After being sued by seven US states, Nexo is starting to be the subject of rumours about its solvency. We take a look back at the various elements that have made news about the platform this week to try and shed some light on the matter.

The Nexo platform at the heart of rumours and court cases

The Nexo platform has had an eventful week of insolvency rumours and legal attacks. On Monday, news broke that California was taking legal action against Nexo, along with six other US states:

- Kentucky;

- New York State;

- Maryland;

- Oklahoma;

- Washington State;

- And Vermont.

The alleged facts relate to the Earn Interest Product, which, as its name suggests, offers interest. However, Nexo does not have the necessary licences to address the US market, which has drawn the attention of regulators.

The State of Kentucky, for example, claims in its complaint that as of 31 May this year, 542 accounts had been opened in the region’s jurisdiction, with a value of 31 million dollars. But more than that, the same state raised doubts about Nexo’s lending and borrowing system.

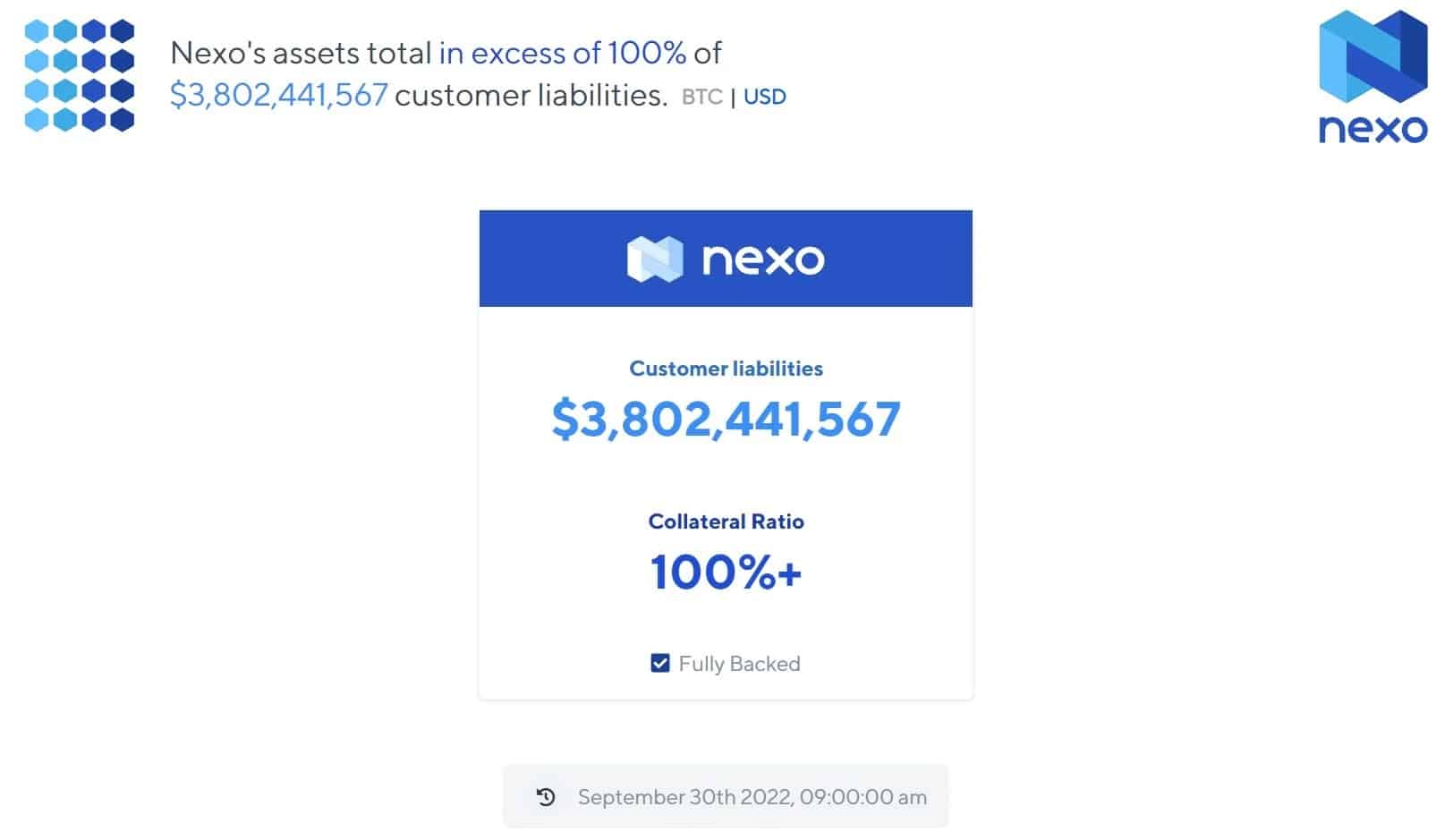

Indeed, it is possible to deposit funds as collateral on the platform in order to borrow assets. Moreover, the platform boasts a real-time auditing system, developed by Armanino. This certifies that Nexo actually has more funds than what was borrowed by users:

Figure 1: Nexo real-time audit

It is also possible to download a report. However, what the Kentucky authorities are complaining about is that the report does not include any details, thus raising doubts about the product’s real solvency.

