The behaviour of the bitcoin price has been surprising over the past week and the resurgence of banking risk in the US and Europe. Bank failures in the US and the difficulties of Credit Suisse bank seem to have attracted capital to bitcoin. Let’s take a look at the fundamentals and the technicals

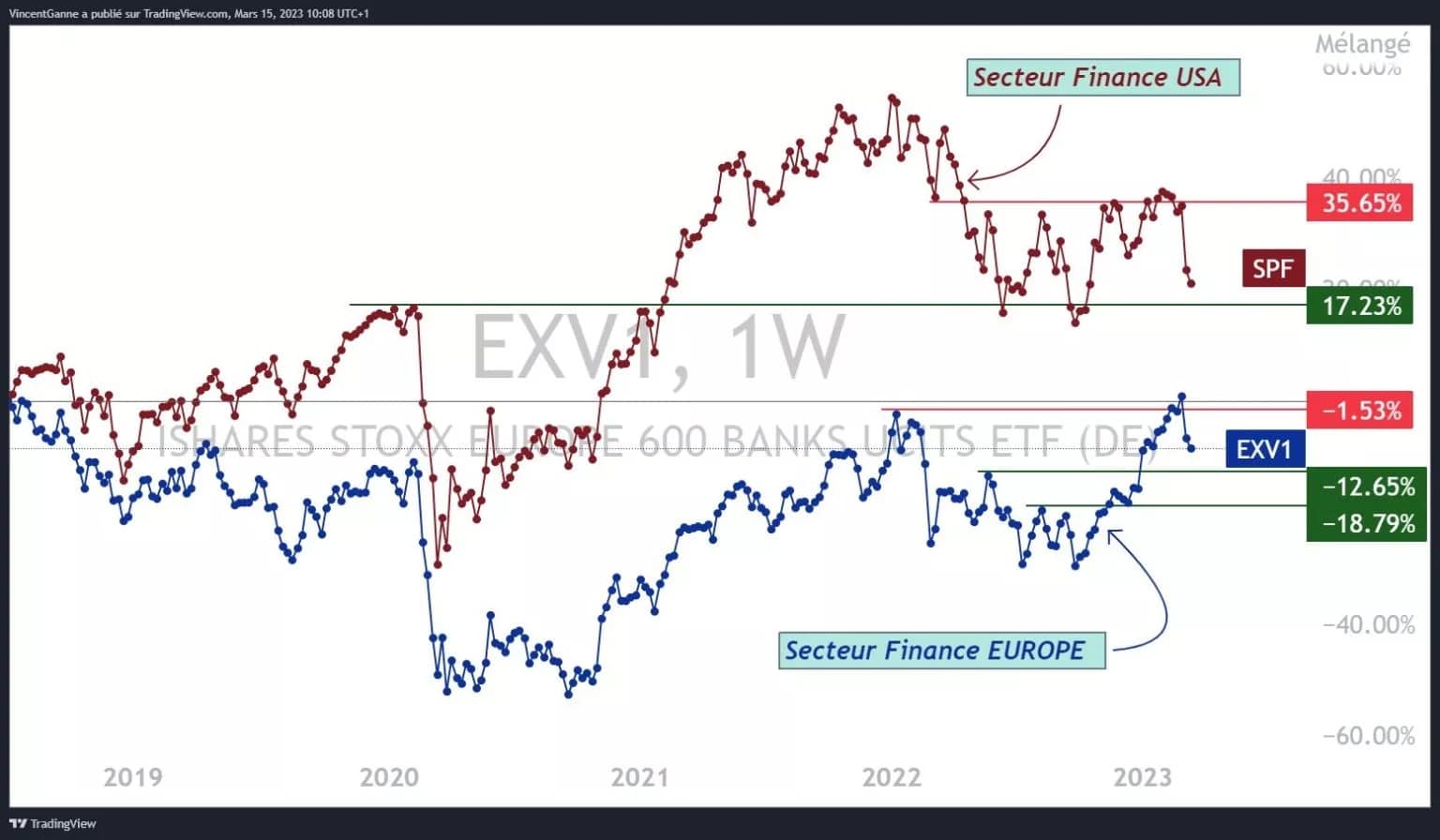

Falling US and European banking stocks support bitcoin

It’s a question that’s been coming up more and more in recent days: is Bitcoin (BTC) a hedge against the banking risk that has made a comeback in the US and Europe?

The answer to this question is clearly no. On the other hand, the US bank failures and the huge difficulties of Credit Suisse (which by the way are very old and which will be able to borrow 50 billion from the SNB, the Swiss Central Bank) have generated a favourable arbitrage for the crypto market, essentially in favour of the Bitcoin price.

These difficulties of the commercial banks are the consequence of the vertical rise of the key interest rates of the Central Banks since one year in order to fight inflation, which led to a fall in the price of bonds which are very present in the balance sheet of the banks.

Bitcoin is not a hedge against the risk of bank failure in the sense that it is simply not comparable :

- Bitcoin is not a depository institution;

- Bitcoin is not a credit institution;

- Bitcoin is not an investment institution.

On the other hand, it is certain that Bitcoin cannot go bankrupt (unless mining is shut down, a black swan that is not worth thinking about) and that anyone holding BTC can convert it into fiat currency at any time. In short, the funds are secure, which should be compared to the so-called European bank guarantee of 100,000 euros per bank account.

