With SEC decisions still pending on all applications for Bitcoin spot ETFs, let’s take a look at the decisive role played by this very specific category of fund for all stock market asset classes. Here is Vincent Ganne’s technical analysis of Bitcoin (BTC)

ETF funds are a game changer for all asset classes in the stock market

In my previous analysis for TCN, I bluntly asked whether to buy the $25,000 support on the bitcoin price. The market seems to have answered in the affirmative during the trading session on Tuesday 29 August. Even so, the die is far from being cast from a technical point of view, not to mention in terms of the external fundamental framework, which remains as restrictive as ever.

But let’s stay focused on the immediate news specific to the ecosystem, with the hot topic of Bitcoin spot ETFs. Crypto fund giant Grayscale has won a legal victory against the SEC, the US stock market regulator, while the SEC is now expected to rule on ETF authorisation applications from other companies, in particular BlackRock.

Of course, there is no guarantee that the SEC’s responses will all be positive at the time of writing, but is it really that important, or is the ecosystem overreacting a little? The answer, or at least my answer, is clearly no.

You must be certain of the following established fact: ETFs, because of the colossal sums under management and the very broad tax eligibility they enjoy, have been, are and always will be a ‘game changer’ for all asset classes on the stock market.

This is the case for the bond market, the equity market, the foreign exchange market (to a lesser extent for the latter) and the commodities market. It should be the case for the cryptocurrency market.

Let’s take the price of gold as an example. Demand for this asset is divided between industrial demand, financial demand and central bank demand (in equal parts over a full year for the first two). Gold ETFs account for more than two-thirds of all financial demand for gold, and have made a major contribution to the rise in the price of gold since the turn of the century.

Another market, another logic. In Japan now, it is equity ETFs that are making a massive contribution to the trend, and the Central Bank of Japan (BoJ) is even going so far as to buy Japanese equity ETFs to support the market.

In short, if all (or some) of the applications for spot Bitcoin ETFs were to be validated by the SEC, it would be a powerful factor in supporting the rise in prices. It remains to be seen whether Gary Gensler’s SEC will decide to spoil the party by playing the card of new legal battles.

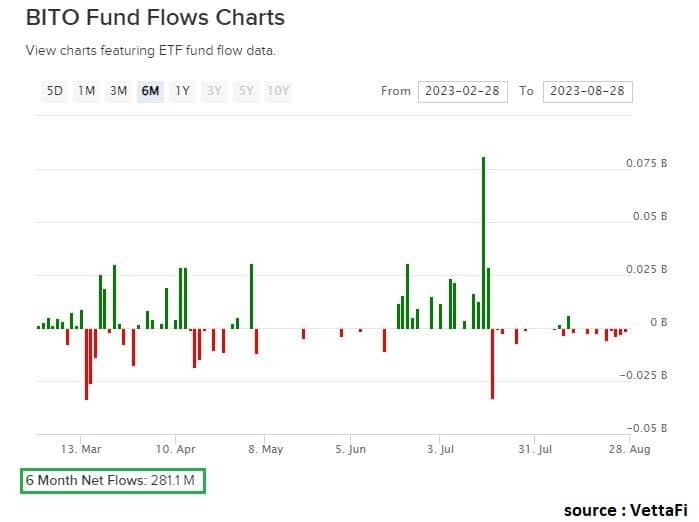

Histogram showing inflows and outflows on Proshares’ long Bitcoin ETF (BITO) over a 6-month period

On the technical front, the rebound to $25,000 support needs to be qualified

The bitcoin price has therefore bounced back from support at $25,000, erasing part of the bearish shock of the massive liquidation session on Thursday 17 August. This rebound illustrates the chartist pivot role of this price level, a role we have regularly described on TCN.

However, bouncing off support is a good thing, but it is only the first step. The necessary second step, breaking through tangible resistance, is not yet present in the price action to argue in favour of resuming the annual uptrend.

It is the resistance at $28,700 that we need to break through in order to finally get back on track to attack annual records. In the absence of such a signal, the technical games are not over and the market can still go hunting for liquidity further down.

Graph produced with the TradingView website and displaying the weekly and daily Japanese candlesticks for the BTC future contract on the Chicago Stock Exchange