The current fall of the USDC to $0.9 has led to various consequences in decentralised finance (DeFi). Between the imbalance in Curve’s liquidity pools (CRV) and the depeg of the stablecoin DAI, we have attempted to compile a non-exhaustive list.

USDC crisis has consequences for DeFi

As the cryptocurrency ecosystem tries to come to terms with the loss of the USDC’s dollar peg since last night, the repercussions of this event are being felt in decentralised finance (DeFi). The first of these is that another stablecoin is suffering from the decline: MakerDAO’s DAI.

Indeed, this decentralised stablecoin works on a debt system: investors deposit cryptocurrencies whose value gives them the right to create DAI. But since part of this collateralisation is provided by USDC, the panic mechanically affects this stablecoin.

This is why the DAI price is currently tracking the USDC price, which is around $0.9.

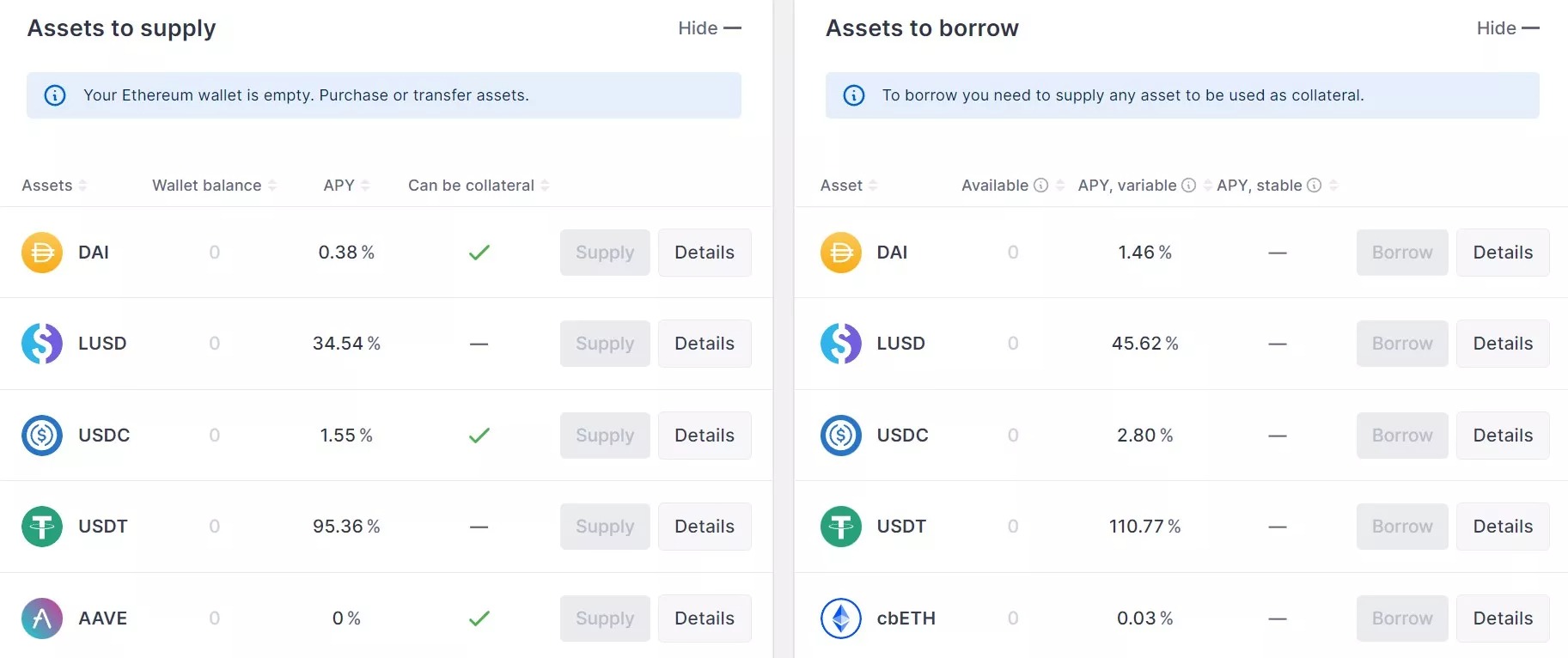

Talking about debt, an interesting phenomenon can be observed on the Aave lending and borrowing protocol. As investors are moving away from the USDC and DAI to the USDT, this has totally disrupted interest rates. As a result, interest rates on the USDT and LUSD could exceed triple digits during the writing of these lines:

Figure 1 – Aave USDT and LUSD interest rates on the Ethereum blockchain (ETH)

The above Ethereum blockchain rates are very volatile, more so for the LUSD due to its very low liquidity. Regarding the Polygon network, LUSD rates were 35% for deposits and 48% for borrowing. This was due to a drying up of USDT and LUSD reserves caused by strong market demand.

