On the eve of The Merge, capital is flowing into ether (ETH) and giving way to heavy speculation by participants in the short and medium term. The scale of speculation underway in the ETH futures and options markets is taking on unprecedented dimensions. On-chain analysis of the situation

The Merge brings Ethereum to the forefront

On the eve of The Merge, the crypto-sphere has its eyes on Ethereum and its token Ether (ETH).

After surging more than 50% in July, ETH’s price performance, as well as its fundamental advances, has led some participants to get their hopes up for its future price action.

Figure 1: ETH daily price

Attracting investors of all kinds, the ETH is currently the subject of much speculation, which is the focus of this week’s analysis. In doing so, today we will examine the extent of the speculation taking place in the ETH futures and options markets.

Capital is flowing into the ETH

Whatever the Merge causes, there is a dynamic transfer of capital from BTC to ETH. Indeed, by measuring the relative share of market capitalisations of the two leading crypto-currencies, it is possible to identify clear periods of dominance.

Thus, the following chart highlights the periods of dominance of BTC in orange and ETH in blue. What stands out in this chart is that following a period of capital inflow from ETH to BTC from January to June 2022, this trend was reversed in July 2022.

Figure 2: Market cap dominance of BTC and ETH

As the Merge approaches, investors have turned around and are allocating capital to ETH at the expense of BTC.

This resumption of ETH dominance signals a strong appetite for risk and volatility among participants, despite the fact that the bear market is in full swing.

