As 26% of ETHs are staked on Ethereum and the asset prepares for its 6th consecutive week of gains, it’s a good time to analyze network activity. With renewed interest in crypto-currencies, the price of gas, for example, has increased more than 8-fold since January 1. What else is important?

26% of ETH is deposited in staking on Ethereum

Following in the footsteps of Bitcoin (BTC), ETH has seen its price rise sharply of late, so much so that as the Dencun update arrives in a week’s time on Ethereum, the asset is currently in its 6th week of consecutive gains.

If this performance materializes on Sunday evening, it will be the first since August 2022, giving us the opportunity to take a look at the current state of the network.

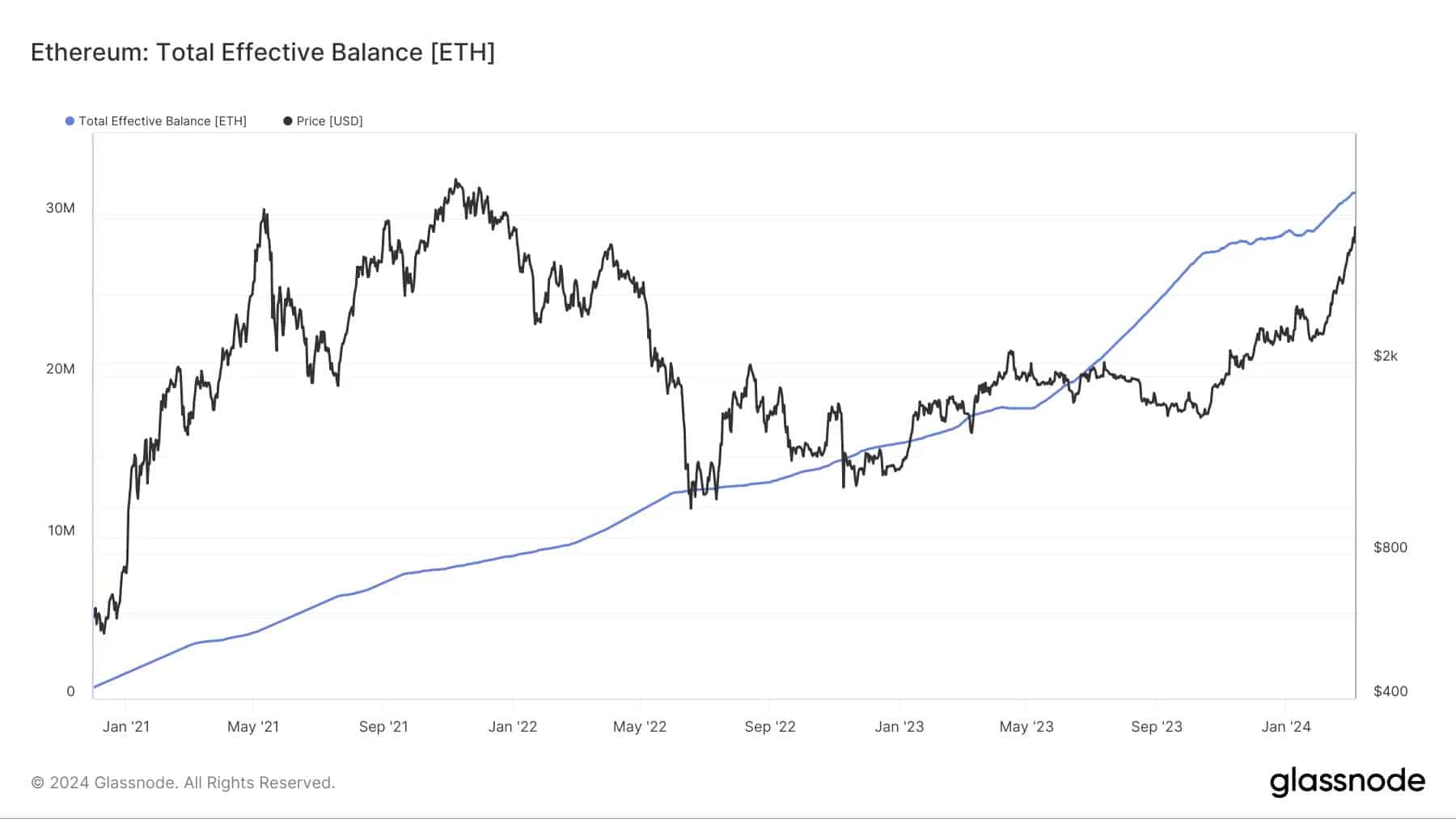

With Proof-of-Stake functionalities fully operational for almost a year now following the Shapella update, the amount of ETH deposited in staking continues to grow, so much so that it now represents over 31 million units, or 26% of the total amount in circulation:

Figure 1 – Total amount of ETH staked

As you can see from the blue curve above, this metric is rising almost constantly, and these ETH are now spread across a total of almost 978,000 active validators.

In terms of revenue, this can vary from one provider to another, but is in the region of 3.6% per annum.

