Given the positive news of recent months and its victory against the SEC, Grayscale is seeing the discount on its GBTC reduced. Spotlight on this investment product indexed to the price of Bitcoin (BTC) spot, which could offer an arbitrage opportunity if the ETF is validated.

Grayscale’s GBTC discount tending to narrow

The price of GBTC is a sensitive issue as Grayscale struggles to convert it into a Bitcoin Spot ETF (BTC). However, its victory over the Securities and Exchange Commission (SEC) on Tuesday and recent news on the subject could change the situation.

As a reminder, the GBTC is a fund that tracks the performance of the CoinDesk Bitcoin Price Index (XBX), which in turn tracks the spot price of BTC.

The problem is that without a dedicated market place like ETFs, GBTC shares are traded over-the-counter (OTC) between investors. This can cause a gap between the reference price and the actual price, either upwards or downwards. This was one of the many reasons for the collapse of the Three Arrows Capital (3AC) investment fund, which was heavily exposed to the product.

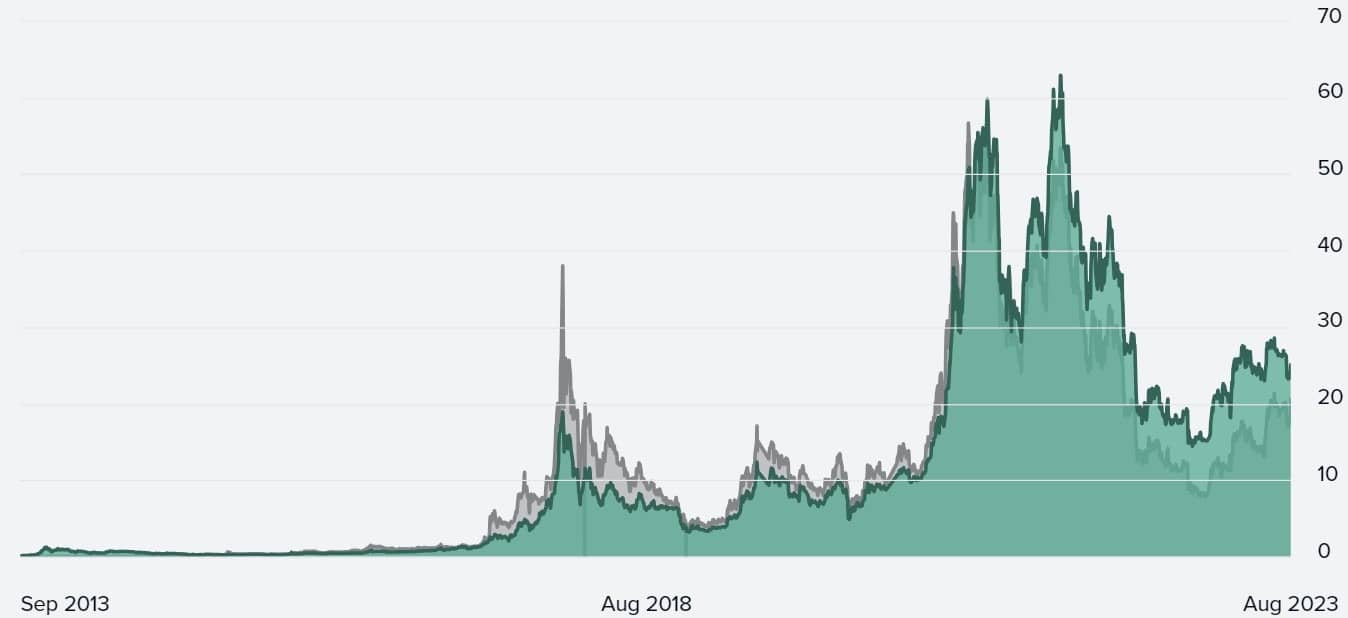

Nevertheless, as the subject of Bitcoin spot ETFs gains momentum and the market seems increasingly optimistic about future SEC acceptances, the GBTC is narrowing its gap with its benchmark price. However, there is still a long way to go, because with an OTC price of $20.56 per share compared with the normal $25.09, this still represents a discount of 18.05%.

On the other hand, this is still much more encouraging than in the past, taking for example the date of 27 December 2022, less than 2 months after the FTX affair. At that time, the gap was more than 48% at $7.86 against $15.21.

An arbitrage opportunity

Since BlackRock’s request for its own ETF, the spread in question has evolved encouragingly over the last few months:

- 20 June 2023: 33.34% ;

- 19 July 2023: 26%;

- 18 August 2023: 25.83%.

The chart below shows the difference between the GBTC’s official price (green) and its OTC price (grey) over time:

Comparison between the official price of the GBTC and its OTC price

It should be noted that if Grayscale’s ETF were to be validated, institutional investors already positioned in the GBTC would be able to trade the product at its official price, which would be a highly profitable arbitrage operation. It is this possibility, in the wake of recent news, that is helping to gradually reduce the discount.

At the time of writing, the GBTC represents 17.4 billion in assets under management.