The US Federal Reserve (FED) unveiled a new monetary policy decision on Wednesday evening and unsurprisingly adopted the monetary status quo. However, the time is still a long way off for the world’s leading central bank to adopt a more accommodating approach. Against this backdrop, the bitcoin price should make its technical choice very soon.

The FED remains intransigent

In this week of Central Banks – US Federal Reserve (FED), Bank of England, Bank of Japan, Swiss National Bank – it was the FED’s monetary decision that was most eagerly awaited.

In particular, investors were awaiting an update on macroeconomic expectations from FED experts. Although expectations were met, the FED significantly raised its expectations for US real GDP growth, effectively ruling out any monetary easing for this year, or even for most of 2024.

In other words, this means that a downward trend in the Fed funds rate cannot be expected before the end of this period. So, the road ahead for risk markets (crypto included) is still long, and there is no end in sight to what is and will remain the priority: the quest to fight inflation, that irreducible enemy that is the West’s primary concern.

A hint of optimism for Bitcoin?

Despite everything, after studying in detail the predictive elements shared by Jerome Powell, I noted the US Central Bank’s optimism about its ability to bring underlying inflation down to 2% by 2025, while preserving the health of the US labor market as much as possible.

The Fed is walking a tightrope, but this balancing act could be a success if the level of US household consumption is not crushed by the new financing conditions.

In terms of market reaction, bond yields have surpassed the peaks of last March’s banking crisis. This is clearly a risk zone for economic agents, and the equity market is continuing the consolidation it began at the end of July.

As for the US dollar (DXY), it is now very close to the 106-point “short squeeze” threshold, and it should be remembered that Bitcoin would have great difficulty in coping with any breach of this resistance.

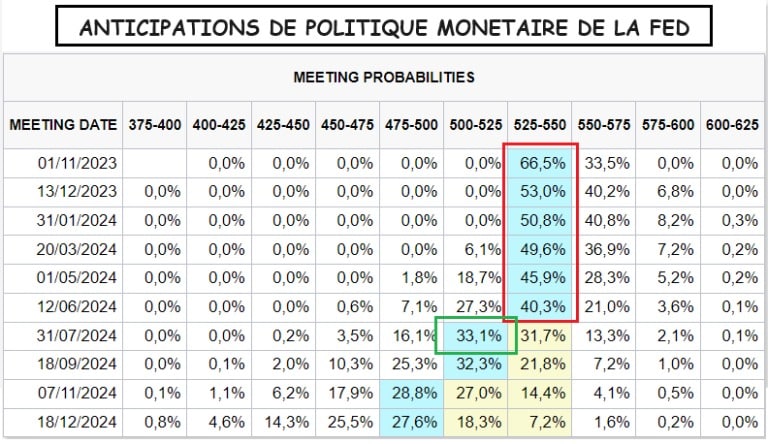

Chart from the Chicago Stock Exchange’s CME FED WATCH TOOL, projecting the future interest rate cycle of the U.S. Federal Reserve (FED)

Bitcoin will make its technical choice, it’s a matter of a few days maximum

Bitcoin’s price was particularly quiet in the wake of the FED’s announcements on Wednesday evening, and is now more than ever at a chart crossroads. As seen together in previous technical points, having bounced off support at $25,000 is not a securing signal until adequate resistance is breached.

Unfortunately, the FED’s announcements did not allow this resistance breakout. As a result, BTC remains locked in a narrow trading range between intraday support at $26,800 and intraday resistance at $27,500.

On the longer time horizon, it’s when the market leaves the chart compression highlighted on the chart below that BTC will finally make its technical choice.

Chart showing Japanese candlesticks in daily data for the bitcoin future contract on the Chicago Stock Exchange (CME)