In short, the bitcoin price has joined the group of financial assets considered as having a “safe haven aspect”, just like gold, silver or the Swiss franc on the foreign exchange market.

Within the cryptocurrency market itself, there has been a clear arbitrage of altcoins in favour of bitcoin as illustrated by the rise in dominance of BTC. Finally, the uncertainty surrounding stablecoins may also have generated capital shifts towards BTC.

It is therefore indirectly that the bank failures have allowed a clear rebound in the price of bitcoin, which is again facing the major technical resistance of 25300 dollars.

Chart juxtaposing the Banking/Finance sector indices of the US equity market and the European equity market

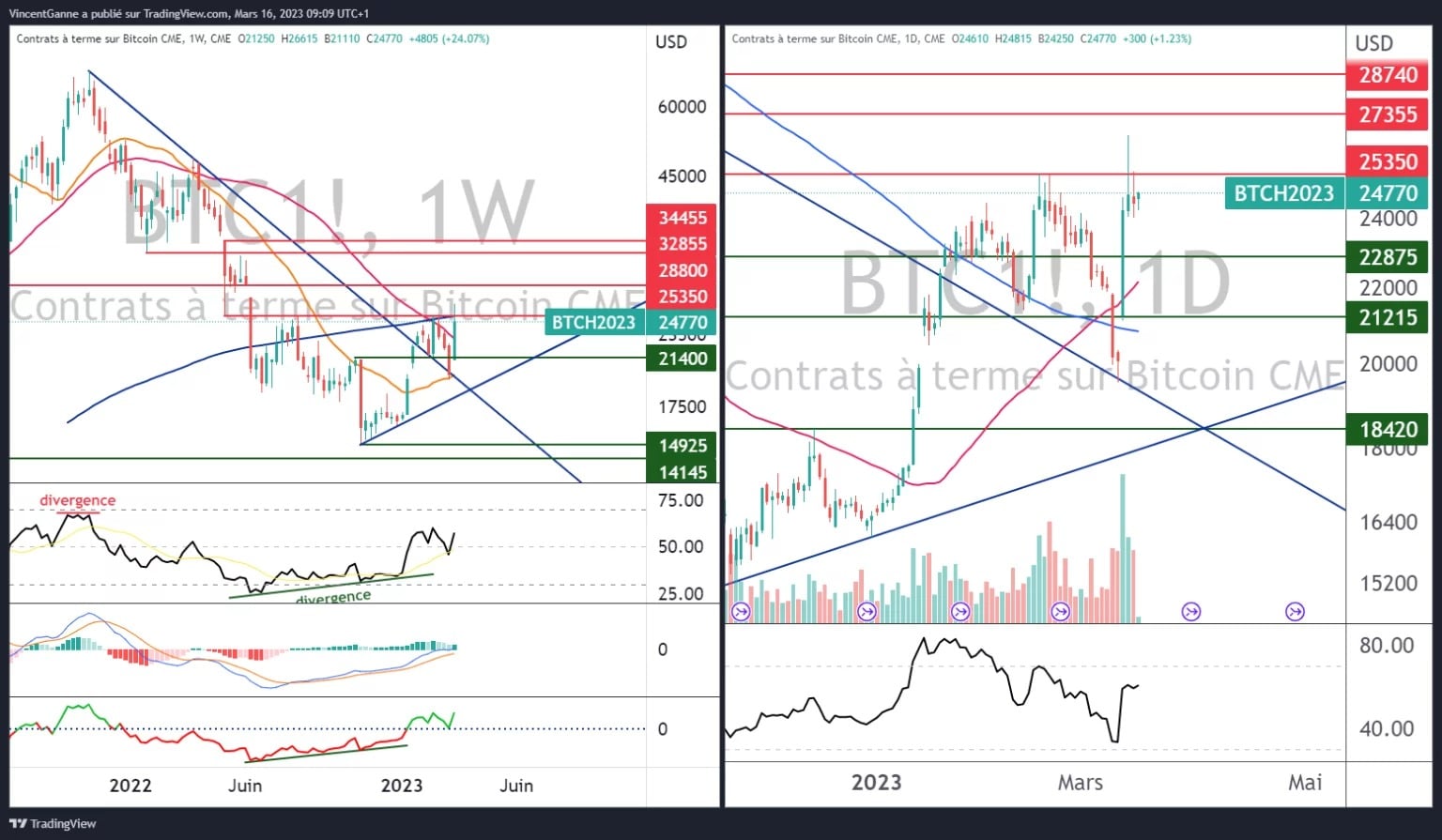

Will the technical lock of $25300 finally break

The bitcoin price rally since the FED bailout announcement and the USDC repeg has been impressive. It combined vertical price action with very high trading volume, but in the end it was back to square one.

The market is once again in contact with major technical resistance at $25,300, a level that needs to be broken on the basis of (at least) a daily close to see further upside.

If resistance is breached, the market will fill an open bearish gap between $27,000 and $29,000. If it fails again, the $20,000/$25,000 trading range will continue to unfold.

Chart showing the weekly (left) and daily (right) Japanese candlesticks for the bitcoin future contract on the Chicago Stock Exchange