Expected for a long time by the ecosystem, Ethereum (ETH) has just succeeded in its famous Merge and thus acts its passage to the proof of stake. We are following this historic event live

Ethereum successfully passes The Merge

Expected for years, Ethereum’s (ETH) transition from Proof of Work (PoW) to Proof of Stake (PoS), symbolized by The Merge, has finally arrived. The famous Terminal Total Difficulty (TTD) occurred today at around 8:42am Paris time, thus making this historic change.

Although it will take some time to finalise the last adjustments, everything has gone according to plan for the moment. After this merger between the Beacon Chain and the Mainnet, miners no longer receive any income for block production and have passed the torch to validators.

While part of the ecosystem feared that miners would “pull the plug” in an attempt to slow down the advent of DTT, Vitalik Buterin himself was surprised that the majority of players had played along. Indeed, he noted last night that the drop in hashrate was less pronounced than expected, far from the 50% that some people were predicting:

Looks like the “hashrate will drop weeks before the merge due to miners rushing to sell ahead of everyone else” thesis has been proven completely false.

I’m a bit surprised! I argued against a 50% drop but definitely expected like 5-10%. pic.twitter.com/l9OpT8fPFl

– vitalik.eth (@VitalikButerin) September 14, 2022

How is Ethereum’s price evolving after The Merge

On Friday, September 16, at 3:30 p.m., just over 24 hours after The Merge, Ethereum’s price is in the $1,450 range, down from when the update was implemented. Prior to The Merge, the ETH price was around $1,600.

The ecosystem is buzzing for the event

As previously announced, cryptocurrency exchanges have suspended withdrawals and deposits of ETH and ERC20 tokens to play it safe. This is particularly the case of Binance or Coinhouse :

⚠️ As a security measure during TheMerge, transactions related to Ethereum as well as deposits and withdrawals of this asset on Coinhouse will be blocked from 11pm tonight until tomorrow morning.

More information on our article here ⤵️ https://t.co/RWItvWcFvD

– Coinhouse (@CoinhouseHQ) September 14, 2022

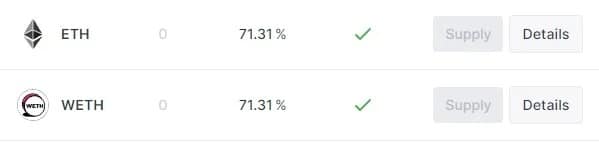

On lending and borrowing platforms such as Aave (AAVE), interest rates have exploded in the face of ETH demand. On Ethereum, for example, people who deposited ETH as collateral were earning the equivalent of over 71% per annum:

Returns earned by cash providers

On the borrowing side, these platforms had to suspend them temporarily, as previously announced. Interest rates were not available on the Mainnet this morning. However, for other networks such as Polygon (MATIC), borrowing rates could sometimes exceed 195% at the time of writing.

Of course, all these variables are only temporary and everything will return to normal as the network stabilises.

Regarding the ETHs stored in the smart contract of the Beacon Chain, a future update will be required to unlock them.

The Merge, while historic, was just one step in the scaling of Ethereum. There is still a long way to go to reach the 100,000 transactions per second that Vitalik Buterin hopes for. The next step in this evolution will be The Surge, with the implementation of sharding.

A surprising anecdote for the last block before The Merge

Wishing to immortalize this historic event for the history of Ethereum, the Vanity Blocks project made sure that the last block before The Merge contained only one transaction.

Vanity Blocks then paid 30.2 ETH to saturate the block, which was necessary to reach the gas limit per block. This allowed Vanity Blocks to be alone on this block. An NFT was then minted and offered for sale on OpenSea.