In an Iran facing international sanctions and rampant inflation, a study reveals a growing adoption of Bitcoin (BTC) and other cryptocurrencies. 25% of Iranians are said to be using cryptocurrencies to cope with the devaluation of their currency, the rial, as well as the authoritarian regime in place. This trend raises crucial questions about the impact of cryptocurrencies in complex economic and political contexts.

What are the reasons driving the adoption of Bitcoin in Iran?

A study published by Adopt a Block explores the use of Bitcoin (BTC) in Iran, a country under the governance of an authoritarian regime and facing international sanctions imposed by the United States and the European Union. The study reveals a growing adoption of cryptocurrencies in the country, attributable to a number of economic and societal factors.

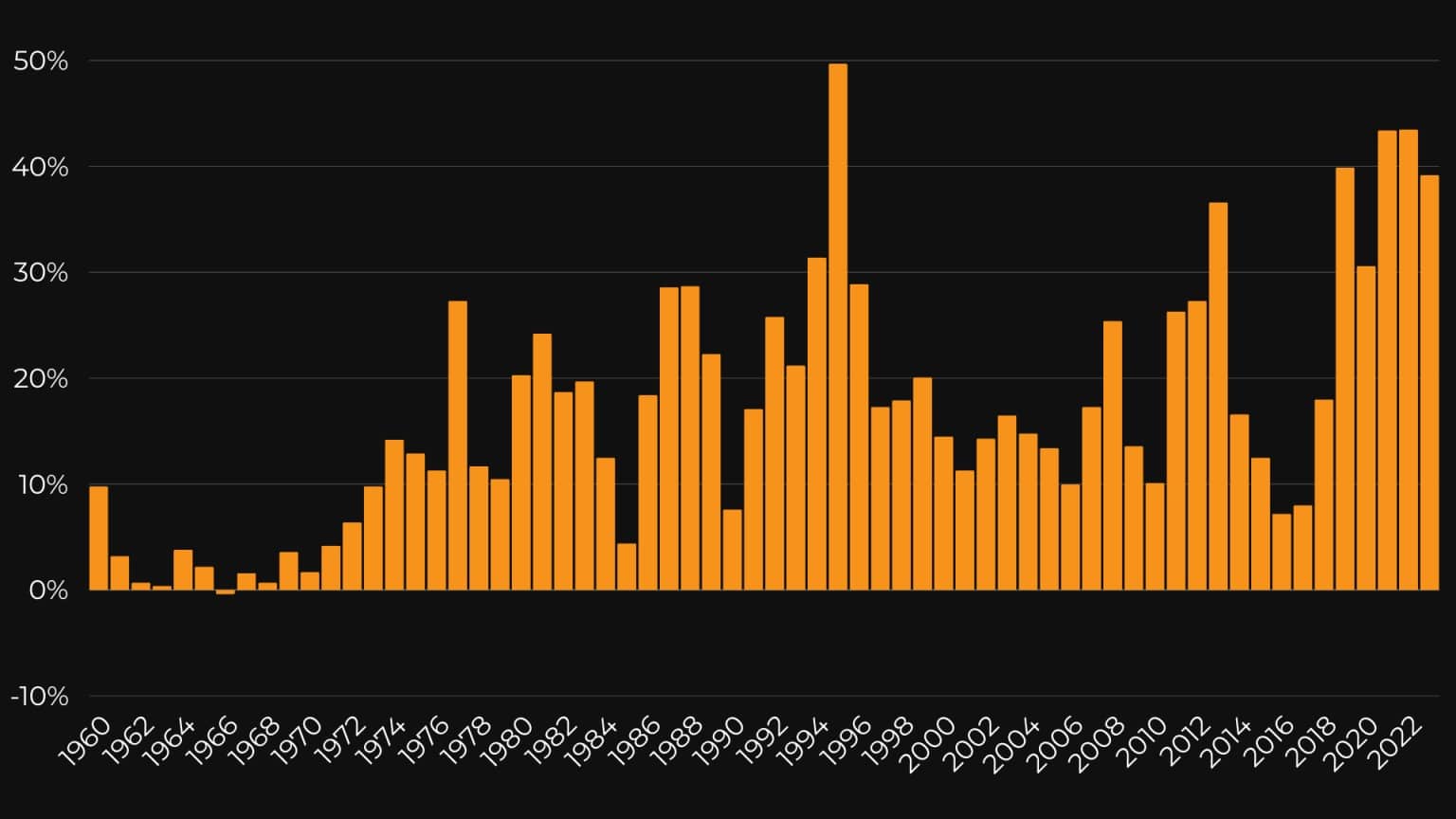

The Iranian rial (IRR) is experiencing high inflation, amounting to around 40% per annum over the past 5 years. As a result, the currency has devalued by 95% over the past decade.

Evolution of the inflation rate in Iran since 1960

Official figures indicate an unemployment rate of 7.5% for the year 2023 for the population as a whole, a statistic that rises to an average of 20.5% among young people. According to testimonies reported by the study, many Iranians receive all or part of their wages informally, thus circumventing excessive taxation which would significantly reduce their purchasing power, already weakened by inflation.

The government of the Islamic Republic of Iran is described as totalitarian, practicing political repression, censorship of information, violation of human rights, and restricting political freedoms.

Power is concentrated in the hands of the Supreme Leader, a position currently held by Ali Khamenei, who limits political participation and individual freedoms. For example, repression of dissidents, censorship of the media and the Internet, and close surveillance of citizens’ private lives are commonplace.

In the face of government repression, protests regularly erupt in Iran, often ending in violent repression by the authorities. Since 1979, some 4,000 people have been killed and 36,000 arrested.

In 2022, the death of Mahsa Amini, a young woman arrested for wearing a hijab deemed inappropriate, triggered nationwide protests, revealing a deeper dissatisfaction with the regime. These protests resulted in the deaths of over 500 people, the execution of 7 individuals, and the arrest of nearly 20,000 people.