A booming business on the network

As cryptocurrency prices rise, so has activity on the various networks. Ethereum is no exception, with transaction costs rising dramatically. For example, where the average price was $3.41 on January 1, the said amount was $28.41 on Wednesday:

Figure 2 – Average cost of an Ethereum transaction since the beginning of the year

As for the number of addresses created on the network, this stands at around 260.58 million, an increase of 2.5% since the beginning of the year.

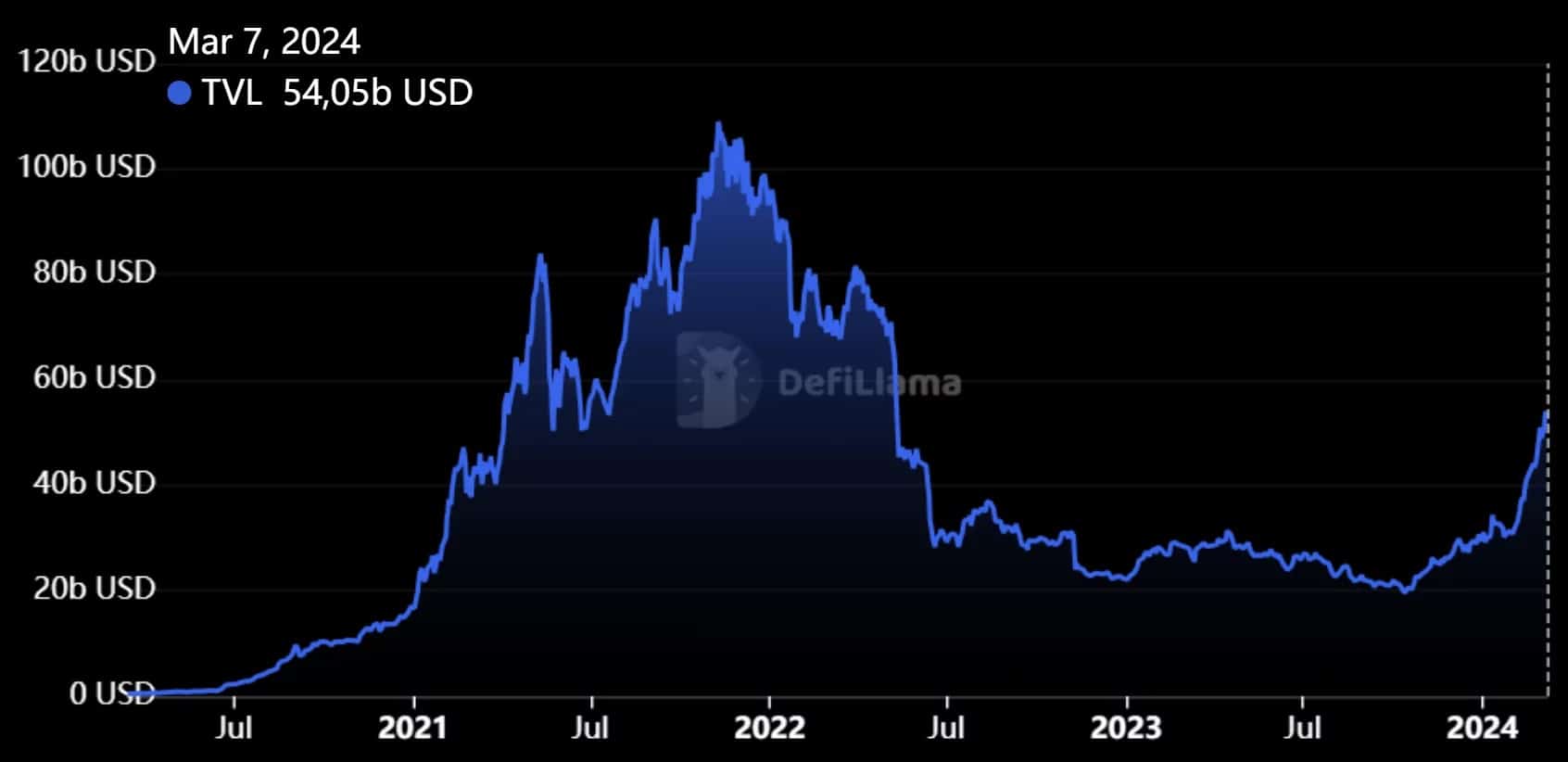

In decentralized finance (DeFi), the total value locked (TVL) on Ethereum is also up sharply.

While we need to be careful not to confuse the amounts actually deposited with their valuation, given the rise in cryptocurrency prices, the figures are nonetheless noteworthy. And for good reason, with $54 billion in TVL according to DefiLlama, this hasn’t been seen since May 2022 :

Figure 3 – TVL evolution of DeFi on Ethereum

As for the ETH price, it was trading at $3,800 at the time of writing, with a capitalization of $456.07 billion. At current levels, the asset still needs to gain 28% to reach its all-time high (ATH).