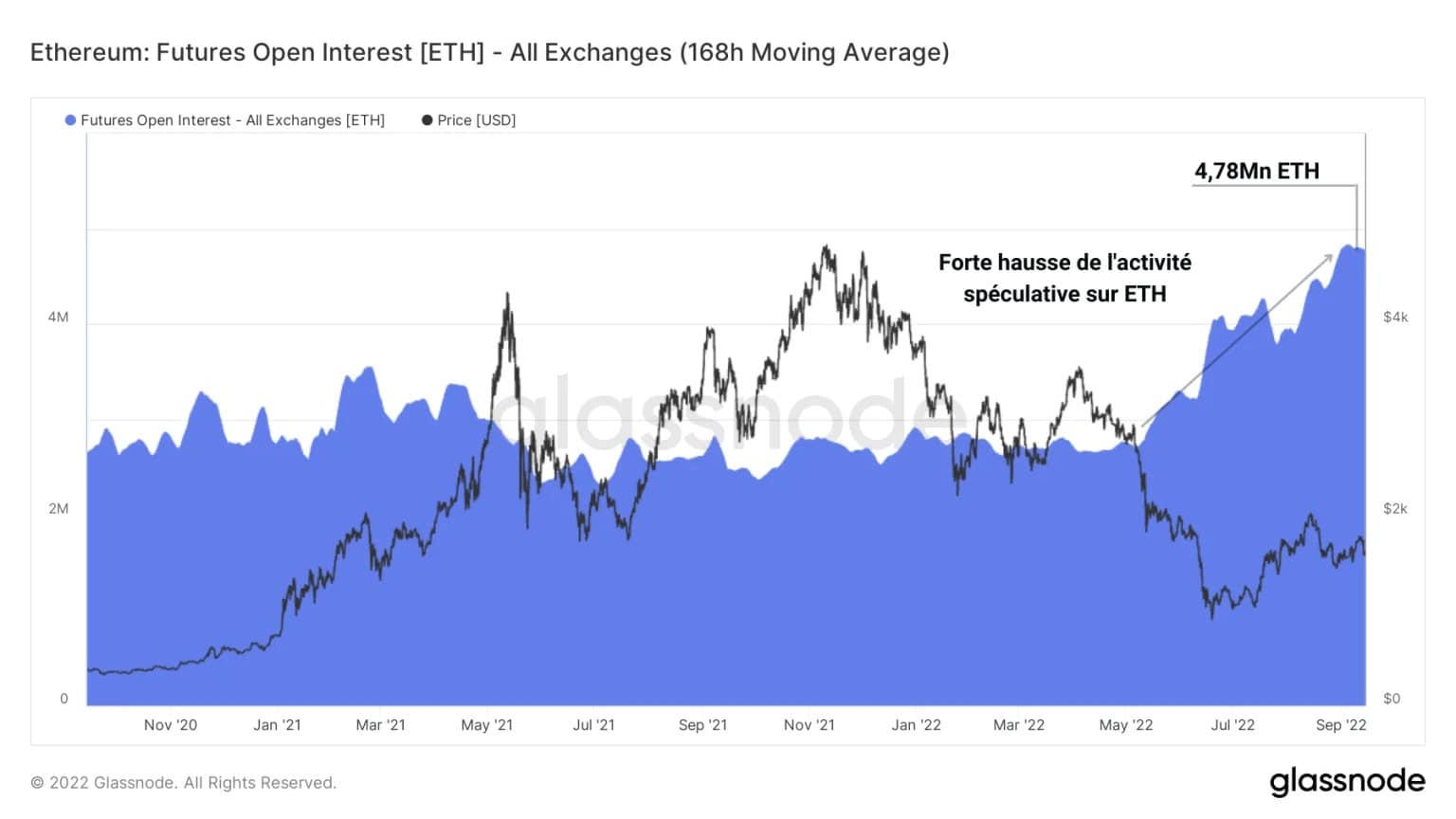

Indeed, if we look at the total funds allocated to futures contracts (called Open Interest or “OI”), denominated in ETH, this behaviour is easily identifiable.

Figure 3: Open Interest of futures contracts for ETH

Growing from 2.9 million ETH to 4.7 million ETH in nearly 6 months, the rise in OI indicates strong speculative interest in the Ether price by participants.

Furthermore, the fact that many participants use their own ETH as collateral indicates that they are willing to take on a high level of risk, as their position can be damaged by the loss of value of their collateral if the ETH price falls.