The NEXO token problem

The Kentucky authorities point to the lack of evidence of Nexo’s solvency, and the fact that a large part of the platform’s cash flow is based on the NEXO token:

“The problem with the NEXO token

“To date, Nexo has provided insufficient information to substantiate its claimed solvency, given recent market fluctuations, bankruptcies suffered by competing cryptocurrency companies, and the fact that most of Nexo Capital’s equity is represented by its proprietary token, the value of which is questionable. “

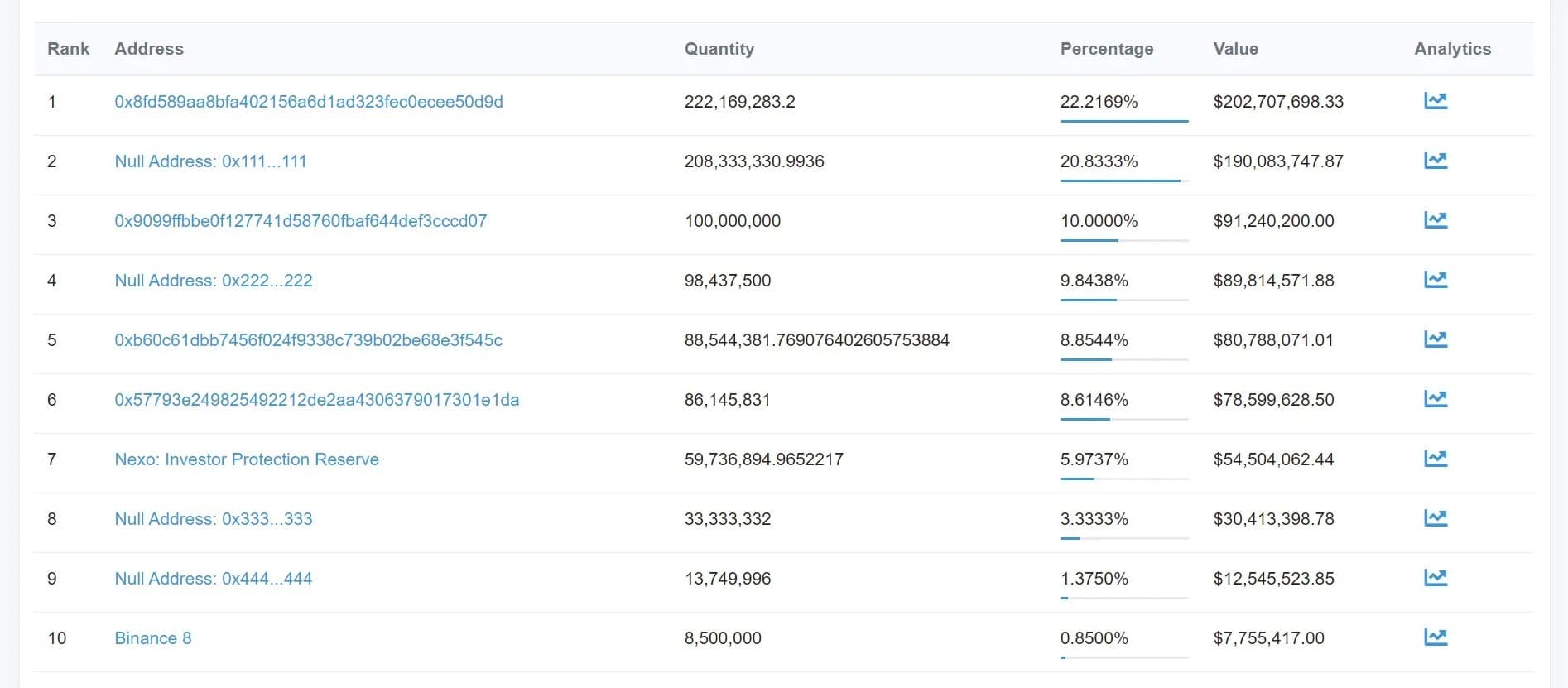

Analysis of the largest NEXO token owners does seem to push the argument in this direction:

Figure 2: Ranking of addresses with NEXO

Addresses stamped “Null Address” are, in theory, not controllable by anyone and are used for token burn. This would indicate that about 35% of the liquidity has been taken out of circulation.

The variety of assets present on the address in position number 5 suggests that this is the deposit contract of the platform’s customers. However, the share of NEXO tokens on the addresses in positions 1, 3 and 6 suggests that these do indeed belong to the platform. If we add these amounts to the address in position 7, we obtain over 46% of the liquidity.

If we consider that the 35% of liquidity on the “Null Adress” is lost, we could estimate that Nexo controls 70% of the liquidity of its token. This is information to be taken on conditional basis and it is not intended to draw hasty conclusions, but if it were true, the real value of NEXO would be seriously questioned, and the solvency of the platform with it.

A stake in a regulated bank

Despite the negative news of the week and the rumours initiated by the investigations, Nexo has still benefited from positive news.

Indeed, the company acquired a minority stake in a regulated US bank: Summit National Bank. In its press release, Nexo states that this operation will facilitate the procedures for addressing its products to the American market. This seems to indicate a desire for compliance.

Concerning the regulation, Kalin Metodiev, co-founder of Nexo, was surprised by these legal actions, in an exchange granted to our colleagues of the Cointelegraph :

We were a little bit surprised that this news was made public, you know, because it’s not a process that just started this week. We’ve been working with our legal advisors in the US who we’ve used over the last couple of years to specifically guide us through these waters in these conversations. “

While it is not appropriate to get carried away with FUD, we will still need to be careful about this case. Nexo is starting to be the subject of rumours, and while not all of them may be true, it has been demonstrated several times during this bear market that “centralised platform” and “lack of transparency” don’t always mix.