We learn from a court document filed on 20 January in a New York court that US federal authorities have seized $700 million in assets belonging to Sam Bankman-Fried. These include 56 million shares of Robinhood stock, cash and accounts held at Binance.

SBF’s assets seized by US courts

According to information revealed by

CNBC reports that U.S. federal prosecutors have seized about $700 million worth of assets belonging to Sam Bankman-Fried, the former CEO of bankrupt exchange FTX.

According to publicly available documents filed in the US District Court for the Southern District of New York, the majority of the funds involved here are believed to be in the form of Robinhood shares. These are at the heart of a dispute between SBF and cryptocurrency lender BlockFi as well as the new management of FTX.

These entities are all claiming ownership of the 56 million or so shares that were previously warehoused at broker EDF Capital Markets. At the current price of HOOD stock, the total value of the haul collected by federal prosecutors in this regard is approximately $533 million.

The US justice system supported the seizure of the assets, alleging that the shares were obtained with funds stolen from the exchange’s customers. Sam Bankman-Fried, who has pleaded not guilty to all eight counts against him, denies using customer funds for illegal purposes.

Other assets seized here and there

According to the January 20 filing, a number of other assets may have been seized. The nearly $700 million seized here is scattered in the form of cryptocurrencies, cash and stocks.

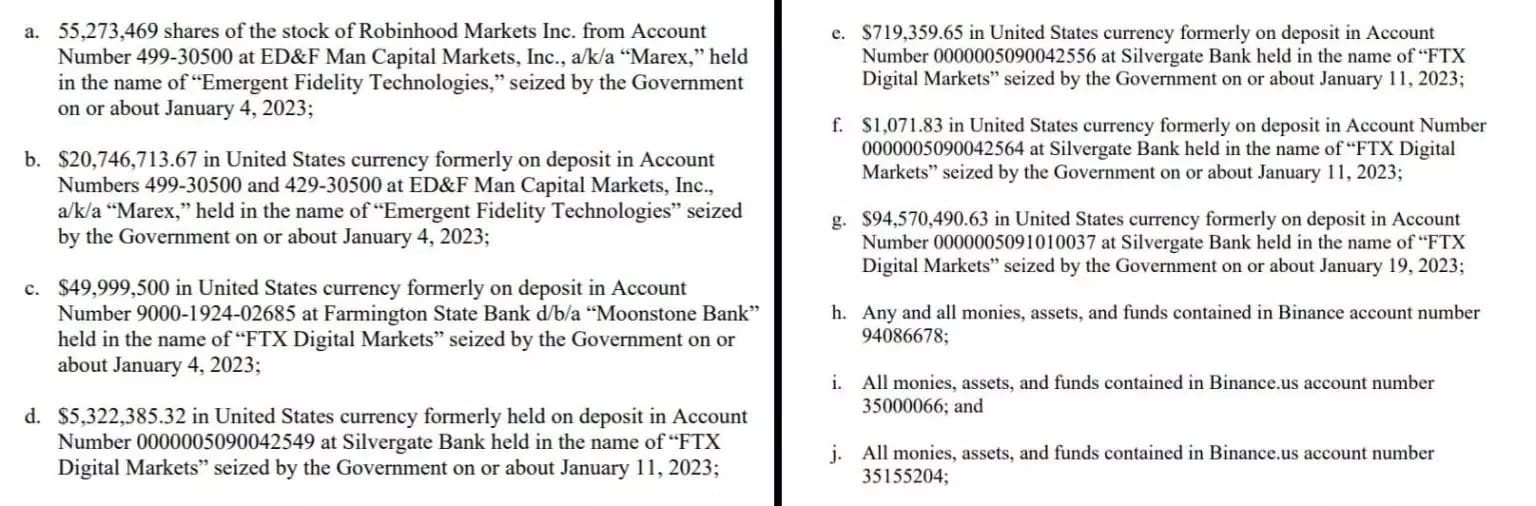

As we can see in paragraph b, more than $20 million was seized from the broker ED&F Capital Markets under the name Emergent Fidelity Technologies, a Antiguan company majority owned by SBF, which also owned the Robinhood shares listed above.

USD 50 million was seized from an account in the name of FTX Digital Markets, a Bahamian subsidiary of FTX, at Moonstone Bank.

Moonstone Bank may have had a close relationship with the empire built by Sam Bankman-Fried, having received approximately $11.5 million from Alameda Resarch in January 2022. However, it very recently issued a statement saying it was leaving the crypto space following the collapse of FTX.

Preview of court document regarding the seizure of Sam Bankman-Fried’s assets

In addition, approximately $100 million has been seized from various accounts belonging to FTX Digital Markets in the vaults of Silvergate Bank. This crypto-bank has actually been very affected by the FTX collapse, as it recently revealed a net loss of $1 billion for the last quarter of 2022.

3 accounts hosted on the cryptocurrency exchange platform Binance have also been seized by the judiciary, but the amounts held there have not been revealed in the document.