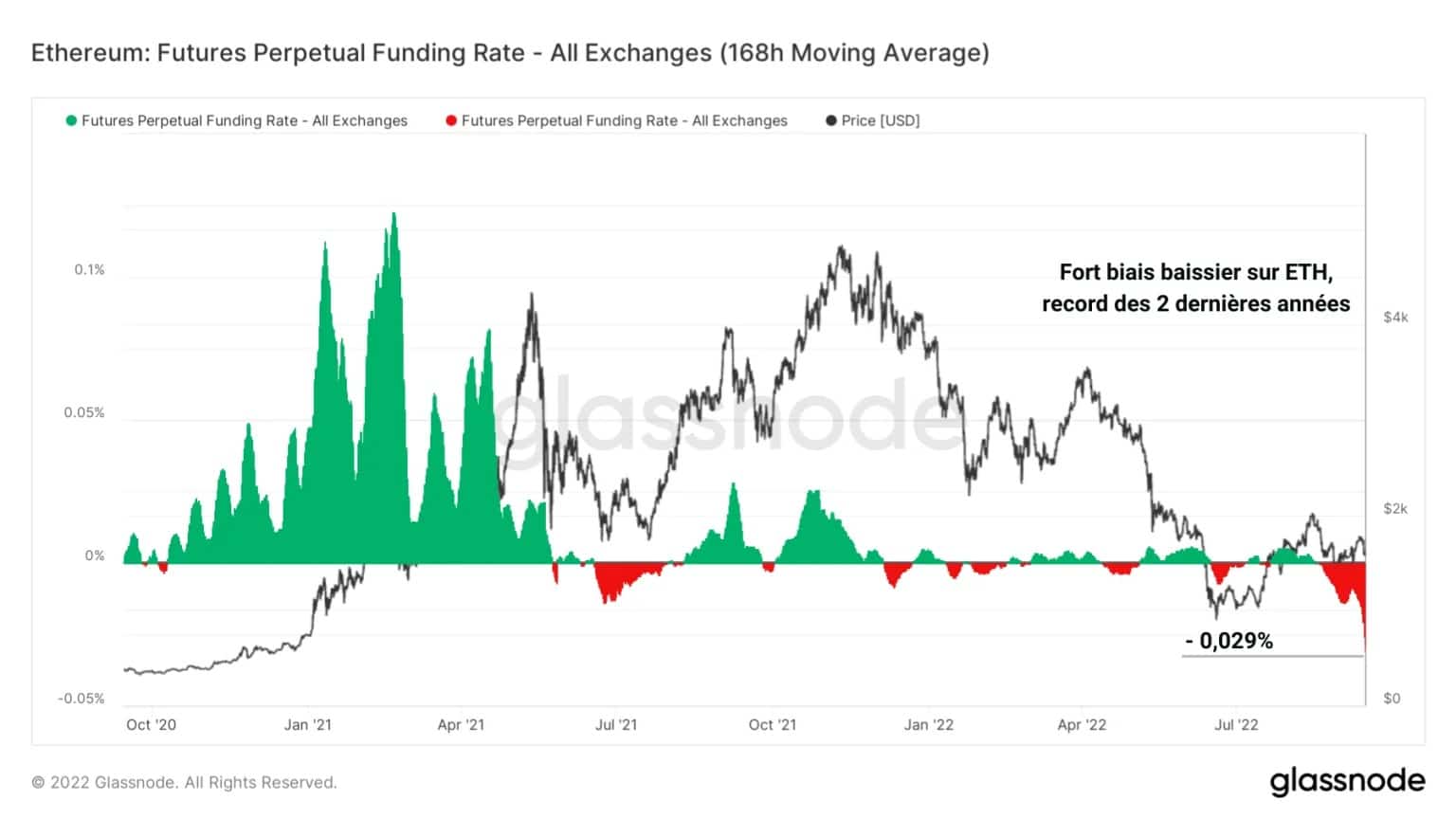

Secondly, if we refer to the financing rate of perpetual contracts, it seems that the dominant bias in this type of derivative market is clearly bearish.

Figure 4: Perpetual contract financing rate for ETH

Recording a value of -0.029%, such a taste for short selling has not been seen since the May 2022 price capitulation.

So it seems that many speculators are betting on ETH’s short-term decline following the Merge on futures and perpetual platforms.