Despite these difficulties, the Iranian population is finding ways around bans and sanctions, including using Bitcoin as an alternative to escape financial restrictions and access otherwise forbidden products and services.

How are Iranians using cryptocurrencies?

Iranians mainly use 2 cryptocurrencies in their daily lives: Bitcoin, a decentralized, censorship-resistant value exchange network operating without a central authority – a peculiarity that makes it extremely difficult to block or ban, and USDT, the most capitalized stablecoin on the market issued by the US company Tether.

Other blockchains, such as Ethereum (ETH), offer relatively similar censorship-resistant features and allow the exchange of stablecoins such as Tether’s USDT.

Cryptos to fight inflation

The Adopt a Block study highlights that many Iranians are turning to BTC and USDT primarily to preserve the value of their wealth, in a context where the rial has lost 95% of its value in 10 years.

Bitcoin’s price against the dollar (orange) and against the Iranian rial (blue)

The US dollar, while more stable, has still lost 25% of its value since 2014. Bitcoin, on the other hand, has proven to be the best-performing asset of the decade, recently reaching an all-time high of over 25 billion rials, up from 19.5 billion in November 2021, when Bitcoin peaked at $69,000.

To bypass government censorship

The use of Bitcoin and USDT allows Iranians to bypass government censorship by offering them ways to bypass national bans, while also making it easier for them to make international payments.

Thanks to these cryptocurrencies, many products and services can be purchased discreetly, mainly because of the government ban on these products.

An Iranian citizen, quoted in the study, explains the importance of Bitcoin to him:

“We don’t even have access to the global financial system, and many daily routines that young people in rich countries take for granted are inaccessible to us. For example, our access to Spotify is limited. Many may find this amusing, but we are fighting 2 enemies: the enemy within, who has imposed many restrictions on us and deprived us of our freedom, and the enemy abroad, whose sanctions have directly affected the lives of ordinary people. […] “

He continues:

“It may be hard to believe, but having access to a free Internet has become a major goal for us. […] The key point here is that cryptocurrencies in Iran are mainly used to store value. People in Iran often queue up to buy dollars in cash, which are now in short supply. “

What are the barriers to Bitcoin adoption in Iran?

