The US Federal Reserve (FED) has unveiled its final monetary policy decision of the year, and it has delivered a pleasant surprise to the financial markets by confirming high finance’s expectations of the end of the monetary tightening campaign. Clearly, the FED’s pivot is certain for the year 2024 and this is a supportive factor for Bitcoin (BTC) and the crypto market.

Disinflation without recession, the FED’s bet for 2024

This week is the last busy week for fundamentals before the end-of-year vacations. The US inflation update, the Markit PMIs (the leading indicators most respected by the market), important US economic aggregates such as retail sales (barometer of household consumption, 70% of US GDP) and above all the latest monetary policy decisions from the leading Central Banks.

All investor attention was focused on the U.S. Federal Reserve (FED), which updated its macroeconomic expectations at 8pm on Wednesday December 13. Jerome Powell’s FED gave the market a pleasant surprise by confirming that the monetary tightening campaign initiated in January 2022 to combat inflation was now over (the FED’s Terminal Rate is definitively set at 5.50%).

The very favorable reaction of the market’s risky assets (the S&P 500 index is once again in contact with its all-time record, and the DAX is setting new all-time highs) was triggered above all by the FED’s new projections for the year 2024. The FED confirmed that it is considering 3 rate cuts next year, meaning that the FED’s pivot is now (almost) certain for 2024.

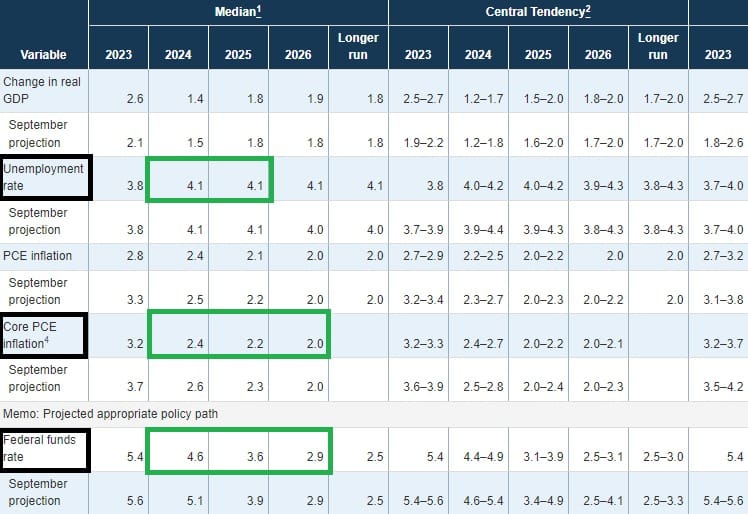

In the table below, you can read that the FED envisages disinflation without economic recession for the years 2024 and 2025, which is the ideal scenario for risky assets on the stock market.

Table proposed by the Federal Reserve (FED) outlining the US Central Bank’s macroeconomic expectations for the years 2024 to 2026

The stock market consequences are logical :

- Continued fall in market interest rates in the United States and Europe (strong bond market rebound);

- Continuation of the US dollar’s downward trend against a basket of major currencies;

- Continued bullish rally in stock market indices, still led by US tech and AI stars in particular.

These cross-asset factors are having a positive effect on the price of crypto-currencies due to correlations, with the bitcoin price managing to bounce off support at $40,000.

The uptrend in the bitcoin price remains well-constructed on a technical level

The reaction of bitcoin and altcoins to the FED was bullish. BTC bounced off support at $40,000 and Ether (ETH) off support at $2,160. As long as these two levels are preserved on a daily closing basis, then the trend is bullish. The bullish movement is well-constructed, with alternating bullish impulses and phases of lateral pause.

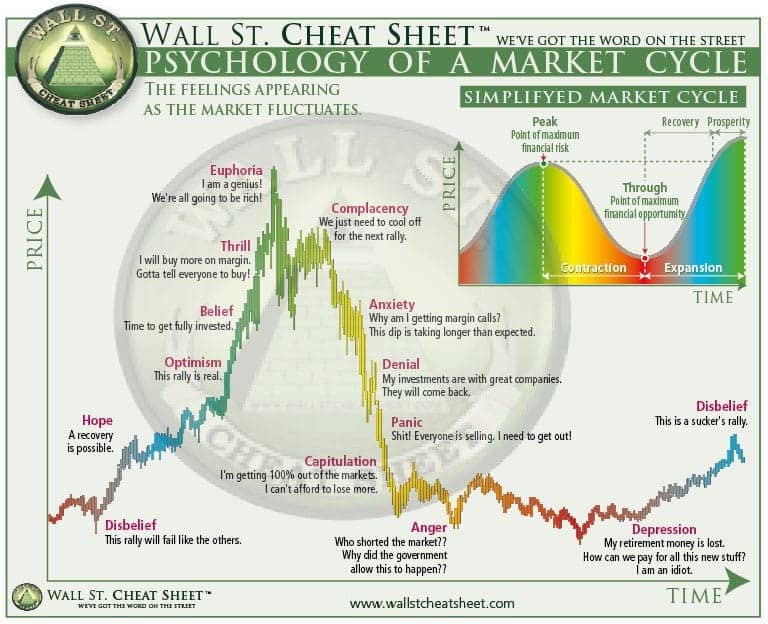

The uptrend is still driven by institutional flows, with retail investors’ “bitcoin” searches on Google Trends remaining at a standstill. This confirms that the market is still between denial and hope in terms of the psychological cycle of reversal of the uptrend.

Infographic illustrating the usual psychology of traders in a full market cycle