Strong optimism in call/put options

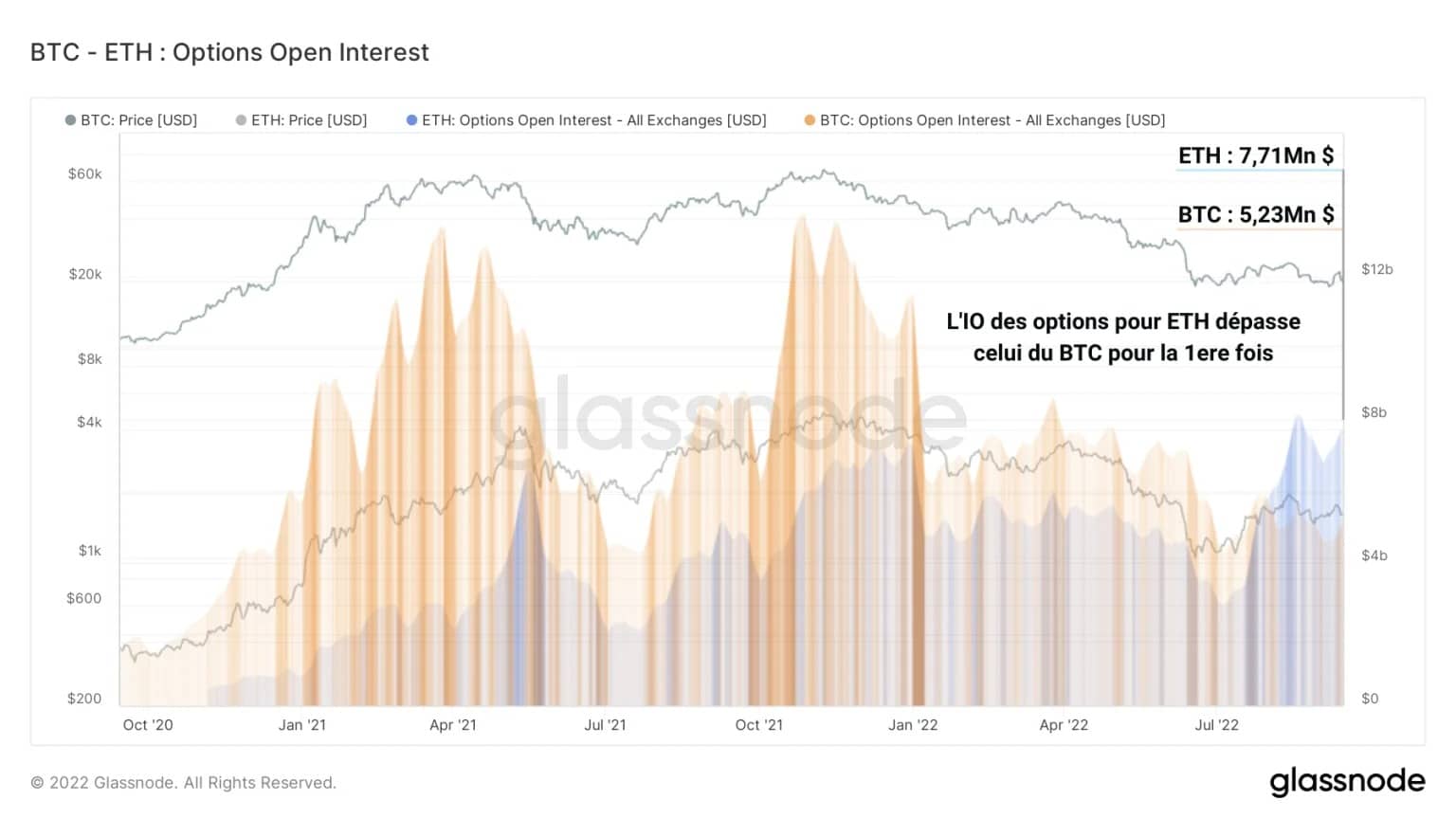

Looking at the dynamics of the call/put options market, a significant observation is that the options OI for ETH has exceeded that of BTC since August.

This indicates not only a strong speculative interest in ETH, as mentioned above, but also a form of flippening where one might not expect it.

Figure 5: Open Interest Options for BTC and ETH

With nearly $7 million allocated to ETH options, speculators seem to be really focused on the short to medium term price of ether, leaving BTC behind for the time being.

