The price of Grayscale’s GLNK, which gives exposure to Chainlink’s LINK, has skyrocketed in the space of a few days. Why is it now trading at a premium of 216%?

The price of Grayscale’s Chainlink fund soars

While Grayscale is best known for its GBTC investment fund on Bitcoin (BTC), the asset manager offers other products, including Chainlink’s LINK-indexed GLNK, which we’re interested in today.

And with good reason, said GLNK trades at a 216% premium to its real price, as one Chainlink ambassador pointed out on X:

Grayscale Chainlink Trust $GLNK trading at a 200%+ premium over spot

$39 per share, with 0.93482160 $LINK per share pic.twitter.com/0dxljSDzQ8

– ChainLinkGod.eth (@ChainLinkGod) November 8, 2023

While a share of this investment fund was supposed to trade at $12.31 yesterday, its over-the-counter (OTC) price was $39. This shows the opposite phenomenon to that of GBTC, which trades at $26.95 OTC versus $31.44 real.

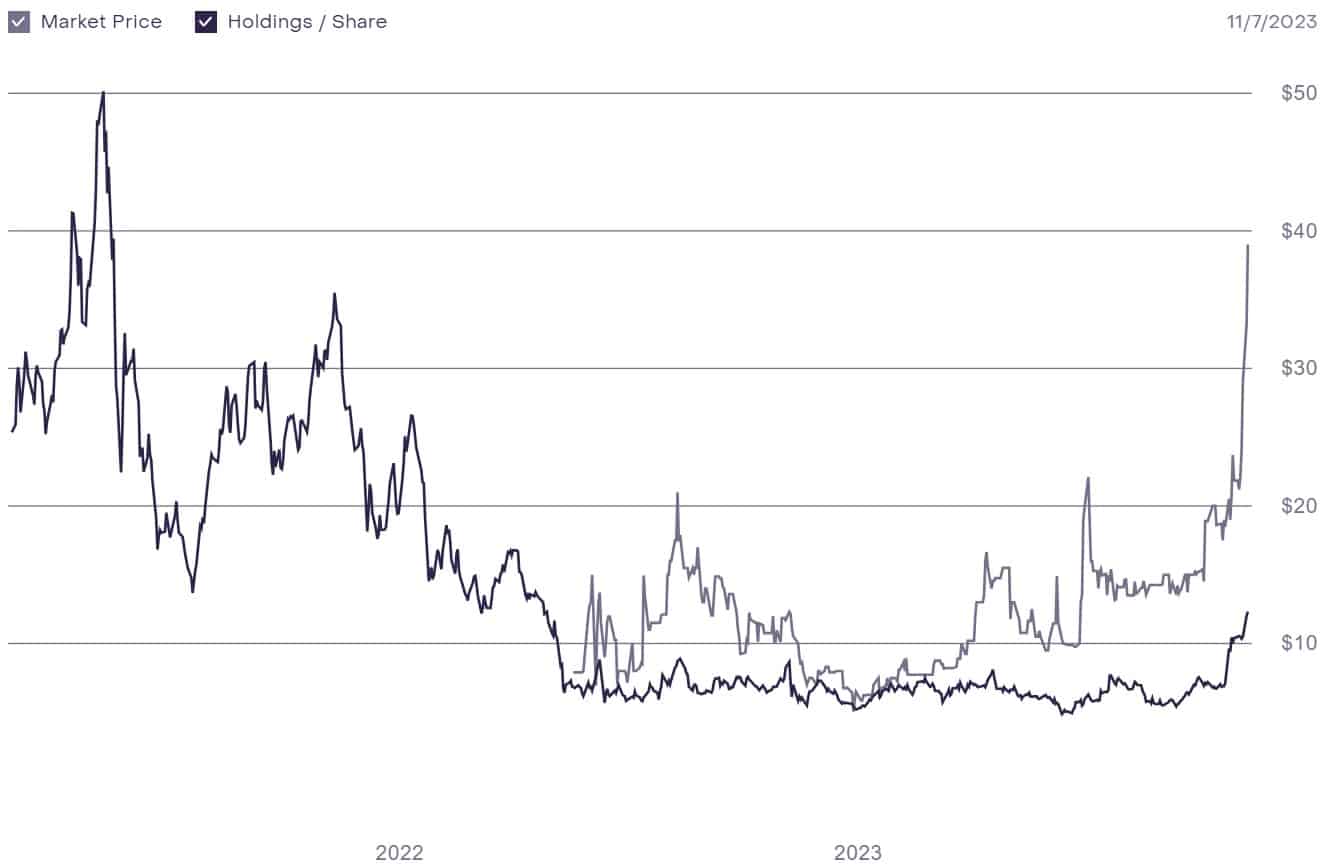

As far as GLNK is concerned, we can see that it has always enjoyed a premium since the OTC market opened in May 2022, but that this trend has become more pronounced in 2023, while LINK, for example, has risen by over 130% since September :

GLNK price evolution compared to its OTC price

The reasons for this price differential

There are a number of factors that could explain such a wide price differential, first and foremost the fact that the liquidity injected into GLNK doubled in just a few days to reach $3.95 million in assets under management. As this capitalization is still very low, the product is more easily subject to price shifts, especially as it targets institutional investors.

Furthermore, as Grayscale’s products are not ETFs, they suffer from low liquidity, as they are not redeemable by the company. This is one of the major challenges facing the GBTC, which aims to become a spot ETF for Bitcoin.

When the market is on a positive trend, it’s attractive for investors to position themselves on such products and then resell them on the OTC market at a premium. However, this same phenomenon can lead to heavy losses if the price of the underlying asset reverses, causing investors to lose interest, as Three Arrows Capital (3AC) did with GBTC.

Following the same logic, we’ll be keeping a close eye on GLNK over the coming months, as the market evolves.