More than $32 billion of BTC is currently held in spot Bitcoin ETFs in the U.S., representing 3.48% of the total BTC supply. Despite a reduction in outflows on Grayscale’s GBTC, other ETFs continue to gain in popularity, with increasingly consistent positive net flows. Meanwhile, BlackRock and Fidelity continue to stand out from their competitors

More than $32 billion of BTC in Bitcoin spot ETFs

It’s time to take stock, 3 weeks after Bitcoin spot ETFs were accepted on the US stock market. At the time of writing, the 10 spot Bitcoin ETFs currently on the market, including Grayscale’s, total $32.42 billion in assets under management.

In other words, 3.48% of the BTC supply in circulation is in the vaults belonging to the companies offering these investment products. Grayscale, whose Bitcoin ETF results from the conversion of its former trust, largely dominates this metric with 2.37% of circulating BTC in its reserves.

Figure 1 – Performance of the various spot Bitcoin ETFs and % of total BTC supply for each (boxed in red)

BlackRock’s IBIT ETF and Fidelity’s FBTC ETF also performed remarkably well, accounting for 0.45% and 0.37% of the total BTC supply after just over twenty days on the market.

As Eric Balchunas, ETF analyst at Bloomberg Intelligence, points out, even though Grayscale’s exit volumes have shrunk considerably, the other 9 ETFs on the market continue to consolidate their positions.

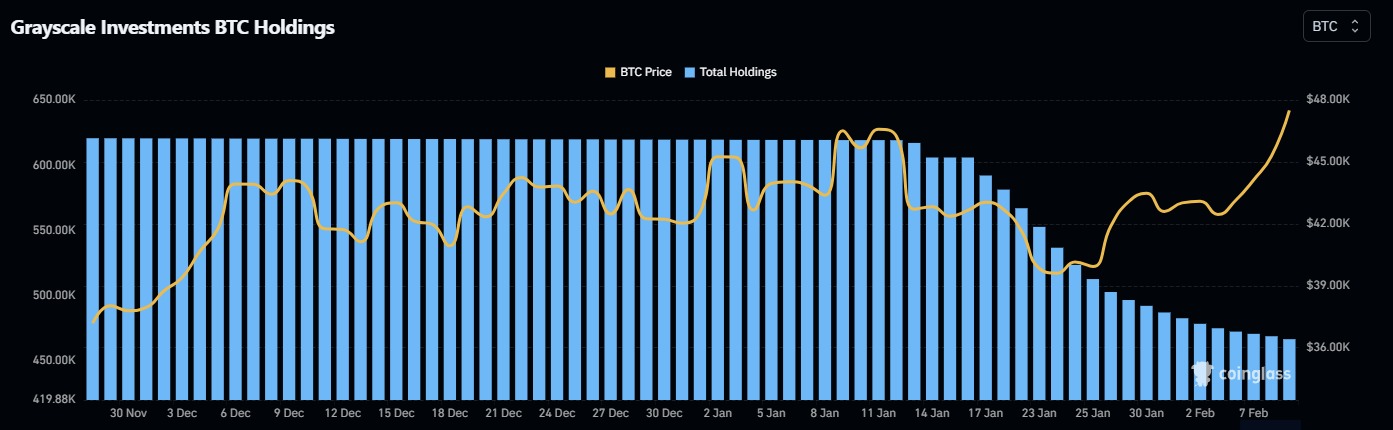

Effectively, while Grayscale held around 619,220 BTC as of January 10, i.e. before the arrival of spot Bitcoin ETFs on the US market, this figure is now down to 466,530 BTC, or around $22.49 billion. A sum which is still quite considerable, of course, but which reflects a profit-taking by individuals who invested in the former trust.

Figure 2 – Evolution of Grayscale’s Bitcoin reserves (blue) and Bitcoin price (yellow)

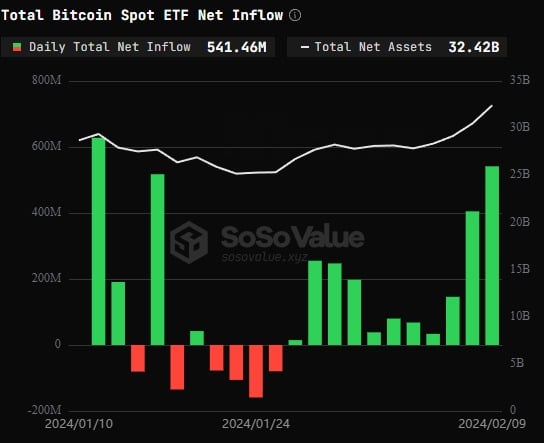

As we can see below, Bitcoin spot ETFs have seen a significant resurgence in investor interest since February 6, after a quiet period of a few days. Indeed, net flows are very much in the green, on the one hand as outflows on Grayscale’s GBTC reduce, but also as new inflows are observed on the other ETFs.

In doing so, on February 9, Bitcoin spot ETFs had their second-best day, with $541.46 million in positive net flows, the best day being when they first entered the market with $628.07 million.

Figure 3 – Net flows observed on all Bitcoin spot ETFs

As we said earlier, BlackRock and Fidelity stand out from the rest of the pack. Indeed, if we exclude Grayscale, 3rd place goes to Ark Invest and its ARKB ETF, which has just passed the billion-dollar mark. By comparison, BlackRock has surpassed $4 billion in assets under management, and Fidelity $3.5.

Although there’s still a long way to go before the latter catch up with Grayscale, it’s worth noting that the daily trading volume on BlackRock’s IBIT has outstripped it since February 7.