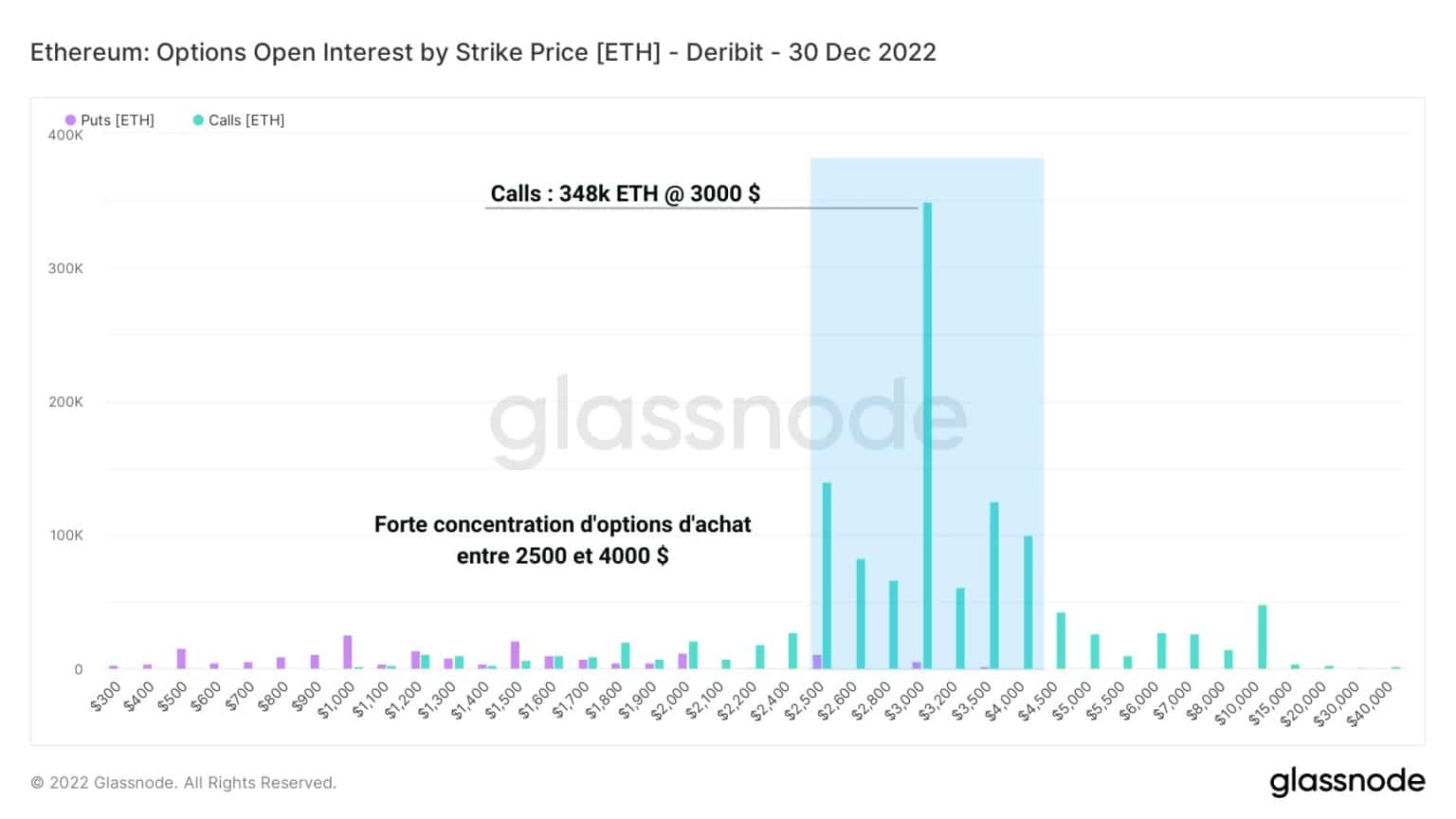

On closer inspection, it appears that a heavy concentration of calls is taking place between $2500 and $4000. This is a clear indication that options market speculators are expecting the price of ether to rise sharply in late 2022.

Figure 6: Open interest for ETH by price bands

With a large volume of more than 348k ETH calls at $3000 per ETH, we can deduce that speculators are expecting at least a doubling of the Ether spot price by December 30.

