Binance has been in the media spotlight in recent days, amid a legal investigation and suspicions of insolvency. While the release of the exchange’s reserve evidence has not gone down well with the public, CryptoQuant has conducted its own analysis: Binance’s reserve behaviour has nothing abnormal or in common with FTX’s in the past.

CryptoQuant looks at Binance

Blockchain data analysis firm CryptoQuant has published a report analysing the Binance proof-of-condition audit conducted last week. As a reminder, this one was handled by the firm Mazars and was questioned by many actors of the ecosystem.

What does Binance’s Proof of Reserve (PoR) report tell us from an on-chain perspective?

A short thread @binance @cz_binance pic.twitter.com/2vAoOmFb63

– CryptoQuant.com (@cryptoquant_com) December 15, 2022

To all those who wondered whether to trust Binance’s proof of reserve or not, CryptoQuant simply answers: no need, as all information is available in the blockchain. In concrete terms, the exchange audit was performed on 22 November 2022, at 23:59. This corresponds to block 764327 of the Bitcoin blockchain.

At that time, CryptoQuant’s indicators estimated Binance’s Bitcoin reserves to be 591,939 BTC. In comparison, the Mazars audit report showed 597,602 BTC. This means that CryptoQuant’s measurement strategy validates 99% of the audit data:

The report shows that Binance’s BTC liabilities (customer deposits) are 97% collateralised by the exchange’s assets. Collateralisation increases to 101% when BTC lent to customers is accounted for. “

Binance has nothing to do with FTX

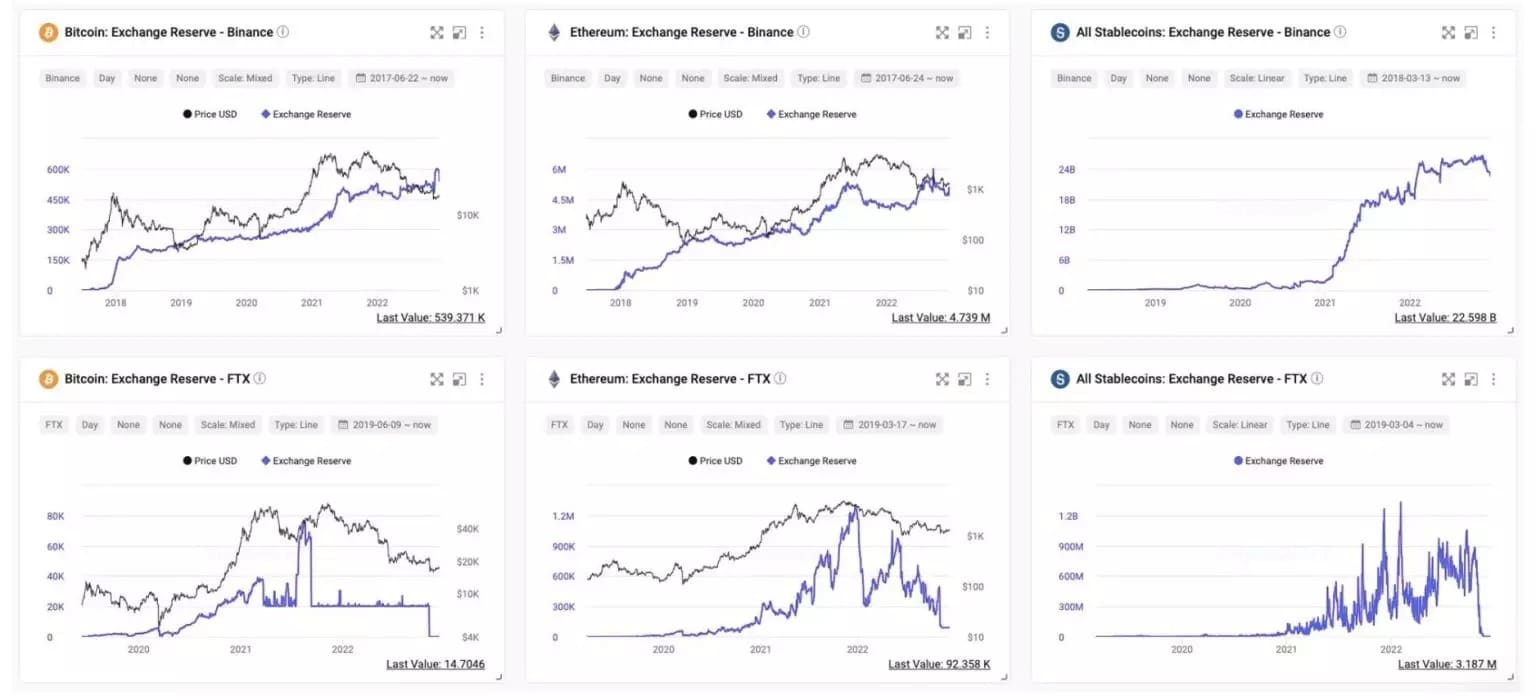

Furthermore, the analysis firm looked at Ether (ETH) and stablecoins. As the charts below show, Binance’s reserves do not show abnormal behaviour. At least, they are not like those of FTX, whose manipulations are one of the reasons for the collapse.