The study also shares an experience conducted by an Iranian on the barriers to Bitcoin adoption in Iran.

According to this experience, accessing relevant information on Bitcoin is not particularly difficult, although fluency in English is an advantage. There is plenty of content on social networks, including YouTube and Telegram, that popularizes Bitcoin and explains how to create, secure and use a Bitcoin or Lightning wallet, for example.

However, the risk of prolonged power or Internet cuts is highlighted as a potential problem. This risk applies to everyone, but particularly to Iranians. Authoritarian governments in various parts of the world have resorted to this type of practice during revolts, and this could also happen in Iran.

What’s more, despite the corruption of the Iranian banking system, the population retains a certain confidence in the security of cash compared to digital money. Most Iranians believe that national currencies, with the exception of the rial, are backed by gold, whereas in fact, no fiat currency has been backed by gold since the end of the Bretton Woods system in the 1970s.

Other challenges faced by this Iranian citizen include the attraction of locals to riskier cryptocurrencies, a preference for holding assets on centralized exchange platforms (CEX), as well as a general lack of interest in learning how to use Bitcoin as a new monetary technology.

A quarter of Iranians hold cryptocurrencies

The author of the study, faced with the difficulty of obtaining an accurate view of reality from testimonials, continues his research based on a report published by the Iranian newspaper ArzDigital, entitled “The Cryptocurrency Space in Iran – 1402”.

The report reveals that in 2023, 25% of Iranians owned cryptocurrencies, and 29% said they had in the past.

Among Iranian cryptocurrency owners:

- 38.10% have not invested in any other market;

- 53% were in loss as of November 2023;

- 61% invested before 2021;

- 82.10% invested to fight inflation;

- 21.90% use decentralized finance (DeFi);

- 9.60% use cryptocurrencies to transfer or receive money from abroad ;

- 7.70% use cryptocurrencies to purchase goods or services;

- 76.6% believe that international sanctions are an obstacle to accessing cryptocurrencies;

- 57.20% believe that Internet access restrictions are a hindrance.

Bitcoin is the most popular cryptocurrency in Iranian wallets, followed by Dogecoin (DOGE) and Shiba Inu (SHIB). Ethereum (ETH), however, only ranks 5th, behind Cardano (ADA).

It’s also worth noting that in recent years, a number of local cryptocurrency exchange platforms have been set up. 84.10% of investors surveyed say they use them because they offer the advantage of being able to pay directly in rial, and 34.70% prefer them because the applications are in Farsi, the most widely spoken language in Iran, underlining the importance of documentation drawn up in the local language.

However, 52.70% of these users felt that withdrawal fees were too high. One of the people interviewed in the Adopt a Block report mentioned an optimization to get around these fees, by performing an “atomic swap” via Boltz, withdrawing BTC via the Lightning Network before receiving them on-chain. This operation would save around 90% of the fees normally paid to platforms.

The Iranian government has introduced regulatory measures for cryptocurrencies, notably requiring a license for Bitcoin mining in order to better manage energy consumption.

In addition, transactions on exchange platforms are restricted, and these must be registered with the Central Bank in order to be authorized to operate. Currently, capital gains made in cryptocurrencies are not taxed, several proposals for taxation having been rejected.

As such, 65% of Iranians perceive cryptocurrency regulation as moderate.

Bitcoin is more than a speculative asset

For Iranians, Bitcoin represents much more than a speculative asset; it embodies a form of freedom in the face of government restrictions.

Its growing adoption in Iran is promising and could play a key role in the country’s economy. However, challenges remain, such as the volatility of Bitcoin’s price and the need to educate users on how to use it in the best conditions, particularly from a security point of view.

In addition, high transaction fees often prompt users to turn to more centralized solutions, such as exchanges or custodial wallets. Alternatives are under development and should improve these shortcomings in the future.

Iran is undergoing significant economic changes, notably through its integration with the BRICS and its economic alliance with Russia, which could ease Western restrictions and improve the quality of life of its population.

In addition, the adoption of Bitcoin could encourage the emergence of a parallel economy, freeing the population from international constraints.