual miners would gradually be sidelined.

The risk associated with governments and regulations

The second major risk, according to Chris Blec, is that associated with governments. Foundry USA and AntPool are regulated entities. As such, they are subject to the regulations, controls and demands of the government to which they belong.

“The government has identification, visibility and control over more than 50% of Bitcoin miners (per hashrate). “

According to the analyst, this in itself influences the decentralization of the network, and above all subjects it to the demands of governments, the opposite of the reason it was created in the first place. What’s more, these two major mining pools implement “KYC”, i.e. identity verification. Users are therefore identified, and a great deal of personal data is collected. According to Chris Blec, all this raises questions:

“The Bitcoin community needs to discuss this urgently. “

A network that was created this way

As several commentators have pointed out, however, the problem lies in the very way Bitcoin is constructed. The “big entities” are rewarded more, and as the network grows, it naturally centralizes around those with the power to keep producing blocks.

The advantage of Bitcoin, however, is that it is a particularly resilient and adaptable payment network. We’ve already seen this with the ban on mining by China, which until then had produced the most hashrate in the world. Cryptocurrencies – and miners – have been able to adapt and find new territories.

However, the question remains: can the Bitcoin network grow to the scale hoped for by its advocates, and maintain its ideals of decentralization? Within the ecosystem, the subject has long been a matter of debate.