Comparison of Binance and FTX reserves

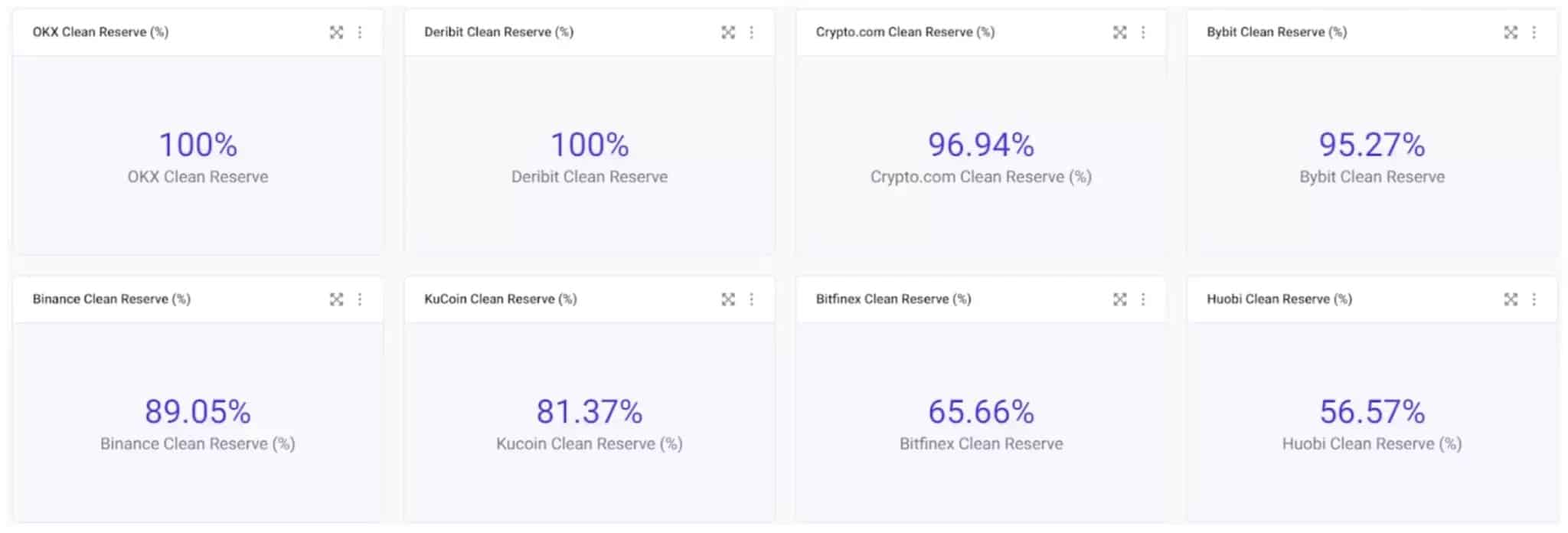

Finally, CryptoQuant has analysed an important data: the proportion of its own platform’s native token in its reserves. As a reminder, it was partly because of its overexposure to its own token, FTT, that FTX precipitated its downfall. In this game, Binance is doing quite well with a health indicator of 89%:

Comparison of health indicators of major exchanges

In practical terms, this means that Binance holds just over 10% of its cash in Binance Coin (BNB), its own token. Of $60.4 billion in assets, about $6.2 billion is in BNB. This figure is considered “acceptable” by CryptoQuant.

An audit that reassures Binance

In the wake of FTX’s collapse, centralized exchange platforms have been forced to comply with an audit to ensure their reserves match customer funds. This is the case of Binance, whose audit revealed that the number of Bitcoin (BTC) held is higher than estimated: it is 101% over-collateralised.

However, these exaggerated figures have not been enough to reassure customers. In addition, many of the major and recognised players in our ecosystem have questioned the audit process, believing that the procedure was agreed in advance and that it is not a thorough and complete study.

After the strange timing of Reuters revealing exclusive content about the judicial investigation around Binance, the FUD continued with a questioning of the platform’s solvency and its audit. This new study from CryptoQuant eases the turmoil as the entire cryptocurrency market retreats on Friday, December 16.

Update: Mazars, a platform known around the world for its tax expertise, has announced it will cease all activities with cryptocurrency exchange platforms this Friday, December 16.