Recently, Bitcoin transactions have been omitted by mining pools, raising concerns about the influence of OFAC and US policies on Bitcoin mining. The phenomenon, discovered by developer 0XB10C via his “miningpool-observer”, raises questions about the Bitcoin network’s resistance to censorship.

FOCA threatens to censor Bitcoin

Over the past few weeks, a notable phenomenon has caught the interest of observers: six Bitcoin transactions involving addresses sanctioned by OFAC, the US Treasury Department’s Office of Foreign Assets Control, have been missing from blocks mined by various mining pools.

This raises questions about Bitcoin’s censorship resistance and the influence of US policies on mining activities outside the USA.

With the help of his “miningpool-observer” project, a Bitcoin developer called 0XB10C on X spotted that several transactions had been censored by certain mining pools.

The miningpool-observer was designed to detect missing transactions in blocks mined by Bitcoin mining pools. As for OFAC, it is a U.S. government entity that issues sanctions against individuals, groups and countries for a variety of reasons, including combating terrorist financing and money laundering.

3 mining pools, F2Pool, ViaBTC and Foundry USA, have recently omitted certain Bitcoin transactions from their mined blocks. F2Pool excluded several transactions in 4 blocks, while ViaBTC and Foundry USA each omitted one transaction in one block.

According to 0XB10C’s analysis, ViaBTC and Foundry USA could have excluded these transactions due to low per-byte charges (sat/vByte) or insufficient propagation in the mempool.

However, the omission by Asia-based F2Pool could indicate intentional compliance with OFAC sanctions, raising concerns about the influence of US policies on global Bitcoin mining.

This suggests a possible US influence on foreign mining pools, calling into question resistance to censorship, a key feature of Bitcoin. If pools start filtering transactions based on sanctions, this could compromise Bitcoin’s fundamental property of censorship resistance.

What does Bitcoin risk?

As mentioned earlier, OFAC is a government entity whose aim is to combat the financing of terrorism and money laundering. So why would it be negative to apply their rules to Bitcoin transactions?

While OFAC’s aims are laudable, widespread compliance by miners with its guidelines could lead to increased and potentially arbitrary control over Bitcoin transactions, removing the incentive to use Bitcoin, a value transfer network intended to be decentralized.

This could lead to a form of censorship where certain Bitcoin transactions or addresses would be blocked or filtered not on the basis of concrete evidence of illegal behavior, but rather according to more subjective or political criteria.

Bitcoin block mining luck distribution – mempool.space

Despite F2Pool’s refusal to process these 4 transactions, the Bitcoin network is still far from being generally censored. In fact, F2Pool undermines just over 11% of Bitcoin blocks, meaning that addresses censored by OFAC could still be validated in 89% of blocks.

It’s important to note that a mining pool is not run by a single entity, but rather consists of a multitude of independent miners and companies. Consequently, if a pool decides to adopt certain regulations, miners have the option of switching pools. In this way, they can redirect their computing power to another pool that more closely matches their preferences and principles.

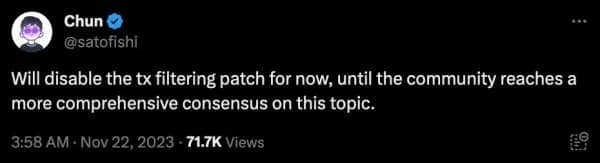

This is precisely what happened with F2Pool. In reaction to the rapid disengagement of some miners following the introduction of a controversial filter, the pool’s co-founder, @satofishi on X, was quickly forced to reconsider his position. Faced with this situation, he announced that the filter would be removed, illustrating the power dynamic between mining pools and individual miners in the Bitcoin ecosystem.

Screenshot of @satofishi’s post reposted by @vinibarbosabr after it was removed

If Bitcoin were to comply with OFAC regulations, it would go against a fundamental principle of the network: its resistance to censorship, as it would then risk compromising the very essence of what gives Bitcoin its uniqueness and value.