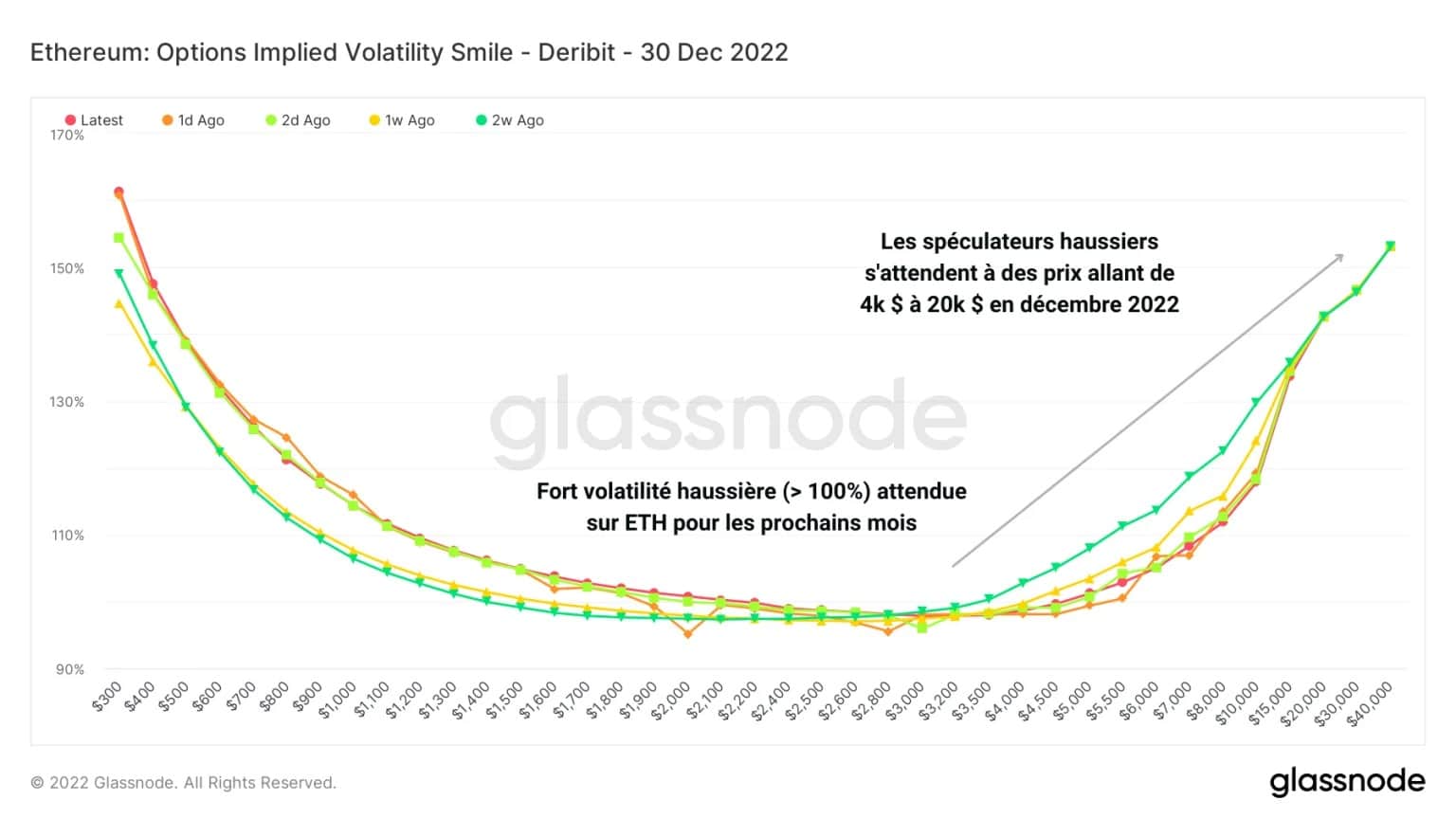

Finally, the implied volatility of the options signals that speculators are planning for high volatility (above 100%) by the end of 2022.

Figure 7: Implied Volatility of ETH Options

With price expectations ranging from $4,000 to $20,000 in the most extreme cases, it seems clear that participants are betting strongly bullishly on the ETH spot price via the options markets.

This is in stark contrast to the bearish bias of the futures markets discussed above. It remains to be seen which part of the speculative cohort will be compensated for their risk-taking

Summary of this onchain analysis

Finally, on the eve of the Merge, participants are showing strong speculative interest in ETH and are attempting to position themselves in a variety of ways.

While the futures bias is notably bearish in the short term, speculators in the options markets are bracing for strong bullish volatility, hoping for at least a doubling of the price by the end of the year.

However, such speculative excesses are likely to result in volatile and erratic price movements, which could lead to a series of cascading sell-offs, both upwards and downwards.