The impact on Curve Cash Pools (CRV)

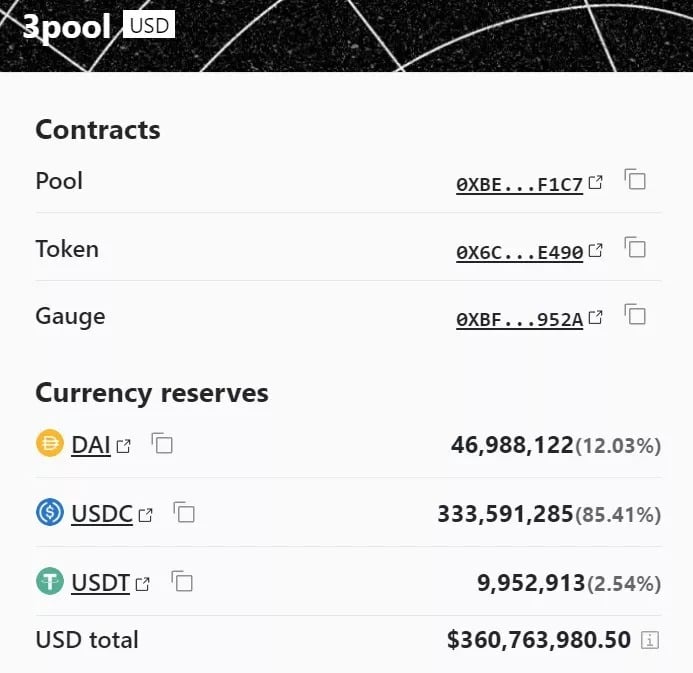

Curve is DeFi’s first decentralised exchange and one of the protocol’s flagship liquidity pools is the 3pool. As the name suggests, it consists of three different stablecoins: USDT, USDC and DAI.

This pool allows for easy trading between these assets, but the current panic has resulted in the USDT pool being emptied and filled almost exclusively with USDC:

Figure 2 – 3pool of CRVs on Ethereum

A similar phenomenon can be observed on the pool containing sUSD and the three stablecoins mentioned above, with USDC accounting for almost 65% of the $65 million in liquidity.

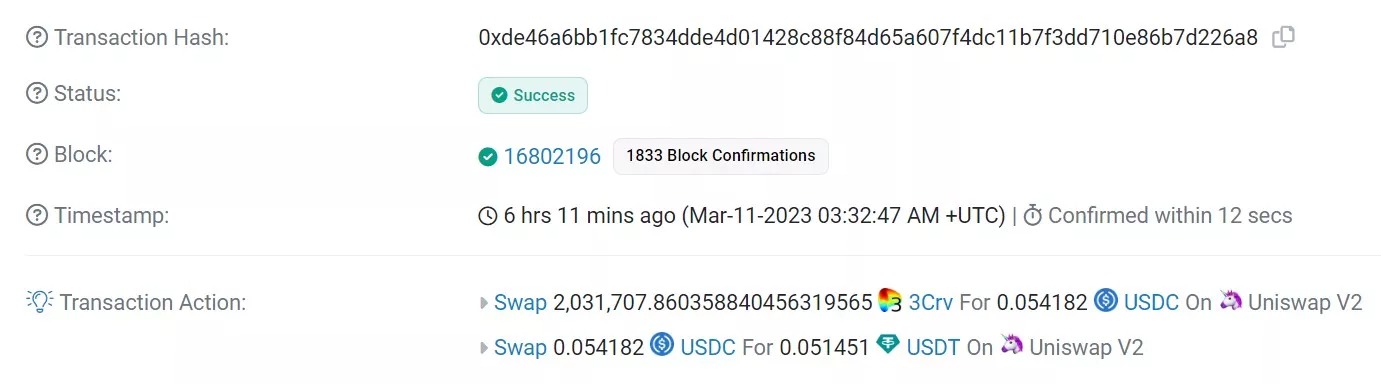

This imbalance can then lead to strong slippage in the event of a trade. This means that the lack of liquidity means that one does not receive the exchange rate that one would normally receive. This unfortunately happened last night to an investor who traded over 2 million USDC for 0.05 USDT, using KyberSwap’s liquidity aggregator:

Figure 3 – Slippage on a USDC to USDT trade

In addition, the current panic has led to an increase in demand on the various blockchains where the crisis stablecoin operates. On Ethereum, for example, the price of gas has risen to a daily average of 79 Gwei according to data from Ultra sound money. This is still only an average, as currently this value is struggling to fall below 100 Gwei.

On the other hand, more than 8,600 ETH have been burned in the last 24 hours, which is almost 6 ETH per minute and a reduction in inflation of about 12 million dollars. In comparison, just under 3,800 ETH were burned on Thursday.

Due to the current volatility of the ecosystem, all of this data changes regularly, but it shows that the difficulties of one player can have consequences for many.